6 Ethereum Facts: 15.19 Million Active Users, Leverage Increases, Price Still IDR33-37 Million

Jakarta, Pintu News – Crypto network activity has stolen the spotlight again after Ethereum set a record number of monthly active users. On the other hand, price movements and trader behavior in the derivatives market show that conditions are not fully stable. This discrepancy between on-chain data and market sentiment is an important concern for cryptocurrency investors, both novice and experienced.

1. Ethereum Users Top 15.19 Million Active Addresses

Ethereum’s monthly active address count surged to 15.19 million, the highest in history. This figure reflects an increase of 38% in a month, 71% in six months, and 114% on an annualized basis.

This surge shows that more and more users are interacting with the Ethereum network. These activities include transfers, use of decentralized applications, and execution of smart contracts in the cryptocurrency ecosystem.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

2. On-Chain Activity Recovery Seems Consistent

The rise in network activity comes after a period of relative sluggishness at the end of last year. The recovery has been rapid and consistent, signaling a return to strong user interest.

For crypto investors, on-chain data is often viewed as a fundamental indicator. The more active the network, the greater the potential long-term utility of Ethereum as blockchain infrastructure.

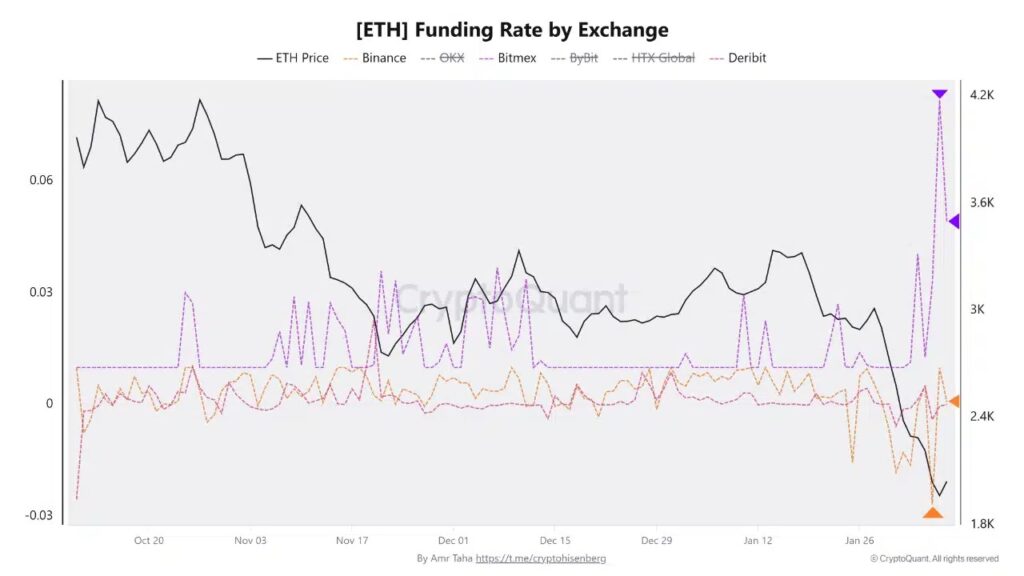

3. ETH Funding Rate Starts to Solidify

In the derivatives market, Ethereum’s funding rate showed a significant increase. On BitMEX, ETH funding rose to 0.049%, the highest since October and well above the previous level of around 0.03%.

This increase indicates that long positions are becoming more dominant. Heavily leveraged conditions often increase the risk of price corrections in the event of mass liquidation.

4. Binance Moves Show Change in Sentiment

On Binance, the ETH funding rate moved from negative around -0.025% on February 5 to the neutral area. This indicates that short position pressure is starting to ease.

The new open interest is mostly driven by long positions. Although it looks positive, this situation has not automatically pushed up the price of Ethereum.

5. ETH Price Stabilizes in the USD2,000-2,200 Area

After the previous selling pressure, Ethereum is now moving sideways in the range of USD2,000-USD2,200. If converted, this range is equivalent to around IDR33.7 million to IDR37.1 million.

This stabilization shows that selling pressure is starting to ease. However, buying interest is not yet strong enough to prompt a price breakout in the near term.

6. Technical Indicators Still Show Indecision

ETH’s Relative Strength Index (RSI) rose to the 30s range, signaling a weakening of short-term selling pressure. Trading volume also declined after the previous surge.

With leverage increasing and prices still fragile, the next direction depends largely on spot market demand. Without real buying support, the risk of a correction remains open.

Overview for Crypto Investors

The combination of record network activity and high leverage creates complex dynamics. Fundamentally, Ethereum is showing adoption strength, but market-wise, short-term risks remain.

For novice investors, this emphasizes the importance of separating network usage data and speculative behavior. Ethereum and other cryptocurrencies are currently in a crucial direction-setting phase.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Samyukhtha L KM / AMBCrypto. Ethereum hits 15.19M users, but where does leverage stand now?. Accessed February 9, 2026.