XRP Price Prediction: Rare Bullish Pattern with Strong Catalysts Ready to Drive Upside!

Jakarta, Pintu News – The price of XRP has stabilized in recent days after rising about 9% from its low this month. On December 22, XRP was trading at $1.9315 and showed three very bullish patterns, which could potentially trigger further gains.

XRP Price Technicals Show Possible Rebound

The chart on the daily time frame shows that the price of Ripple has seen a sharp decline so far this year. The price plummeted from a peak of $3,668 in July and bottomed out at the key support level of $1,8145.

Read also: XRP Price Held Below $2, Buyer Momentum Still Sluggish

XRP’s sustained price decline has pushed it below its 50-day and 100-day moving averages – signaling that bear pressure is still dominant. In fact, the current price is still below the Supertrend indicator.

However, on the positive side, XRP has formed three chart patterns that could potentially trigger a bullish breakout in the near future.

First, the Ripple price formed a triple bottom pattern at the $1.8145 area – which was the low point in October, November, and December. This pattern usually indicates that the bears are starting to hesitate to take further short positions below that level.

Second, it formed an inverted head and shoulders pattern, which is a common bullish reversal pattern. Its neckline is shown with a green line connecting the highs since October 27.

Thirdly, XRP also forms a falling wedge pattern, which consists of two descending trend lines that narrow each other, where bullish breakouts usually occur when the two lines almost meet.

In addition, the Percentage Price Oscillator (PPO) and Relative Strength Index (RSI) indicators show a bullish divergence pattern, which is when the indicators move up while the price is still in a downward trend.

Thus, the future price projection of XRP tends to be bullish, with an initial target at the psychological level of $2. If the price is able to break through this level, the next potential increase could be towards the important area around $2.50.

The bullish view will be invalidated if the token drops below the key support level at $1.8145. Should such a drop occur, it would signal further potential weakness, possibly towards the psychological level around $1.50.

XRP’s Key Drivers Begin to Align

Meanwhile, data from third parties suggests that the XRP price has a number of catalysts that could drive gains in the short term.

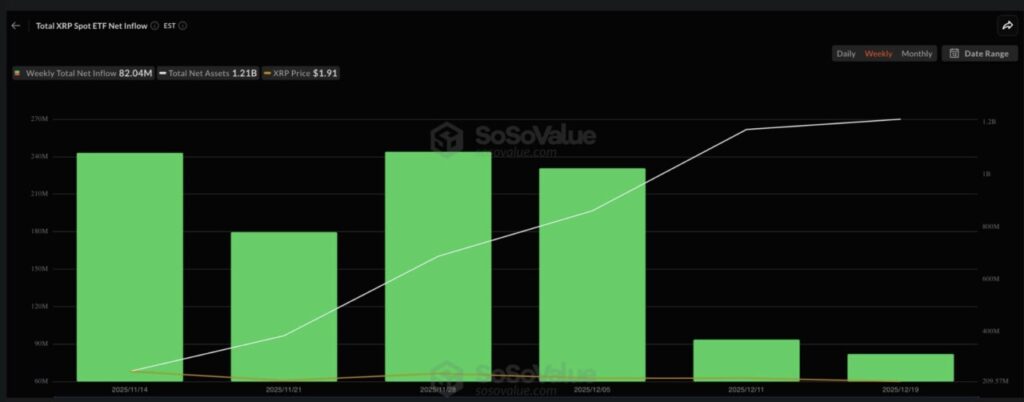

The most important factor is the increase in XRPETF inflows since the product’s approval in November. Total net inflows have surged to over $1.07 billion, with total net assets reaching $1.2 billion. This growth indicates continued accumulation from retail and institutional investors in the United States.

Read also: Gold and Silver Prices Set New Record Highs, Can Bitcoin Follow the Surge?

In addition, the stablecoin Ripple USD (RLUSD) is also showing positive performance – a trend that is expected to get stronger as it expands into other layer-2 networks such as Base and Optimism. RLUSD’s total assets continue to rise and now stand at $1.33 billion.

Based on data from CMC, the daily volume of RLUSD surged by 62% on December 22, 2025.

The price of XRP could also potentially receive an additional boost from a gradual increase infutures open interest, signaling that investors are starting to more actively use leverage in the crypto market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. XRP Price Prediction: Rare Bullish Patterns Align With Powerful Catalysts. Accessed on December 24, 2025