Vitalik Buterin Calls Prediction Markets the Antidote to Social Media, What’s the Reason?

Jakarta, Pintu News – Ethereum co-founder Vitalik Buterin says that prediction markets offer something that social media does not, which is accountability or responsibility for statements made.

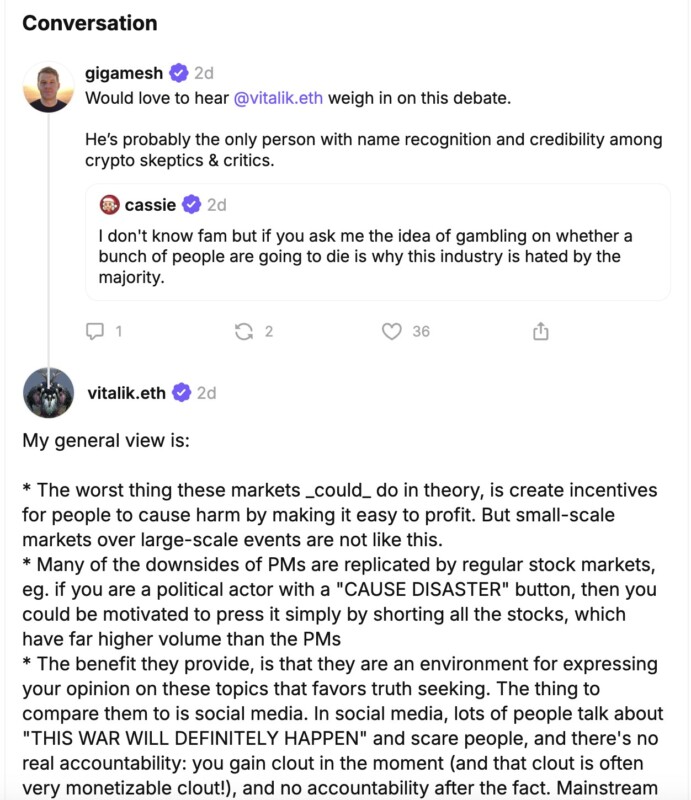

In a recent discussion on the Farcaster platform, Buterin argued that betting markets like Polymarket serve as an “antidote” to the exaggerated claims, emotional reactions, and misinformation that often appear freely on social media.

Prediction Market vs. Social Media

According to Vitalik Buterin, the argument is simple: on social media, users can make bold statements about wars, disasters or political outcomes without bearing any risk if they are wrong.

Read also: Ethereum Price Drops to $2,900 Today: ETH Bullish Reversal Signal Reappears!

Such claims often attract attention, gain followers, and even make money through interaction. When their predictions are disproven, there are no consequences.

In contrast, prediction markets operate in a different way. Its participants have to bet money based on their outlook. If the prediction is wrong, they lose the money. In the long run, this system rewards accuracy and penalizes excessive claims.

Buterin emphasized that this mechanism makes prediction markets more truth-oriented than platforms driven by “likes” and sensational titles.

He cited his experience of reading alarming news, then checking the market prices on Polymarket. In some cases, the odds in the market showed there was only a 4% chance of the feared bad outcome. That helped him assess risks more rationally rather than reacting emotionally.

The Ethics of Betting on Tragedy

The debate comes after criticism that betting on events like war or death is a moral failing in the crypto world. One Farcaster user questioned whether markets that predict death have crossed an ethical line.

Buterin made it clear that markets that directly incentivize harmful actions – such as assassination markets – should not exist and should be rejected.

He added that modern prediction market systems already have mechanisms to cancel or reject unethical markets, citing past designs that allowed communities to reject certain outcomes.

However, Buterin also argues that small-scale markets focused on large public events do not significantly increase the risk of harm.

The Ethereum co-founder added that a similar incentive problem already exists in traditional financial markets, where large parties could theoretically profit from disasters by short selling stocks.

Read also: Wall Street Reveals Tesla Stock Price Predictions for the Next 12 Months!

Why Prediction Markets are Harder to Manipulate

Buterin also explained why he thinks prediction markets are healthier than many other trading environments. Prices in these markets are capped between zero and one, representing probabilities from 0% to 100%.

This structure naturally reduces extreme speculation and limits the “pump and dump” behavior that often occurs in both crypto and stock markets.

Because prices can’t rise indefinitely, the prediction market is more resilient to hype cycles, high volatility, and the mentality of “there will always be someone willing to buy more later.”

Meanwhile, the popularity of prediction markets continues to rise. A recent report showed that activity on major platforms jumped from less than $100 million per month in early 2024 to more than $13 billion. Analysts expect this growth to continue throughout the next decade.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Vitalik Buterin calls Prediction Markets the Antidote to Social Media. Accessed on December 23, 2025