Santa Rally 2025: A Guide to the Top 5 Assets to Watch This Holiday Season

Jakarta, Pintu News – As the last trading days of December approach, investors are assessing whether seasonal factors will again influence price movements towards the end of the year. The period known as the “Santa Rally” lasts for seven days, from December 24 to January 5, 2026.

Historically, this period often shows better-than-average market performance, driven by holiday optimism, thin trading volumes, spending from year-end bonuses, tax loss settlements, as well as institutional portfolio rebalancing.

1. Technology Stocks

Historically, tech stocks have been one of the standout sectors during the Santa Rally period, with an average gain of 2.1 percent in that seven-day span-although results can vary widely from year to year.

Read alsod: Bitcoin Whale Doubles Short Investments in BTC, ETH, and SOL Worth $243 Million!

The Nasdaq Composite Index has generally recorded a stronger performance than the broader market index, with a historical win rate of 82 percent for the December-January period.

However, tech stocks are currently facing a challenging situation. Although the Nasdaq has gained 19 percent since the beginning of the year (YTD), pressure has started to emerge in recent months, mainly due to a decline in sentiment towards AI-related stocks.

Key factors:

- E-commerce momentum: Black Friday 2025 spending reached a record $11.8 billion, with demand remaining high throughout December as last-minute purchases drove revenue for Amazon and digital payment companies.

- Holiday infrastructure: Sectors such as cloud computing, semiconductors and digital payments benefit from the surge in spending during the holiday season, both from retail transactions and year-end corporate spending.

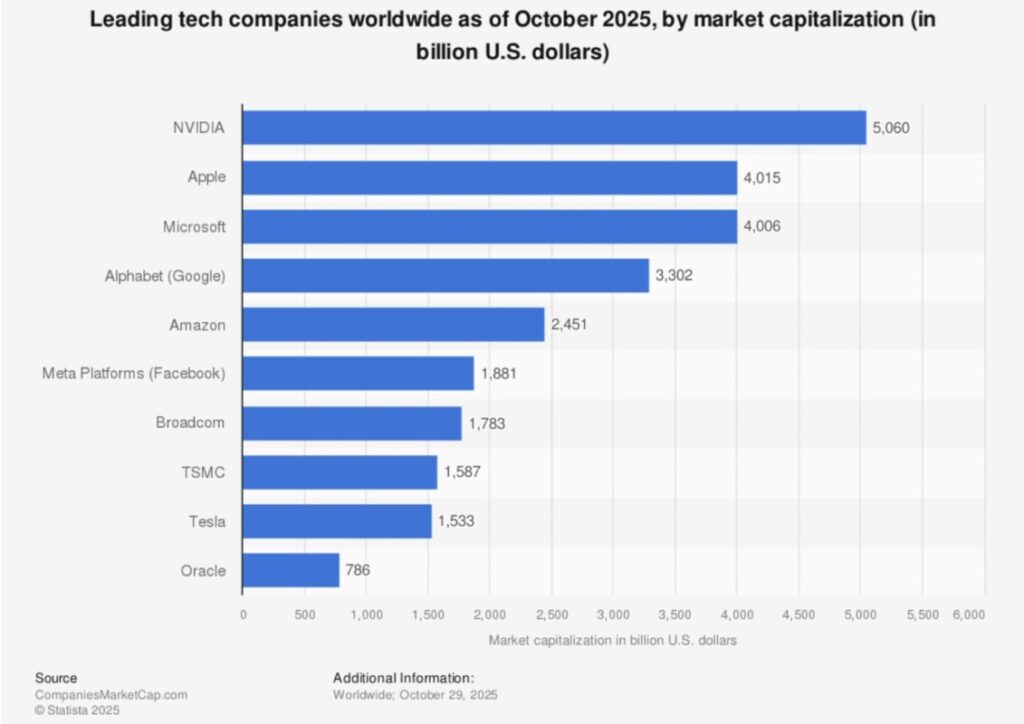

- Concentration risk: Five large companies – Nvidia , Microsoft , Apple , Alphabet , and Amazon (AMAZNX)- account for about 30 percent of the total return of the main index. Periods of weakness in these companies, as seen recently due to volatility in AI sentiment, can drag down the performance of the entire tech sector.

2. Gold

Gold is entering one of its strongest seasonal periods, from mid-December to February, during which time it has posted gains every year since 2015.

Gold prices continued to show strength throughout December, despite the resilience of the US dollar, so the precious metal is well positioned ahead of the peak Christmas jewelry season.

Key factors:

- Seasonal demand for jewelry: About two-thirds of the total annual gold production is used for jewelry making. Christmas, Chinese New Year (February 2026) and the wedding season in India create regular buying patterns, as traders stock up in December.

- Dollar weakness pattern: Historically, December is the weakest month for the US dollar, with the negative trend starting around December 22. Since gold has an inverse correlation with the dollar, dollar weakness can push gold prices up during this period.

- Real yield environment: With the Fed lowering interest rates to a range of 3.5-3.75 percent while inflation remains around 3 percent, real yields remain low, which could support higher gold valuations.

- Accumulation by central banks: Continued buying by central banks as well as institutional portfolio rebalancing later in the year could also provide additional support to gold prices.

3. EUR/USD

Historically, December has been the most positive month for the EUR/USD currency pair, with an average gain of around 1.2 percent over the past 50 years.

The US dollar usually shows clear weakness during the Santa Rally period, especially from December 22 onwards. However, this year, the Fed’s hawkish interest rate cut policy provided additional support for the dollar.

Read also: Crypto AI is Predicted to Become the Crypto Market Leader by 2026, What’s the Reason?

Key factors:

- Holiday liquidity dynamics: During the holiday period, institutional trading volumes decrease, resulting in less support for the dollar as the market is driven more by retail traders and small-scale participants. Such a thin market can magnify price movements, both up and down.

- Year-end portfolio rebalancing: Investors from Europe and Asia often repatriate funds or rebalance portfolios towards the end of the year. This creates demand for non-dollar currencies, which usually strengthens EUR and AUD against USD.

- Dollar strength due to hawkish Fed policy: The Fed’s December rate cut was accompanied by guidance that there would be fewer cuts in 2026. This keeps the dollar strong despite the rate cut, and could limit the influence of EUR/USD’s seasonal pattern on market movements.

4. Retail Stocks

Historically, discretionary and retail consumption sector stocks have performed better during the holiday period, with an average gain of between 1.9-2.1 percent during the Santa Rally time window.

The year-end shopping season accounts for about 30-40 percent of annual revenue for many retail companies, making it a very important period for full-year performance.

Key factors:

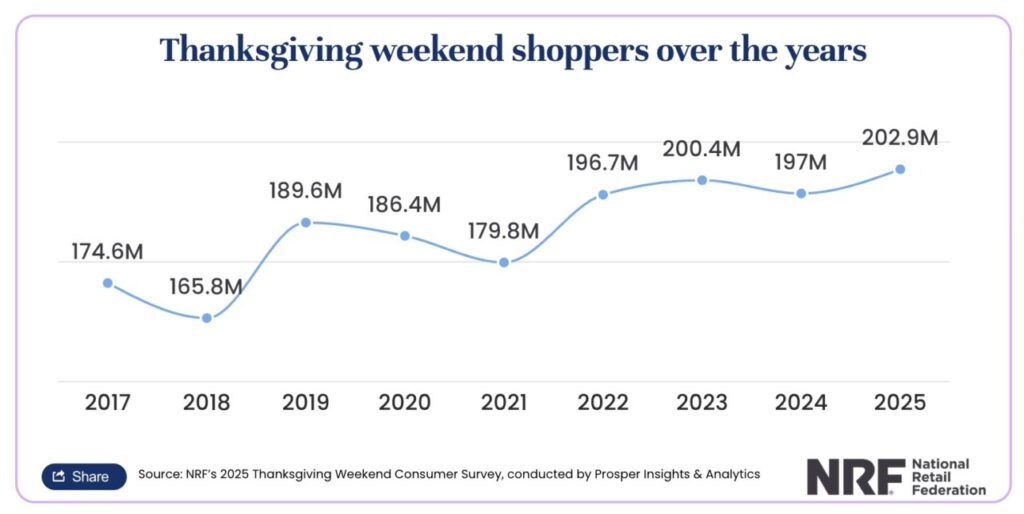

- Surge in holiday shopping traffic: A total of 202.9 million consumers shopped over the Thanksgiving weekend through Cyber Monday, up from 197 million in 2024 – a record high so far. November spending increased 3.8 percent on an annualized basis, and total holiday spending is expected to surpass US$1 trillion for the first time.

- High-income shopper trends: Retailers with a value strategy (such as TJX and Five Below) and those with a strong omnichannel presence are capturing a larger market share, compared to retailers targeting lower-middle-income consumers.

- Positive impact after the Fed decision: The rate cut in December provided a slight boost to consumer purchasing power, through lower borrowing costs. This could potentially extend spending activity into the end of December, as access to credit becomes easier.

5. Bitcoin

Bitcoin’s performance in December was inconsistent, with a median return of -3.2 percent, contrary to the positive Santa Rally pattern of traditional assets. Currently, Bitcoin is trading around $87,500, down about 30 percent from its record high of US$126,210 in October.

However, there are some signals that this notoriously volatile crypto asset could potentially experience a rebound triggered by this year’s Santa Rally effect.

Key factors:

- Maturing institutional infrastructure: More than $120 billion is now under management in spot Bitcoin ETFs, creating an institutional framework that could support new capital flows if sentiment towards risk assets improves, although inflows cannot be guaranteed.

- Pro-crypto policy expectations: Discussions about possible new policies, such as the US Bitcoin strategic reserve and the CLARITY Act bill, could influence market sentiment ahead of 2026, although the final outcome is still uncertain.

- A turning point in the four-year cycle: The most recent price drop occurred about 18 months after the last Bitcoin halving event, which historically often coincides with inflection points in some previous price cycles. This four-year cycle narrative has the potential to influence current market behavior.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Go Markets. 5 Assets in Focus This Christmas: Santa Rally Guide 2025. Accessed on December 24, 2025