2026 Crypto Narrative: 10 Market Shifts to Watch Out for

Jakarta, Pintu News – The crypto industry is getting into the mainstream. Financial institutions have become major players in the market. Capital is now flowing into projects that are capable of generating real revenue.

Short-term price fluctuations are no longer the main focus. Sustainable business models are now a must. Tiger Research predicts that there will be ten major changes in the crypto market by 2026.

1. Institutional Capital Stays Put on Bitcoin

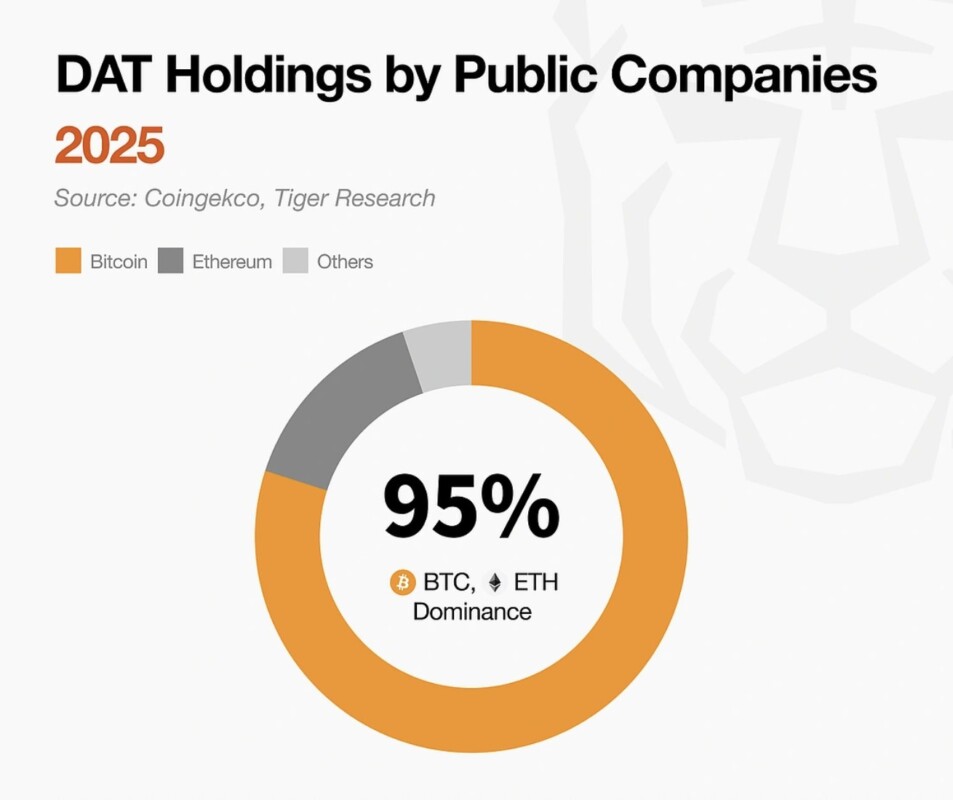

As institutions start to lead the market, capital flows become more cautious. Institutional investors tend to avoid unproven assets and focus only on Bitcoin and Ethereum . This trend is expected to continue, with market growth centered on assets that meet institutional standards.

Read also: 3 Altcoins with Small Market Cap that are the Target of Crypto Whale Right Now, What’s Happening?

2. Projects without profit will be eliminated from the market

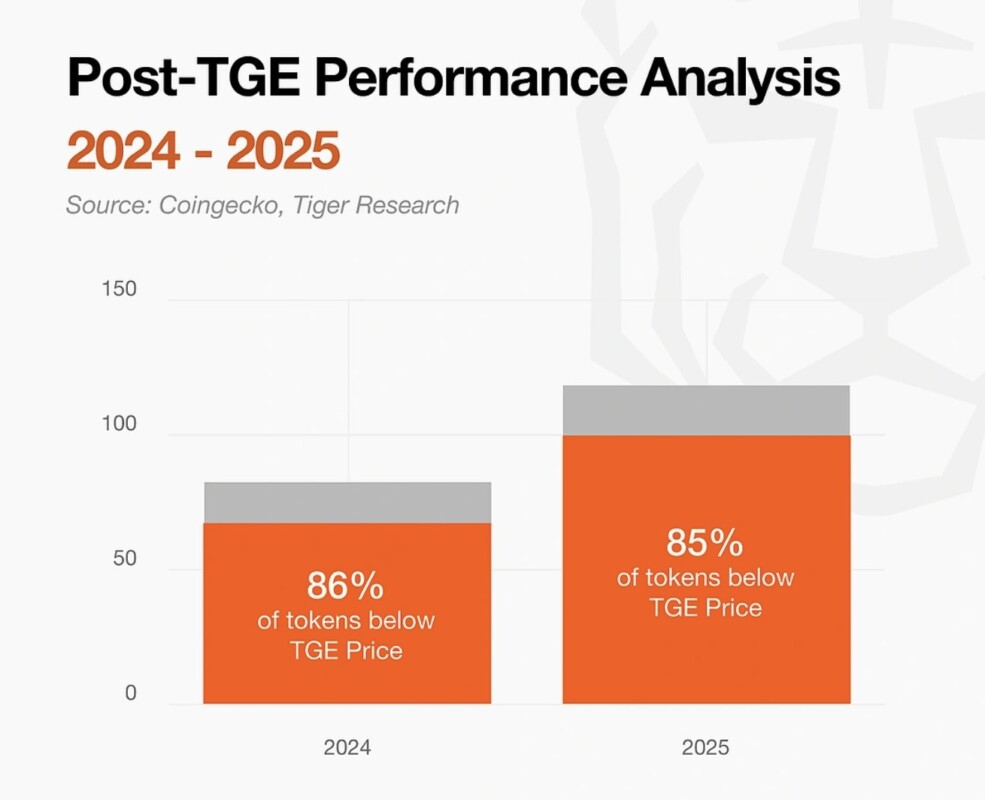

The price drop of 85% of new tokens after TGE’s launch shows the limits of narrative-driven growth. Hype-based projects will quickly be replaced by new trends.

The market will start to shift towards projects that are capable of generating real revenue and have strong fundamentals.

3. Utility Token Failed. Buyback becomes the main solution.

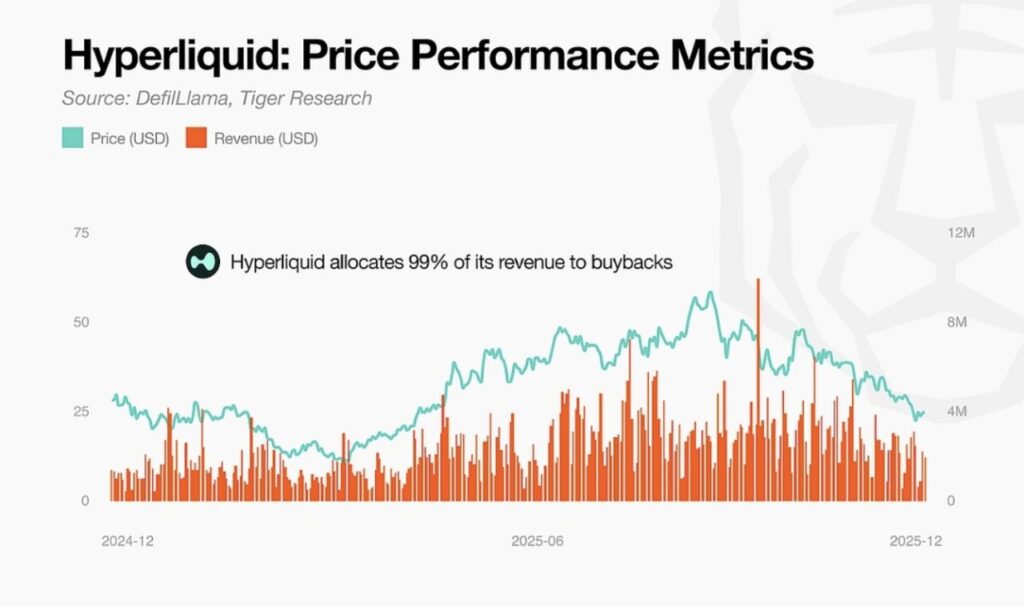

Utility-based tokenomic models have failed; voting rights in governance don’t attract investors, and complex structures prove unsustainable. Now, the market demands a clear return on value.

Projects that offer direct returns through buyback and burn mechanisms will survive, including structures that link protocol growth directly to token prices. These changes will give birth to new innovative models.

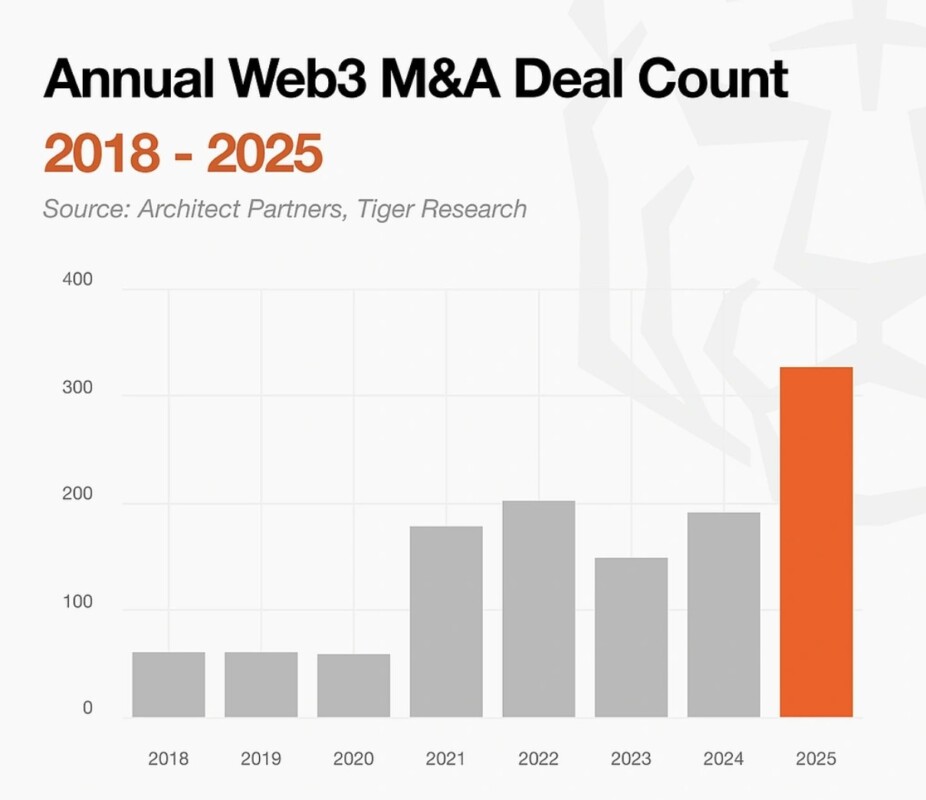

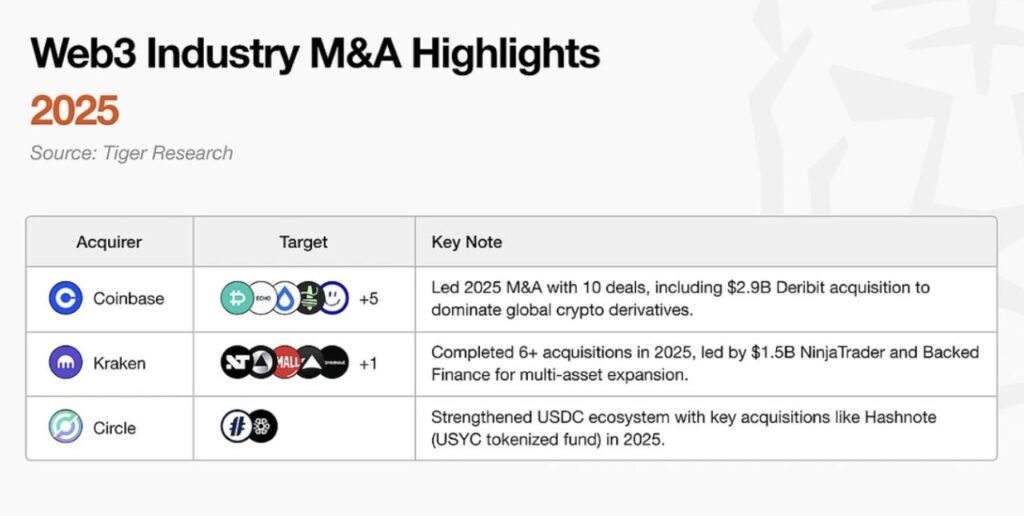

4. Merger & Acquisition Opportunities Between Projects will Increase

The Web3 is maturing and competition for market dominance is increasing. Mergers and acquisitions (M&A) are the fastest way to expand and improve competitiveness. Excellent companies will drive aggressive M&A activity. The market will be reshaped by the players who are able to create real advantages.

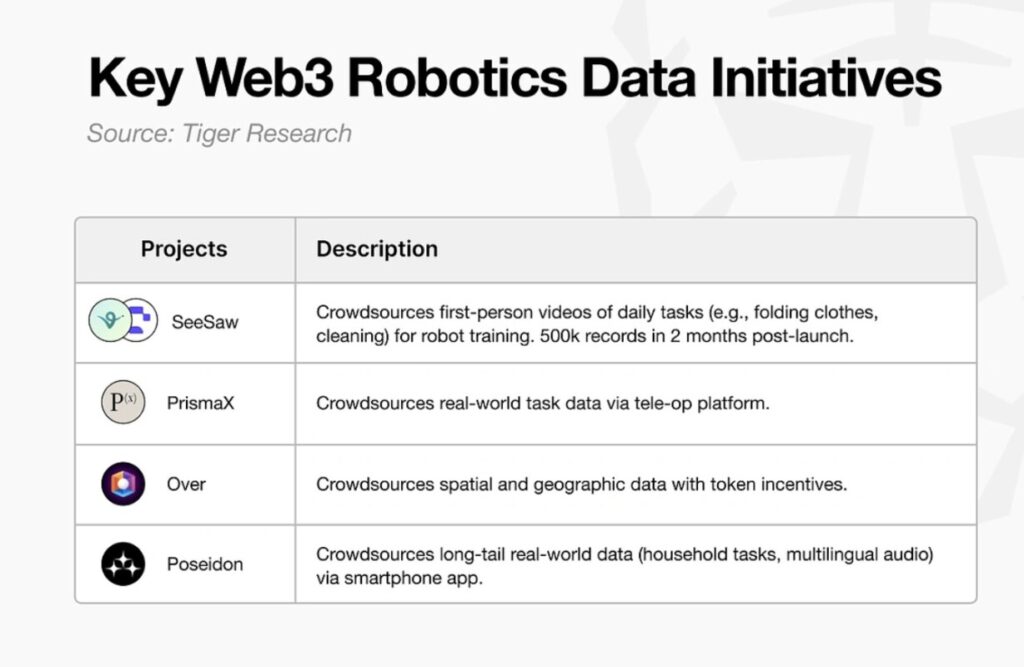

5. Robotics and Crypto Will Open a New Era of Gig Economy

The robotics industry is growing, and real-world data is key in robot training. Traditional centralized methods are unable to efficiently collect large amounts of data.

Blockchain with decentralized crowdsourcing provides the solution, enabling data collection from individuals around the world transparently and with instant rewards. A new era of robotics-based gig economy will emerge.

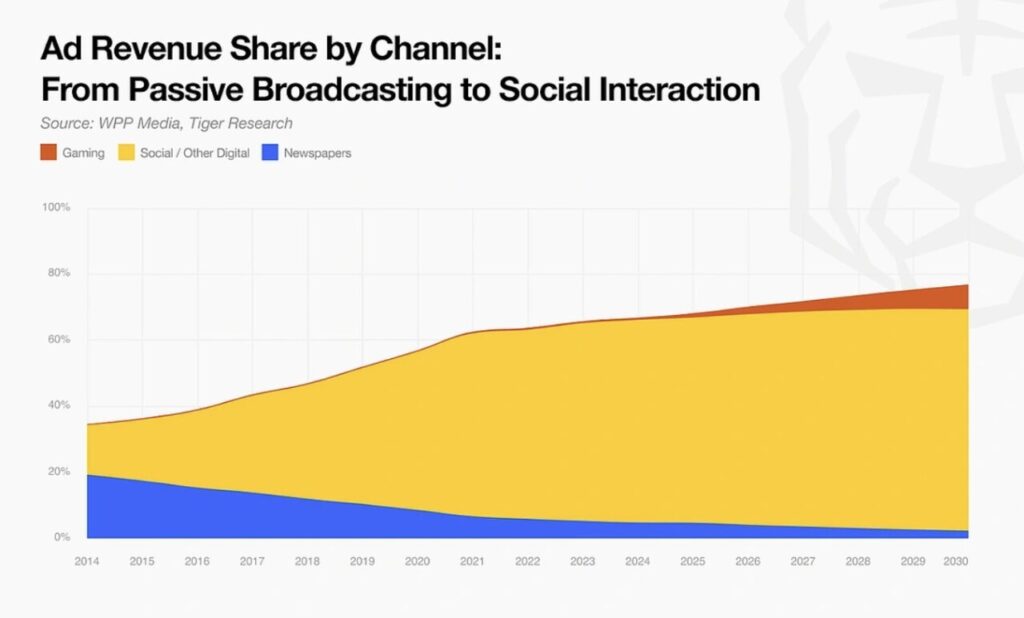

6. Media Companies Will Adopt Prediction Market

As traditional revenue models begin to reach their limits, media companies will adopt prediction markets as a survival strategy. Readers will shift from passive consumption to active participation by betting their capital on the outcome of a story. This shift will optimize the revenue structure and drive deeper audience engagement.

Read also: 3 Important Crypto Events in January 2026: What to Watch Out For?

7. Traditional Financial Institutions Lead RWAs Through Their Own Blockchain

Traditional financial institutions (TradFi) are the main suppliers to the Real World Assets (RWA) market. Due to the need for asset control and security, the use of third-party platforms is considered less favorable.

Therefore, these institutions are likely to build their own blockchains to maintain market leadership. RWA projects that do not have a self-sustaining asset supply source may lose competitiveness and be eliminated.

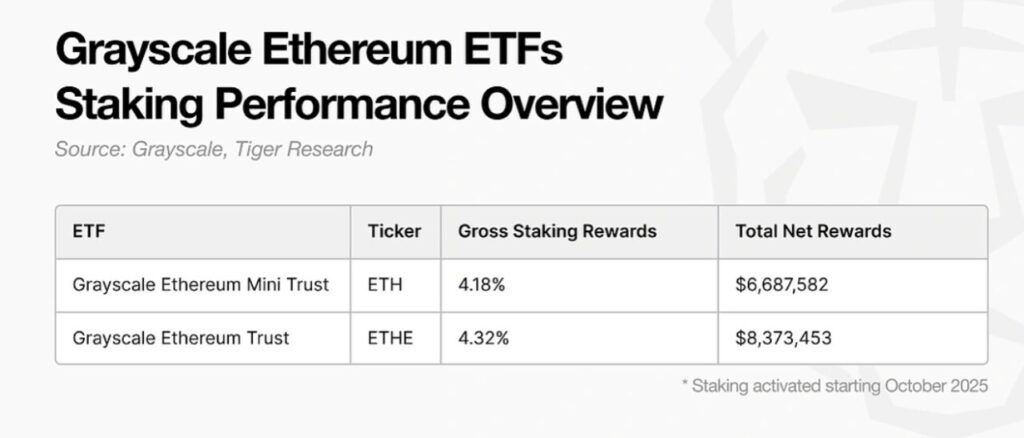

8. ETH Staking ETFs Will Drive BTCFi Growth

The launch of an Ethereum staking ETF will encourage Bitcoin ETF holders to seek yield, and the BTCFi ecosystem is here to fulfill that need. As large funds enter Bitcoin, the need for asset utility will increase.

This push for yield will be the trigger for BTCFi’s next wave of growth.

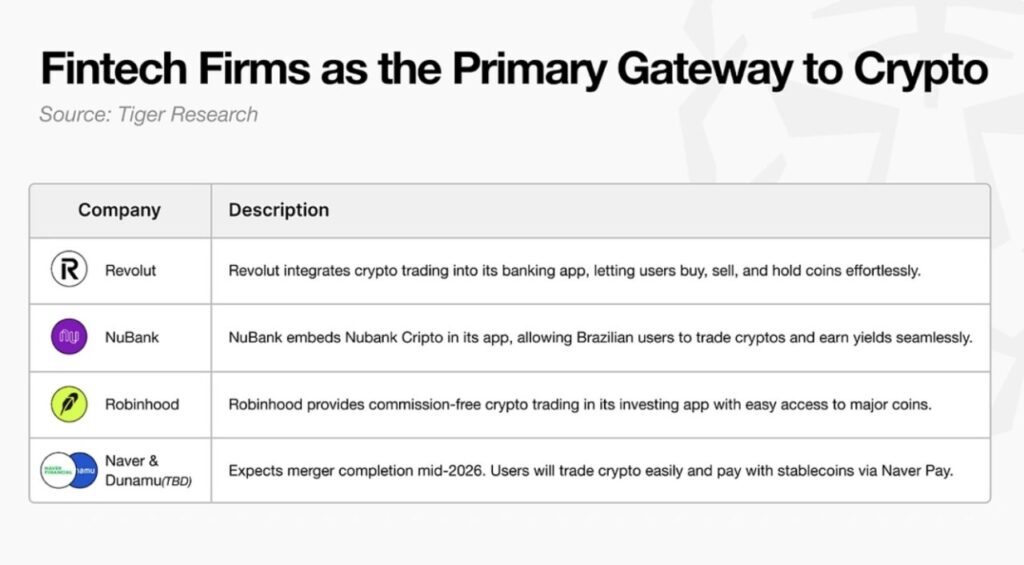

9. Fintechs will replace exchanges as the main entry point for crypto

With regulations becoming clearer, fintech apps are now the first choice for crypto transactions. New users no longer need to use crypto exchanges, as they can buy and sell crypto directly through the apps they already use daily. The next wave of growth will likely be led by these fintech tools.

10. Privacy Technology Becomes Core Infrastructure for Institutions

The transparency of blockchain opens up trading plans to the public, which is a weakness for large companies. Investors with large funds have to hide their moves for security.

Privacy technology is an important tool for institutions to enter the crypto market. Large capital flows will only happen if trading data is protected.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGecko. 10 Crypto Market Shifts for 2026. Accessed on January 2, 2025.