Top 3 RWA Crypto Tokens Catching Whale Interest in 2026 — Here’s Why

Jakarta, Pintu News – Real-world assets (RWAs) saw a huge surge in 2025, and now the question is simple: can this momentum be sustained amidst more difficult conditions, or has it already peaked?

Factors such as liquidity, regulation, and real-world usage will determine who takes the lead next. This article discusses three RWA tokens worth keeping an eye on in 2026. The list is compiled based on real demand, smart investor behavior, and the initial structure seen on the chart.

Maple Finance (SYRUP)

Real-world assets (RWA) became the most profitable crypto narrative in 2025, with an average gain of more than 185% according to data from CoinGecko. In this context, Maple Finance occupies the credit segment of the trend and closed the year with a gain of around 109% over the previous year. The latest increase of 7.5% shows that the momentum is still strong.

Read also: 3 Meme Coins to Watch Out for in January 2026, What Happens?

Maple Finance is an institutional lending platform, where companies can borrow funds through real lending activities. Lenders earn returns that are tied to on-chain credit, rather than inflationary token issuance. It is this position that keeps Maple Finance on the list of RWA tokens worth monitoring in 2026.

Bitget’s CMO, Ignacio Aguirre Franco, told BeInCrypto exclusively that Maple’s performance in 2025 should be seen in the right context:

“Prices can rise much faster than the underlying adoption rate or revenue,” he said.

He also added that prices are not the main metric to rely on going into next year:

“Towards 2026, we will prioritize revenue growth and transaction settlement volume as key metrics to watch,” he added.

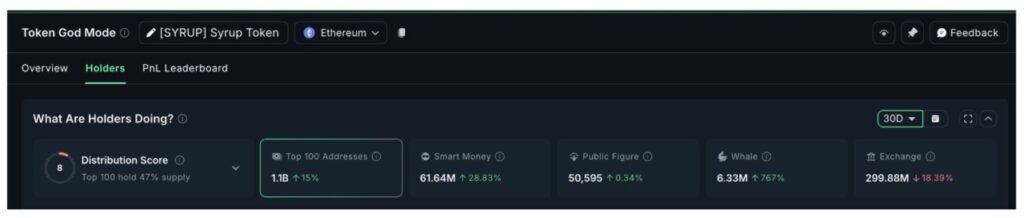

On-chain data supports that there is growing interest. In the last 30 days, holdings by large investors (whales) jumped 767% to approximately 6.33 million SYRUP tokens, with an additional approximately 5.6 million tokens.

Mega-whales increased their holdings by 15%, while wallets categorized as “smart money” added around 28%.

The price chart reinforces the interest from whales and smart money. It appears that a cup and handle pattern is forming, with consolidation at the “handle”. A breakout above $0.336 will initiate an upside movement, and confirmation occurs if the price crosses the sloping neckline around $0.360.

The price projection after confirmation points to $0.557 (approximately +60%). A weakness signal appears if the price drops below $0.302, and the pattern will fail if it falls below $0.235.

Chainlink (LINK)

Chainlink did not experience a price surge like RWA projects in the application layer during 2025. Instead, the token ended the year with a decline of around 38% on an annualized basis and is currently trading around $12.37.

In the past seven days, LINK recorded a gain of 1.7%, but the recovery has been slow and uneven.

Nonetheless, Chainlink remains one of the RWA tokens in the infrastructure layer worth monitoring in 2026 due to its important role in institutional systems and data integrity.

This position is in line with Ignacio Aguirre Franco’s explanation to BeInCrypto when asked why infrastructure projects will probably grow in importance as adoption matures.

He explained that platforms like Chainlink are closer to the trust layer needed for real transaction settlement processes:

“Chainlink and Stellar are at the infrastructure layer… Chainlink provides trusted data and verification processes that are used by various other applications.”

Both are particularly important when dealing with tokenized assets that are connected to real-world value. Since Chainlink and Stellar have been performing their functions for years, this makes them attractive to institutional investors who prioritize trust and stability,” he added.

Ignacio also emphasized that institutions tend to prefer proven infrastructure:

“Institutions don’t want to rely on experimental systems at every layer. Trusted infrastructure at the bottom and flexible applications on top is the combination that makes the most sense going forward,” he explains.

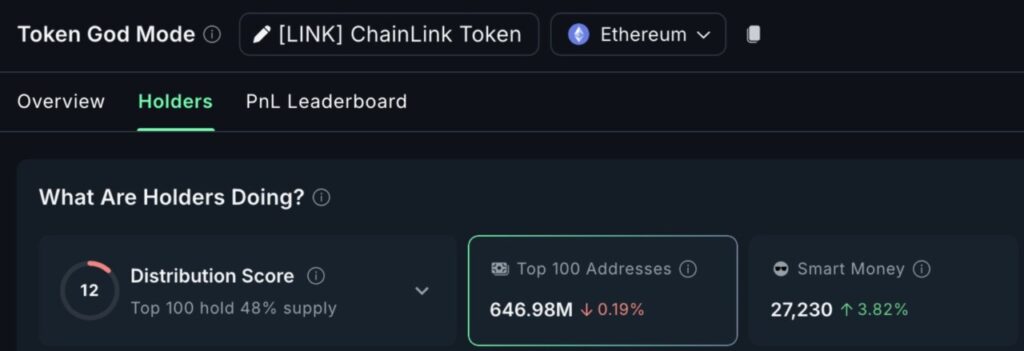

The behavior of smart money reflects this shift. In the last seven days, smart money wallets added 3.82% to their holdings, while mega whale holdings declined. This indicates selective accumulation rather than widespread confidence, but is still a noteworthy signal amid weak market conditions.

Technically, the chart shows a double bottom pattern starting to form around the $11.73 level. The RSI (Relative Strength Index) indicator, which measures momentum, shows higher lows.

When the price retests the support level while the RSI rises, it reflects a bullish divergence, which signals that the selling pressure is starting to weaken – an early sign of a potential trend change.

LINK itself has started to rise since that point. To continue the uptrend, LINK needs to break the $12.45 level as confirmation of a short-term rise.

If successful, the next target is $13.76 – an important resistance level that halted the last rally on December 12 and hasn’t been broken since.

Read also: 3 Crypto’s that Have the Potential to Set New Record Highs in January 2026

If LINK is able to break $13.76 with the support of sustained smart money inflows, the price could potentially rise to $14.24 and even $15.01 – key points where a momentum direction decision is likely to occur. Conversely, if the price drops past $11.75, the bullish scenario could weaken and LINK’s technical structure risks being broken.

Zebec Network (ZBCN)

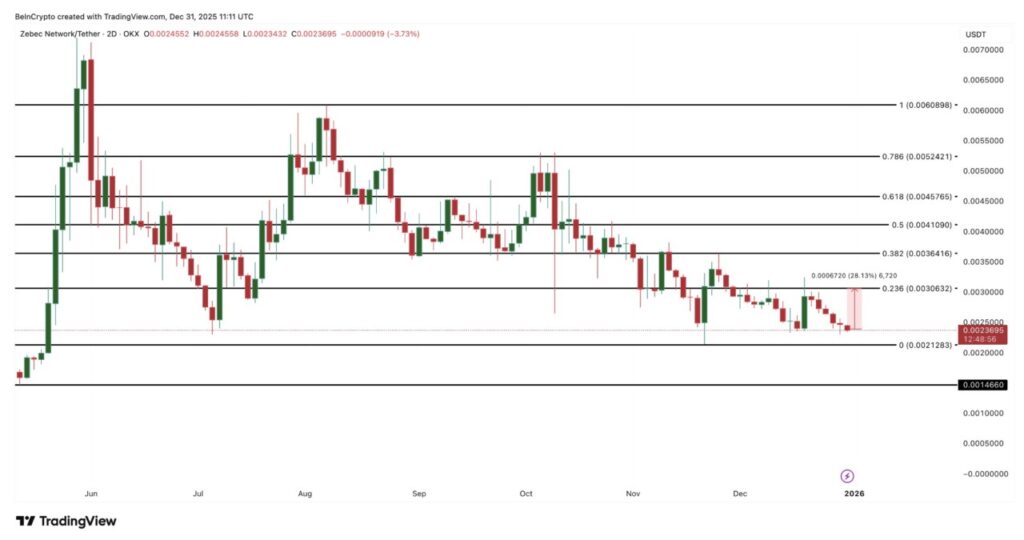

Zebec Network is in the real-time payroll and money movement segment – part of the Real-World Assets (RWA) ecosystem. The token became one of the best performers in 2025 with an annualized surge of about 164%. However, in the last three months, its performance has declined sharply with a drop of about 42%, and it is now trading around $0.0023.

As of December 31, the ZBCN price was flat and still trying to regain momentum. Even so, its use cases have kept the token on the RWA list worth monitoring in 2026.

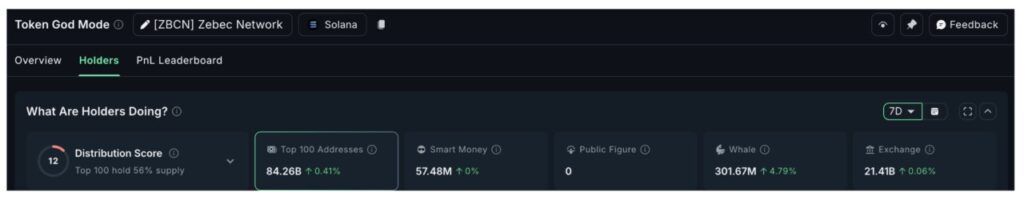

Recently, large investors (whales) have come back in. In the last seven days, large holders increased their holdings by 4.79%, to about 301.67 million ZBCN, with the addition of about 13.8 million tokens.

This action took place right at an important support zone (which is explained further in the technical analysis). This zone is likely the reason why the whales are trying to re-enter, even though the general market trend is still weak.

However, Konstantin Anissimov from Currency.com reminds us that not all RWA segments have the same staying power. Regarding Zebec, he highlights:

“Real-time payroll is the segment most susceptible to market rotation… Without sustained usage growth, this sector will be most impacted when the market turns,” he explains.

This statement is an important marker for Zebec: whale buying does help, but it still requires evidence of real, growing usage.

Technically, ZBCN’s price movement structure will start to look mildly bullish only if the price manages to return above $0.0030. This level has been missing since November 29, and a rise above it would mean a jump of about +28% from the current price.

If that is achieved, the next levels to break are $0.0036 and $0.0041. Breaking and holding these levels will be confirmation that retail buyers are starting to follow the whales’ lead.

However, if $0.0021 – a key support level – is broken, the technical argument for price support will collapse, and the whales’ optimism will be tested. The next area of decline is around $0.0014, which is the short-term invalidation limit for Zebec’s potential RWA recovery.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Real World Assets (RWA) Tokens To Watch In 2026. Accessed on January 2, 2025