5 Dogecoin Price Scenarios for 2026: Could it Fall Below $0.10?

Jakarta, Pintu News – Dogecoin , one of the most recognizable meme cryptocurrencies, is facing significant market pressure as investor sentiment shifts and digital asset dynamics change as early as 2026.

Various technical analysts are now forecasting the possibility of DOGE prices falling below the psychological level of US$0.10 in the short term, while fundamental factors and market behavior remain key indicators for investors. This information is summarized from recent market reports that mention the changing market structure and shifting focus of capital in the global crypto market.

1. Dogecoin Price Pressure and Downside Prospects

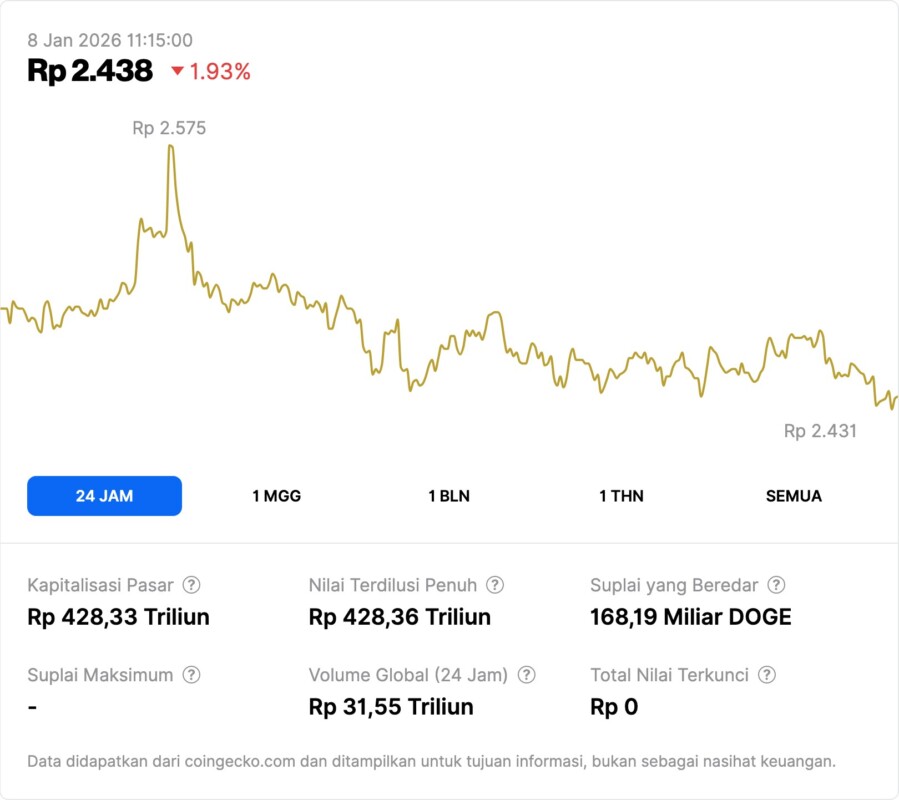

Dogecoin is now experiencing volatile price movements characterized by declines at several key support levels. Recent technical data suggests that if the downward trend continues, DOGE could potentially move below US$0.10, or around Rp1,679 per DOGE based on an exchange rate of 1 USD = Rp16,796. This change partly reflects the reduced interest of retail investors compared to the previous rally period.

According to market reports, this selling pressure is related to reduced liquidity in the Dogecoin market. A large number of whales are reportedly moving capital to other assets that are perceived to have more obvious utility while demand for DOGE is declining. This increases the risk of further declines in the short term.

Also Read: Ethereum (ETH) Keeps Going, Is 2026 the Right Time to Buy?

2. Change of Investment Focus in Crypto Market

The changing focus of investors in the cryptocurrency market has influenced Dogecoin’s price movements. Market reports suggest a rotation of capital from assets that rely solely on social sentiment to assets that have stronger use cases or technical utility. This change can be seen as a response to the search for more stable investment opportunities amid market volatility.

Investors looking for long-term growth potential are now looking more at projects with strong technical fundamentals or real adoption in the DeFi and Web3 sectors. Since Dogecoin has no use other than as a transaction medium or price speculation, this makes DOGE less attractive to some institutional market participants.

3. Price History and Market Psychology

Dogecoin’s past price movements show that the token is heavily influenced by social momentum and online community trends. At its peak in 2021, DOGE reached a very high price compared to current levels, but extreme volatility often followed after these rally periods. This historical data shows how the meme coin market is very sensitive to sentiment factors.

But the high volatility that accompanies Dogecoin also reflects the inherent risk of an asset that is poorly supported by fundamental use cases. This understanding is important for investors considering long-term exposure in volatile crypto markets.

4. Technology Support and Asset Utility

Dogecoin has maintained relevance as one of the oldest meme coins, but its underlying technology is not evolving as quickly as some other projects in the cryptocurrency space. Market reports suggest that a number of other assets with more defined technical utility or business models are now attracting greater attention from investors. These assets often offer additional features such as staking, DeFi, or cross-network integration.

The absence of major technology upgrades for DOGE as experienced by some competitors has also affected market perception of price projections. Investors who value projects based on technical roadmaps are now more selective in structuring their portfolios.

5. Risk Factors and Sentiment Influence

Dogecoin also faces risks related to the general market perception of meme coins, which often depend on social activity and digital community trends. When these trends subside or shift to other assets, DOGE’s liquidity and trading volume tend to decline. Market reports note that this phase of social momentum is now much reduced compared to the peak rally period.

External factors such as macroeconomic sentiment and overall cryptocurrency market movements also put additional pressure on Dogecoin. When the broad crypto market undergoes a correction or consolidation, assets with lower utility often lead the decline over more established assets.

Dogecoin remains one of the tokens that has caught the attention of the crypto community, but short-term price projections suggest downside risks if the trend of market pressure continues. Investors are advised to understand the characteristics of volatility and combine it with a sound risk management strategy.

Also Read: New Strategy in the Crypto World: 680,000 BTC Acquisition by Strategy!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Crypto News. Dogecoin (DOGE) Could Drop Below $0.10 as This Best Cheap Crypto to Buy Now Shows Strength. Accessed January 9, 2026.