Antam Gold Price Chart Today: Update on January 8, 2026

Jakarta, Pintu News – The price of Antam gold today is of concern to market participants after recording quite dynamic movements in line with fluctuations in world gold prices and the rupiah exchange rate. Based on the latest data from HargaEmas.com, the movement of Antam gold reflects the pressure from the decline in global gold prices despite the relatively stable rupiah exchange rate. This condition shows that external factors are still the main determinant of the direction of domestic gold prices.

World Gold Prices Press Antam Gold Movement

On January 8, 2026 trading, the world spot gold price was recorded at around USD 4,421.50 per troy ounce. This figure experienced a daily decline of around USD 35.50 compared to the previous session, reflecting profit-taking in global markets. This data indicates that short-term sentiment towards hedge assets is adjusting.

If converted to rupiah with an exchange rate of USD / IDR around IDR 16,787, the world gold price is at the level of IDR 2,386,472 per gram. The decline in global gold prices is the main factor suppressing the movement of Antam gold today. According to HargaEmas.com data, the correlation between world gold prices and Antam gold is still very strong in the short term.

Also Read: Ethereum (ETH) Keeps Going, Is 2026 the Right Time to Buy?

Antam Gold Price Chart in the Last Week

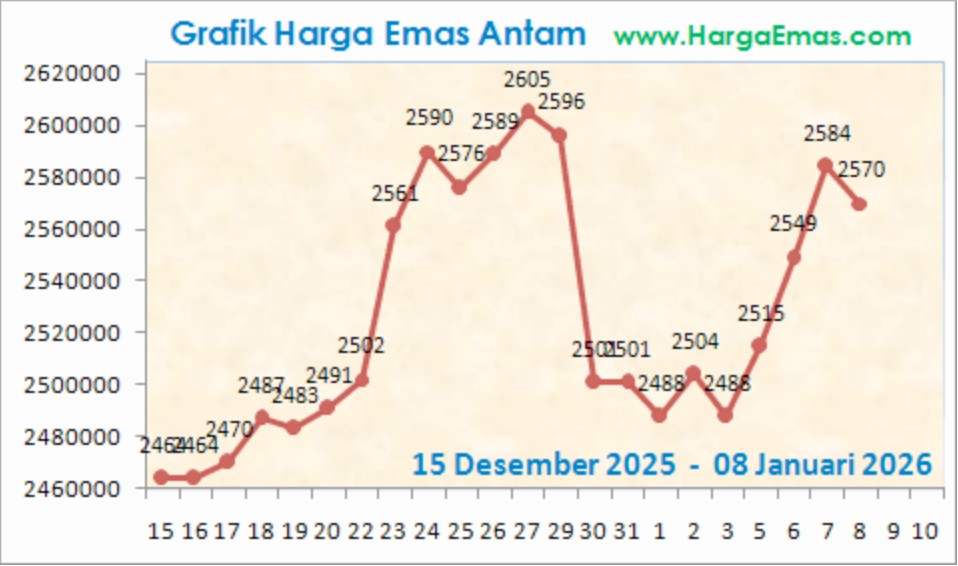

The Antam gold price chart shows high volatility from mid-December 2025 to early January 2026. Within this range, the price touched an area above IDR 2,600,000 per gram before experiencing a sharp correction at the end of December. This movement signaled a consolidation phase after the previous strong rally.

Entering January 2026, Antam gold prices began to fluctuate with a tendency to stabilize in the area of IDR 2,500,000-Rp2,580,000 per gram. This historical data shows that the market is still looking for a new balance amid global uncertainty. According to HargaEmas.com’s records, this movement pattern is common after a significant price spike.

The Effect of Rupiah Exchange Rate on Antam Gold Price

In addition to world gold prices, the rupiah exchange rate also affects Antam’s domestic gold prices. Today, the rupiah recorded a slight strengthening against the US dollar, which slightly restrained the rate of increase in domestic gold prices. The strengthening of the rupiah usually has a direct impact on the decline in rupiah-based gold prices.

However, the effect of the strengthening of the rupiah this time is relatively limited as the decline in world gold prices is more dominant. Based on HargaEmas.com data, the combination of global gold prices and exchange rate movements remains the main factor determining the daily Antam gold price. This makes Antam gold remain sensitive to global market dynamics.

Antam Gold Price Short-Term Outlook

In the short term, Antam’s gold price movement is expected to follow the volatility of world gold. Uncertainty over the direction of global monetary policy and geopolitical conditions are factors that the market continues to pay attention to. Data from HargaEmas.com shows that investors still tend to be cautious in taking new positions.

Despite this, gold is still seen as a hedge asset in the medium to long term. Daily fluctuations as seen today are considered part of the normal dynamics of the market. As such, today’s Antam gold price chart provides an important snapshot of the new balance that is forming in the domestic gold market.

Also Read: New Strategy in the Crypto World: 680,000 BTC Acquisition by Strategy!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- HargaEmas.com. Antam Gold Price Chart and Update Today. Accessed January 8, 2026.