Will Bitcoin (BTC) Continue to Strengthen? IFear & Greed Index Shows This Signal!

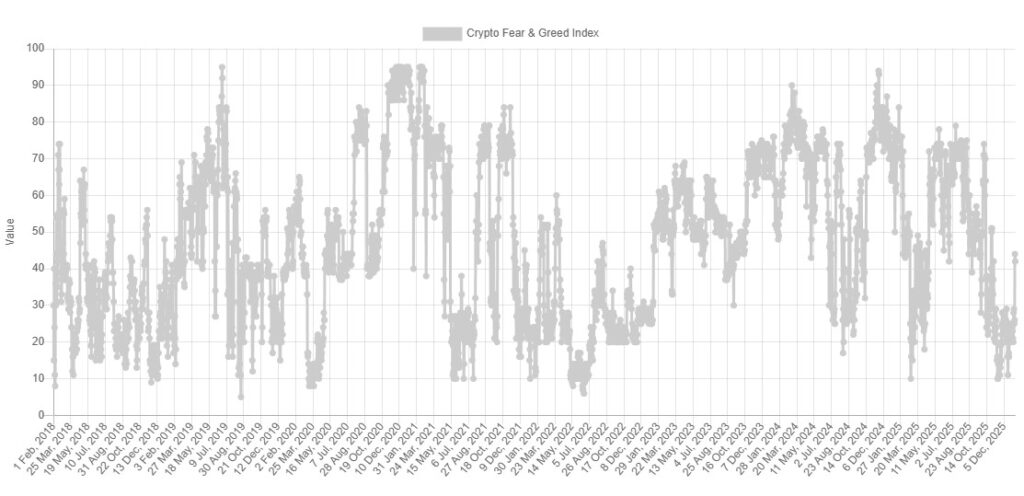

Jakarta, Pintu News – The Bitcoin market has recently shown a significant recovery, which is reflected in an improvement in trader sentiment. The Fear & Greed Index, which is an important indicator in market analysis, has now almost reached the neutral zone after a long period of fear dominance.

Understanding the Fear & Greed Index

The Fear & Greed Index was created by Alternative as a gauge of sentiment in the Bitcoin (BTC) market and cryptocurrencies more broadly. The indicator incorporates several factors such as trading volume, volatility, market capitalization dominance, social media sentiment, and Google trends. A numerical scale from zero to one hundred is used to represent this sentiment, where values below 47 indicate the presence of fear, while values above 53 signify greed.

Currently, the Fear & Greed Index value stands at 42, indicating that fear sentiment still dominates. However, this value is already very close to the neutral zone, indicating that the dominance of fear is not too strong. A few days ago, the situation was much worse with the index in the extreme fear zone.

Also Read: 5 Conditions for the Crypto Market to Hit an All-Time High in 2026, Here’s What Needs to Happen!

Bitcoin (BTC) Price Movement and Market Sentiment

Bitcoin (BTC) recently broke through the $94,000 price at the beginning of the week, but experienced a decline and returned to the $92,000 price. This price movement coincided with the change in value on the Fear & Greed Index The rise from the extreme fear zone to almost neutral coincided with the recovery rally enjoyed by Bitcoin (BTC) and other digital assets.

If this bull market trend continues, it is possible that trader sentiment could return to the neutral zone or perhaps even slightly to the greed zone. History has shown that cryptocurrencies like Bitcoin (BTC) often move against the expectations of the masses. The possibility of this opposite movement tends to be strongest in the extreme zones of fear or greed.

Market Outlook in Light of Current Sentiment

With the Fear & Greed Index nearing the neutral zone, the prediction of the market’s next direction has become more uncertain. At the moment, traders don’t seem to agree on the direction the market will take. Under these conditions, the possibility of price movement in either direction is equally high.

These volatile market conditions require investors to be more cautious in making investment decisions. Observing indicators such as the Fear & Greed Index can provide additional insights that are useful in analyzing volatile market sentiment.

Conclusion

An in-depth understanding of the Fear & Greed Index and Bitcoin (BTC) price dynamics provides a clearer picture of the likely direction of the cryptocurrency market. Although the market is currently showing signs of recovery, it is important for investors to remain vigilant and pay attention to various market indicators before making investment decisions.

Also Read: The Pattern Repeats? Ripple (XRP) is Ready to Surge Like 2017!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects

this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Fear & Greed Nears Neutral as Price Recovers. Accessed on January 9, 2026