Wintermute Identifies 3 Key Drivers That Could Revive Crypto in 2026

Jakarta, Pintu News – The crypto market is experiencing a liquidity imbalance by 2025, according to market-making firm Wintermute. Investor capital is focused on a small group of tokens, while the bulk of the market struggles to expand.

As crypto market patterns shift from previous cycles, the firm identified three key developments that it believes could lay the foundation for a broader market recovery in 2026.

Crypto Liquidity Becomes Centralized in 2025

In its review of the digital asset over-the-counter (OTC) market in 2025, Wintermute notes that the year tested many long-held assumptions in the crypto market. In addition, the report also reveals a major shift in the way liquidity operates in the sector.

Read also: 3 Cryptos Whales Are Buying — and Selling — Ahead of the US CPI Report

Typically, capital flows in the crypto market follow a cyclical pattern: it starts with Bitcoin as the main entry point for liquidity, then switches to Ethereum when Bitcoin’s momentum starts to slow down. After that, capital typically flows to large-cap altcoins, then to small-cap altcoins as investors’ risk appetite increases.

However, this pattern does not occur in 2025.

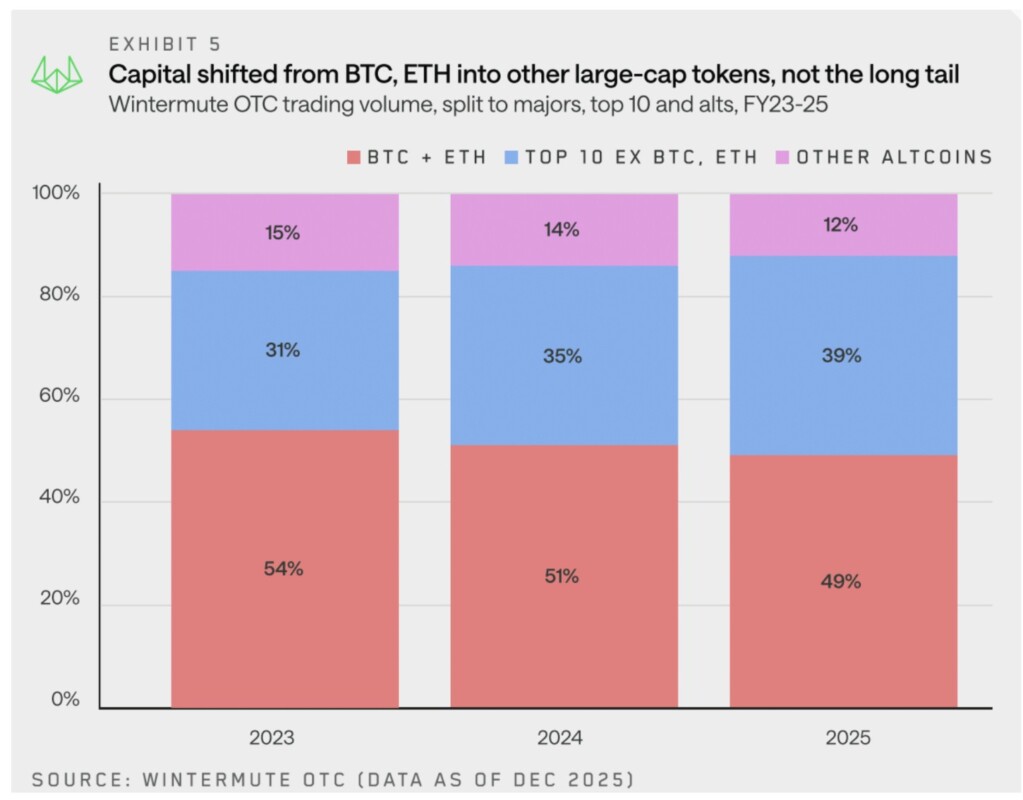

The market-making firm found that trading activity during 2025 was heavily concentrated on Bitcoin, Ethereum, and a handful of other large-cap tokens. As a result, liquidity is becoming increasingly concentrated in key assets, instead of being spread evenly across the market.

“Capital is no longer spread widely across the market. Instead, liquidity has become more concentrated and unevenly distributed, leading to large differences in yields and activity,” the report states.

Impact of ETFs and Digital Asset Treasuries

According to Wintermute, this shift is driven by the presence of exchange-traded funds (ETFs) and digital asset treasuries (DATs). Previously, stablecoins and direct investments were the main entry points for capital flows into the crypto market.

“However, ETFs and DATs have structurally changed the way liquidity flows into the ecosystem,” Wintermute wrote. “As mentioned, their mandates are starting to expand and now allow exposure beyond BTC and ETH – especially to other large tokens. However, this process is gradual, so the impact on the altcoin market has yet to be significantly felt.”

The result is a narrowing of market coverage and a widening of yield differentials between assets. This reflects a more focused capital deployment, rather than an overall market rotation. This trend is evident in the performance of the altcoin and meme coin sectors.

The report noted that the duration of rallies in the altcoin market decreased dramatically compared to previous years. In the period from 2022 to 2024, altcoin rallies typically lasted 45 to 60 days.

Meme Coin Performance Highlights from Wintermute

In contrast, in 2025, rallies only last around 20 days on a median basis. This decline occurred despite the emergence of various new narratives and themes, such as the launchpad meme coin, perpetual DEX, and x402 narratives.

“These narratives did trigger a momentary spike in activity, but failed to develop into a broader, sustainable market rally. This reflects unstable macro conditions, market fatigue after the previous year’s excessive surge, as well as insufficient altcoin liquidity to support further narratives. As a result, the altcoin rally felt more like tactical trading than a confidence-backed trend,” the report explains.

Wintermute also highlighted the performance of meme coins throughout 2025. The aggregate market capitalization for meme coins fell sharply after the first quarter, and was unable to break back through important support levels. Although there was a spike in activity, it was not enough to reverse the long-term downward trend.

Read also: Following Trump and Melania, Former New York City Mayor Launches Latest Coin Meme!

The report cited brief moments of volatility, such as the competition between meme coin launchpad platforms Pump.fun and LetsBonk in July, as examples of localized trading interest that did not develop into a sustained market recovery.

Wintermute Presents Three Scenarios for Broader Market Recovery in 2026

Wintermute emphasized that a reversal of the market dynamics occurring in 2025 would most likely require at least one of the following three developments:

Broader Institutional Exposure

Currently, most of the new liquidity in the crypto market comes through ETFs and digital asset treasuries (DATs), but these flows are still highly concentrated. To support a broader market recovery, there is a need to expand the investment scope of these institutional instruments to assets beyond big tokens like BTC and ETH.

Major Asset Reinforcement

A strong rally in Bitcoin or Ethereum could create awealth effect that drives capital flows across the market. However, it is uncertain to what extent the capital from these major asset rallies will flow into other cryptocurrencies.

Retail Investor’s Return to Attention

A shift in retail investor interest from the stock market back to crypto could trigger an influx of fresh funds. However, Wintermute rates this scenario as the least likely to happen compared to the other two.

The report concludes that the outcome of the crypto market in 2026 largely depends on whether any of these three triggers are strong enough to expand liquidity beyond major assets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Wintermute. Crypto Market Revival 2026: Wintermute Analysis. Accessed on January 15, 2026