Surprising Crypto Market Outlook for 2026: Institutional Adoption Accelerates

Jakarta, Pintu News – The crypto market enters 2026 at a crucial point, no longer driven by hype alone, but rather by institutional adoption, regulatory clarity, and seamless integration of digital assets into the traditional financial system.

While the price of Bitcoin ended 2025 almost flat – in contrast to the positive performance of traditional assets like gold and silver – institutional adoption surged, fund flows into ETFs reached $23 billion, and legislation on stablecoins was officially enacted.

These developments make 2026 a pivotal moment where crypto moves from being a side bet to a core part of the financial ecosystem, although the risks of price volatility and execution challenges remain high.

Bitcoin Price Prediction 2026

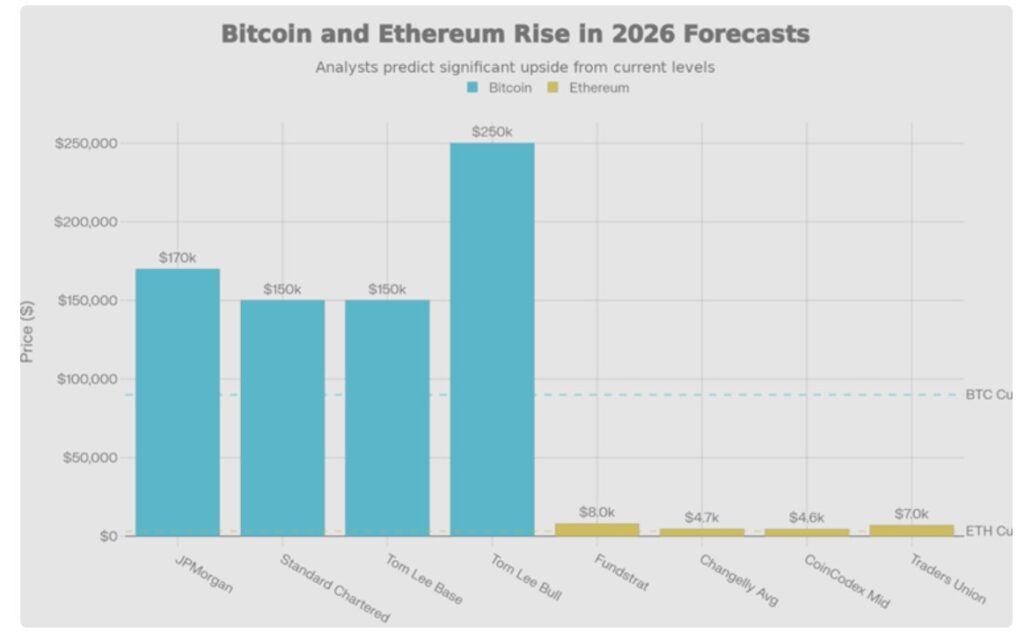

Bitcoin’s price predictions for 2026 show some uncertainty in the short term, while still reflecting strong confidence in its long-term potential. Projections from major institutions vary widely: JPMorgan expects the price to reach $170,000, Standard Chartered is targeting $150,000, and Fundstrat’s Tom Lee predicts between $150,000-$200,000 at the start of 2026, rising to $250,000 by the end of the year.

Read also: Best Performing Crypto Today: Top 5!

On the other hand, more cautious views, such as the assessment from Fidelity that calls 2026 a “rest year” in Bitcoin’s four-year cycle, predict the price will consolidate in the range of $65,000 to $75,000.

Meanwhile, the worst-case scenario from Bloomberg Intelligence suggests prices could plummet to $10,000 if liquidity tightens significantly.

The options market currently reflects an almost equal chance of Bitcoin trading at $70,000 or $130,000 by mid-2026, and an equal chance of $50,000 or $250,000 by the end of the year.

This huge range of volatility reflects the recent uncertainty regarding monetary policy, leverage conditions and the sustainability of demand for ETFs.

Ethereum 2026 Price Predictions by Leading Analysts

Ethereum is expected to experience significant volatility in 2026. ETH market predictions are mostly in the $4,500-$7,000 range, with optimistic scenarios pushing the price to $11,000 by the end of the year as the tokenization of real-world assets (RWA) accelerates and decentralized finance (DeFi) expands.

Tom Lee projects ETH prices to be between $7,000-$9,000 by early 2026, influenced by the tokenization trend and growing institutional demand for stablecoin settlement layers. He even predicts ETH could reach $20,000 by the end of the year.

A similar opinion was shared by Arthur Hayes, co-founder of BitMEX, who in the Bankless podcast with Lee maintained a $10,000 target for Ethereum.

Standard Chartered also took a more bullish stance, raising its price target for Ethereum to $7,500 and its estimate for 2028 to $25,000.

Meanwhile, Joseph Chalom, CEO of Sharplink, believes that Ethereum’s total value locked (TVL) could grow 10-fold by 2026. However, not all analysts are optimistic. Crypto analyst Benjamin Cowen, for example, argues that Ethereum is unlikely to reach new highs next year, citing Bitcoin’s market conditions and limited overall liquidity.

Crypto ETF Fund Flows Could Hit $40 Billion

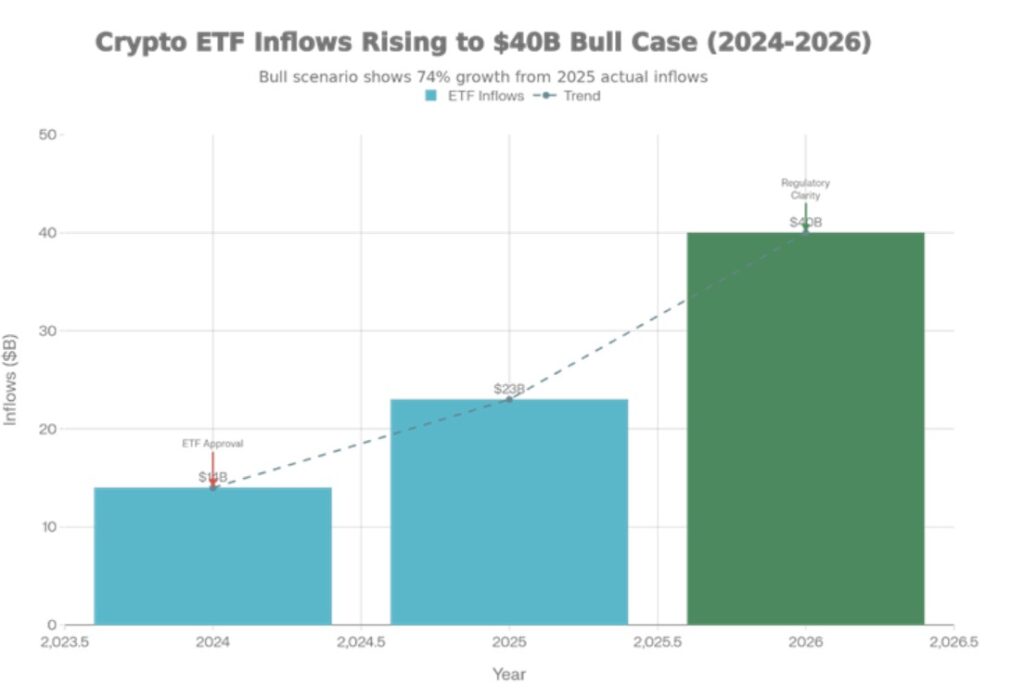

The approval of Bitcoin and Ethereum spot ETFs in 2024 has paved the way for institutions to enter in an organized and regulated manner.

The year 2025 saw net fund flows of $23 billion; Bloomberg Intelligence’s senior ETF analyst Eric Balchunas projects that 2026 could reach $15 billion in a conservative baseline scenario, or jump to $40 billion if conditions are favorable.

Galaxy Digital and other large institutions have even predicted fund flows could surpass $50 billion, as wealth management platforms remove restrictions and start incorporating crypto into their model portfolios.

Bitwise estimates that ETFs will buy more Bitcoin, Ethereum, and Solana (SOL) than the total new supply coming into the market by 2026. In other words, demand from ETFs could outstrip supply, potentially pushing prices up significantly due to demand pressure on asset availability.

Crypto ETF Fund Flow Projections and TVL DeFi Growth (2024-2026)

Theassets under management ( AUM) of Bitcoin ETFs is expected to reach $180-$220 billion by the end of 2026, up from around $100-$120 billion currently.

The main factors driving this growth include interest rate cuts by the Fed (expected throughout 2026), approval of additional altcoin ETFs (possibly including Solana, XRP, and others), and potential public allocations from large pension funds or sovereign wealth funds.

Overall, the AUM of all crypto ETPs (exchange-traded products) is expected to surpass $400 billion by the end of 2026 – double from around $200 billion today. It is anticipated that more than 100 new crypto ETFs will be launched, including more than 50 altcoin spot ETFs following the passage of generic listing standards by the SEC.

Altcoin Price Trends: Solana, XRP, and More

The top altcoins exhibit different risk and return profiles, depending on the level of institutional adoption and regulatory clarity.

Solana (SOL)

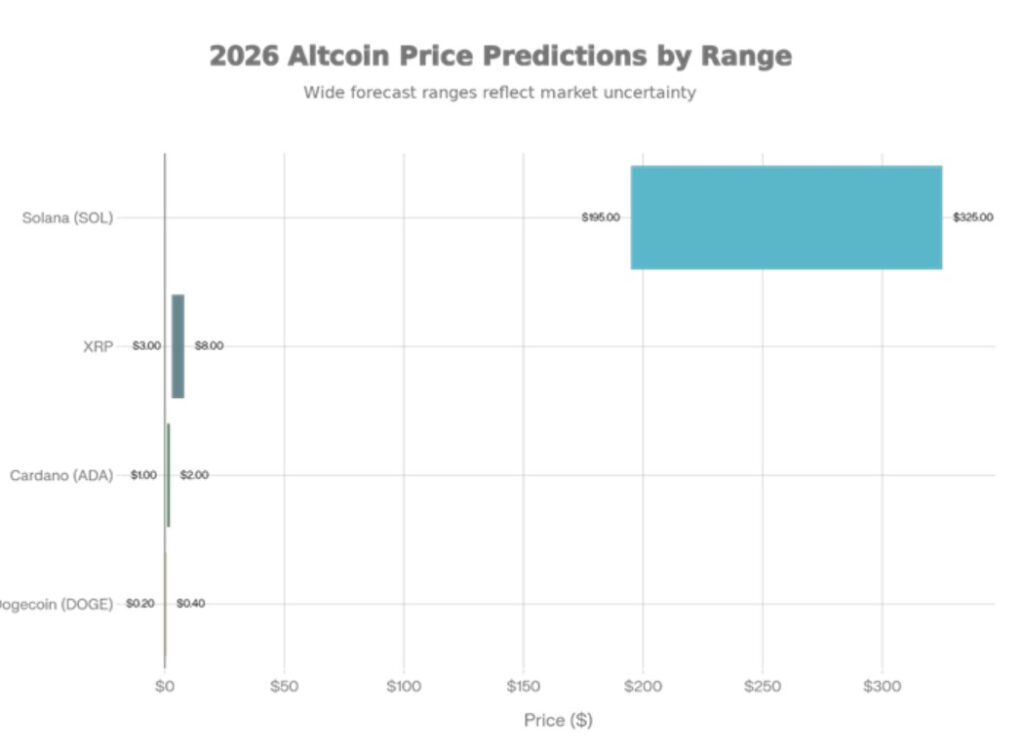

Solana is considered a major smart contract alternative to Ethereum. SOL price predictions for 2026 are in the range of:

- $195 (average)

- $325+ (bullish scenario)

According to Traders Union, prices could reach $210-$270 by mid-2026, and even $412 by 2029.

This projection relies heavily on Solana’sInternet capital markets growing from around $750 million to $2 billion, as more institutional financial activity moves to blockchain networks and Solana’s ecosystem shows maturity beyond mere fad memecoins.

Currently, DeFi Solana’s total value locked (TVL) is around $9.19 billion, making it the fastest-growing DeFi ecosystem after Ethereum, which still leads with a TVL of around $71 billion.

XRP (Ripple)

XRP has the widest range of price projections among the major altcoins:

- Standard Chartered (the most bullish institution) projects that the price of XRP could reach $8 by the end of 2026, which would mean an increase of about 330% from the current price. This projection relies on

:Polylang placeholder do not modify

However, more conservative analysts expect the XRP price to only reach $3-$5, citing execution risk and competition from stablecoins and central bank digital currencies (CBDCs).

AI-based predictions also show differences:

- ChatGPT predicts $6-$8 if ETF fund flows reach $10 billion

- Claude (Anthropic) projects a more aggressive range: $8-$14

Interestingly, XRP has recorded ETF fund flows of $1 billion, confirming institutional interest in officially regulated crypto exposure.

2026 Altcoin Price Predictions (From Conservative to Bullish Scenarios)

Some altcoins such as Cardano (ADA) and Dogecoin are expected to experience more moderate price movements in 2026 than other major altcoins.

Cardano (ADA)

ADA’s price prediction for 2026 is within range:

- $1 – $2

This price movement is highly dependent on the accelerated adoption of smart contracts and the growth of the developer ecosystem on the Cardano network. If technical development and adoption of decentralized applications (dApps) continue to increase, then there is potential to approach the upper limit of the projection.

Read also: Dogecoin Price Slumps 7% Today: Big Wallet Transfers $500 Million DOGE!

Dogecoin (DOGE)

Despite having a large and loyal retail community base, DOGE is expected to trade rangebound:

- $0,20 – $0,40

These forecasts reflect relatively conservative expectations, barring major network upgrades or significant technology integrations. Without fundamental changes, DOGE’s price will likely remain dependent on market sentiment and community support.

DeFi Market Projected to Reach $200 Billion by 2026

Decentralized finance (DeFi) is now entering the institutional validation phase. Total value locked (TVL), which had reached $150-$176 billion by the end of 2025, is expected to cross the $200 billion mark by early 2026, driven by institutional participation in stablecoin lending, borrowing, and settlement activities.

This marks a significant recovery from the low point of around $50 billion after the FTX collapse in late 2022 – an almost 4-fold expansion in just under three years.

Ethereum remains the main leader in DeFi activity, accounting for about 68% of the total DeFi TVL (about $71 billion as of December 2025). The liquid staking segment is the main driver, reaching $44.8 billion only on the Ethereum network, with 4% growth over the year and peak growth of 33% in August-September 2025.

Some of the key protocols that reflect the dominance of value in this sector include:

- Lido: $27.5 billion TVL

- Aave: $27 billion TVL

- EigenLayer: $13 billion TVL

These protocols show a large concentration of value inpermissionless lending services and restaking mechanisms.

DEX Growth and Crypto Lending

Decentralized exchanges (DEXs) are expected to take over more than 25% of combined spot trading volume by the end of 2026, up from around 15-17% today. Driving factors include KYC-free access, lower fees, and appeal to market makers who want less friction.

Meanwhile, crypto-based lending volumes are predicted to exceed $90 billion, with the dominance of on-chain activity continuing to rise. Institutional players are increasingly choosing DeFi protocols over centralized exchanges due to the efficient use of capital.

On-chain lending rates are expected to remain below 10% with low volatility, supported by institutional capital and arbitrage opportunities asoffshore rates fall.

Predicted Market Surge

Prediction markets are also emerging as the fastest growing category. Platforms like Polymarket are now approaching $1 billion in weekly volume, and are projected to consistently exceed $1.5 billion by 2026.

These markets play an important role in daily price discovery for retail traders, as well as providing institutions with expectation-based risk management tools. However, they will also face greater regulatory scrutiny on issues of insider trading and market manipulation.

Stablecoin adoption surges after regulatory clarity

Stablecoins took center stage in 2026, driven by major advances in regulation. The passage of the GENIUS Act(Guiding and Establishing National Innovation for U.S. Stablecoins) in July 2025, which will come into effect in January 2027, provided much-needed legal clarity. This law stipulates that stablecoin issuers must:

- Provide 1:1 reserves in the form of short-term treasuries or cash currency

- Comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) rules

- Disclose reserve composition on a monthly basis

This clear regulatory framework has encouraged partnerships between the traditional financial sector (TradFi) and stablecoin issuers. In fact, nine major global banks are currently exploring the launch of G7 currency-based stablecoins. These banks include: Goldman Sachs, Deutsche Bank, Bank of America, Banco Santander, BNP Paribas, Citigroup, MUFG (Mitsubishi UFJ Financial Group), TD Bank, and UBS.

Read also: 3 Key Catalysts That Could Restore the Crypto Market in 2026, According to Wintermute

This move is seen as an important turning point that could accelerate the global adoption of stablecoins, both for payment settlement, cross-border remittances, and as a bridge between the traditional financial system and the DeFi ecosystem.

Global Stablecoin Market Capitalization Growth (2024-2027)

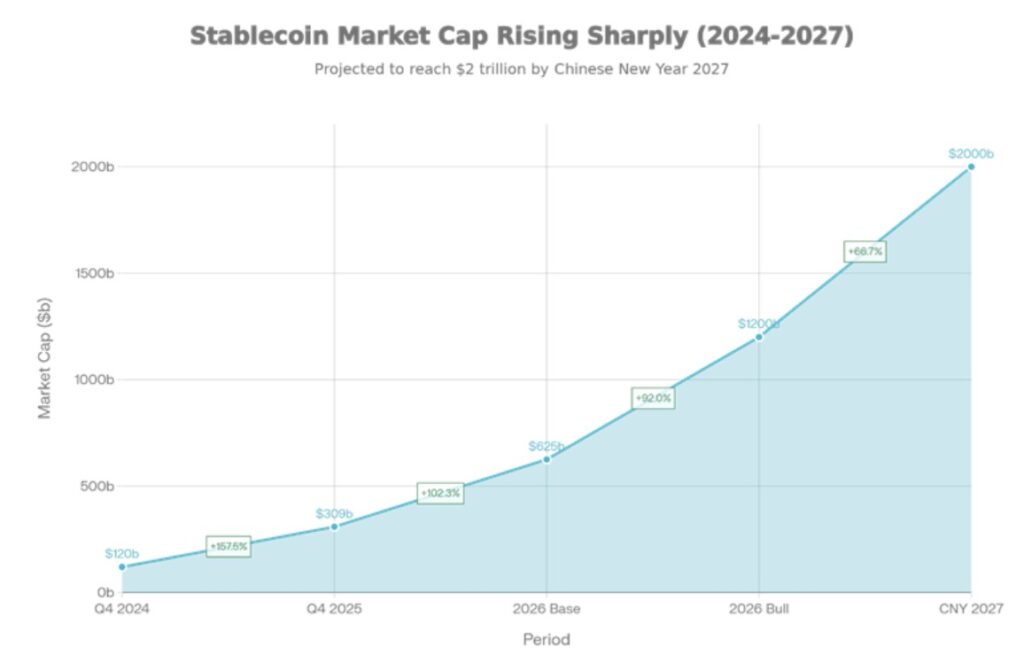

The stablecoin market is experiencing a huge surge, growing from around $120 billion by the end of 2024 to $309 billion by the end of 2025 – an increase of 158% in just one year. Currently, this market is still dominated by:

- Tether : $187 billion

- Circle : $77 billion

- New entrants such as PayPal USD (PYUSD): $3.8 billion, as well as a number of competitors from the traditional financial sector (TradFi) that are starting to enter the market.

Projected Growth 2026: Towards Trillions of Dollars

JPMorgan projects that the stablecoin market capitalization will reach:

- $500–$750 billion in a conservative scenario

- $1–2 trillion in a bullish scenario by the end of 2026 or around Chinese New Year 2027

Citi Research estimates stablecoin issuance at:

- $700 billion in the base-case scenario

- $1.9 trillion in the optimistic scenario

Stablecoins Predicted to Beat Traditional Bank Transaction System (ACH)

Stablecoins are predicted to surpass the transaction volume of the ACH (Automated Clearing House) system – the old banking transaction system – by 2026.

Galaxy Digital predicts that Visa, Mastercard, and American Express will channel more than 10% of cross-border settlement volume through public stablecoins in the same year.

However, end users won’t notice any changes as the stablecoin will serve as a “behind-the-scenes settlement rail” without changing the user experience.

The supply of stablecoins is expected to grow at a compound annual growth rate (CAGR) of 30-40%, driving a surge in transaction volumes globally.

Increased Demand for Stablecoins & Real World Asset (RWA) Tokenization

The entry of large institutions confirms this growth direction, among others:

- Western Union launches US Dollar Payment Token on Solana network

- Sony Bank is developing a stablecoin that will be used across its ecosystem

- SoFi Technologies introduces SoFiUSD on Ethereum for more efficient interbank settlements

This trend suggests consolidation of stablecoin usage by the traditional financial sector, where one to two dominant stablecoins per region will emerge as the main rails for transaction settlement. Superiority in network effects and brand familiarity will accelerate adoption.

Real World Asset (RWA) Tokenization Penetrates Mainstream Capital Markets

Tokenization of real-world assets is becoming an important part of global capital markets. Some notable trends:

- Fortune 500 companies, including banks, cloud providers, and e-commerce platforms, have launched corporate Layer-1 blockchains that accomplish more than $1 billion of real economic activity each year.

- This blockchain is starting to bridge to public DeFi for liquidity and price discovery purposes

Major banks will begin accepting tokenized shares as collateral on par with traditional securities. The SEC is expected to grant an “innovation exemption” allowing non-wrapped tokenized securities to be traded directly on public DeFi networks. The formal regulatory process for this is scheduled to begin in the second half of 2026.

Crypto Adoption by Institutions, Corporations, and Countries

Institutional Adoption: Surging Fast in 2026

The adoption of digital assets by institutions has accelerated significantly:

- 76% of global investors plan to increase exposure to digital assets by 2026.

- 60% of them expect to allocate more than 5% of their AUM (assets under management) to crypto.

- As of the 3rd quarter of 2025, 172 publicly listed companies were recorded as holding Bitcoin – up 40% from the previous quarter, with total holdings of around 1 million BTC (about 5% of the total circulating supply).

Traditional Financial Infrastructure Starts to Integrate

The Office of the Comptroller of the Currency has granted conditional approval to five digital asset-based national trust bank charters: BitGo, Circle, Fidelity Digital Assets, Paxos, Ripple.

This move places stablecoins and crypto custodial services under the umbrella of federal banking regulation, offering institutional-grade compliance and risk management standards.

Adoption by the State: New Momentum in 2026

Crypto adoption by governments is starting to show real progress. Countries like:

- Brazil

- Kyrgyzstan

has enacted regulations that allow the purchase of Bitcoin for sovereign reserves – an important step towards state adoption.

Regulatory Clarity in the Trump Era: Stricter and More Targeted Rules

The shift from a “regulation by enforcement” approach to the establishment of explicit rules marks a major turning point for the U.S. crypto industry:

- GENIUS Act: Establishes national standards for stablecoins.

- CLARITY Act: Passed by the U.S. House of Representatives, it addresses market structure and jurisdictional clarity.

Outside the U.S., regional regulatory frameworks are also reinforcing the legal foundation:

- EU’s MiCA (Markets in Crypto-Assets Regulation)

- UK regulatory standards

- Singapore’s MAS stablecoin framework

- Crypto guidelines from the UAE

Together, these developments are creating a compliant and scalable environment for institutional participation in the crypto ecosystem.

Monetary Policy & Its Impact on Risk Assets

Several macroeconomic factors are predicted to boost market sentiment towards risky assets, including crypto:

- Fed rate cuts anticipated throughout 2026

- Discussion on fiscal stimulus

- Possible replacement of Fed Chair with a more dovish figure in May 2026

More Structured Regulation: Two Emerging Market Pathways

Governments are starting to look at blockchain technology not only as a financial innovation, but also from a national security standpoint. This is fueled by concerns over:

- Sanction avoidance

- Illegal activities

- Involvement of state actors

As a result, there is a clear separation between:

- Regulated and institution-friendly crypto market

- Offshore platforms and privacy-focused assets, which face greater regulatory pressure

This is beneficial:

- Highly compliant platform

- Regulatory compliant digital assets

Meanwhile, privacy-oriented tokens and unregulated exchanges will likely face stricter restrictions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Exclusive Report: Crypto Market Predictions 2026. Accessed on January 19, 2026