Bitcoin Drops Below USD 93,000: Here are 5 Big Impacts to the Crypto Market!

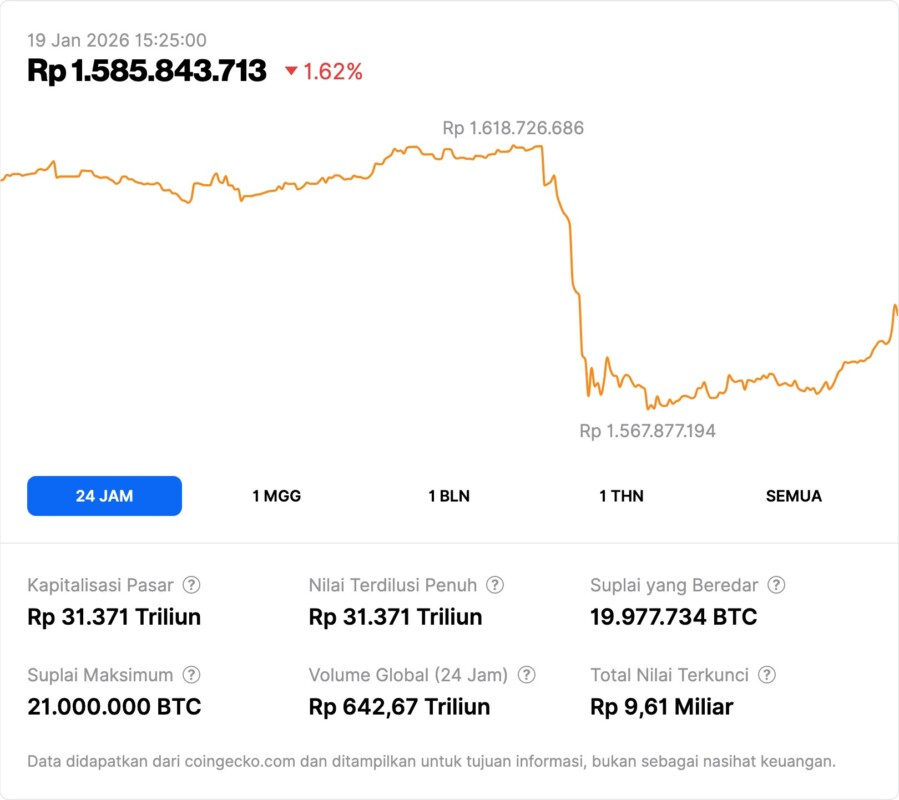

Jakarta, Pintu News – Bitcoin experienced a price drop to levels below USD 93,000 in recent trading after an earlier rally weakened and a massive long liquidation reaching hundreds of millions of dollars, an event that reflects the pressure on the cryptocurrency market more broadly.

1. Bitcoin drops to touch levels below USD 93,000

Bitcoin experienced a significant drop and is trading below USD 93,000, reflecting the increasing selling momentum. This level is an important psychological area as it is often a support point for market sentiment. The drop indicates a change in price direction after several quieter rally sessions.

This decline came as global selling pressure intensified, especially in the Asian trading session. As a result, market participants became more cautious about taking new positions. The correction also appeared to affect other cryptocurrencies, demonstrating the strong correlation between Bitcoin and the crypto market as a whole.

Also Read: 5 Realistic Ways to Earn 2 Million in a Day, Here’s the Secret!

2. $680 Million Longs Liquidated in Derivatives Market

One of the factors driving down the price of Bitcoin is the large liquidation of long positions in the crypto derivatives market. Estimated at around USD 680 million, this liquidation shows the pressure on traders using high leverage. When technical support levels fail to hold, automatic stop-losses trigger the closing of positions, accelerating the price drop.

Large liquidations can create continued selling pressure as closed positions must be transacted on the spot market. The impact is felt not only on Bitcoin but also on other altcoins such as Ethereum and Ripple . High liquidation volumes often reflect sharper risk sentiment towards the cryptо market.

3. Liquidity Pressure and Crypto Market Volatility

A drop below USD 93,000 indicates that liquidity in the crypto market is limited in lifting prices again. When thin liquidity and high leverage shrink, volatility tends to increase. This makes Bitcoin price more sensitive to sell-offs and negative news.

Crypto traders and investors often see phases like this as healthy consolidation or as a natural correction after a rally phase. However, short-term volatility makes risk management strategies even more important. Weak long positions may continue to pressure the price until the next support area is tested again.

4. Implications to Altcoin Prices and Crypto Ecosystems

Bitcoin’s price decline usually affects altcoins because Bitcoin is often the benchmark for the entire cryptocurrency market. When Bitcoin weakens, altcoins such as Ethereum, Solana , and Dogecoin tend to follow the same direction. This correlation suggests that volatility in the Bitcoin market often creates selling pressure across crypto asset classes.

As a result, a large liquidation of long positions at once can expand price volatility in altcoins, especially for assets with high leverage or high intrinsic volatility. For long-term investors, a phase like this can also be a moment to evaluate their strategy towards a particular crypto.

5. Risk Management Lessons for Bitcoin Traders

This major liquidation event is a reminder of the importance of risk management in trading Bitcoin and other cryptocurrencies. High leverage can magnify both profits and losses. When markets move sharply, positions that are not properly hedged can be liquidated more quickly.

Traders and investors are advised to monitor important support and resistance levels and use appropriate stop-losses to limit risk. An understanding of global market dynamics, including liquidity and investor sentiment, can help in making more measured decisions.

Also Read: 10 Ways to Make Money from Games Quickly but Realistically (Online & Mobile)

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinDesk. Bitcoin slides below USD 93,000 as USD 680 million longs are liquidated. Accessed January 19, 2026.