Silver Jewelry Price Today January 21, 2026: Latest Update per Gram

Jakarta, Pintu News – The price of silver jewelry today, Wednesday, January 21, 2026, is recorded to be stable following the movement of global silver prices and adjustments to the precious metals market in Indonesia, with the selling price per gram still in the range of tens of thousands of rupiah.

Silver Jewelry Price Update Today

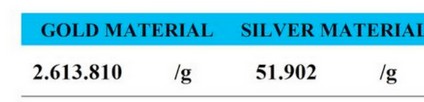

Based on the latest data, today ‘ s silver jewelry prices in the domestic market are in the range of IDR 51,900 per gram for silver material. This price reflects the selling value of silver after taking into account global spot prices, the rupiah exchange rate, as well as local distribution margins.

It should be noted that the price of silver jewelry differs from the price of pure silver in the international market. The price difference generally comes from production costs, design, and quality of workmanship, which affect the final selling price at the consumer level.

Also Read: 7 Trump Meme Coin Facts and Impact on US Crypto Policy

Comparison with World Silver Price

In the global market, global silver prices have remained relatively stable amid fluctuations in the commodity market. Silver continues to have unique characteristics as it not only serves as a precious metal, but also has high demand from industrial sectors, including electronics and renewable energy.

The conversion of global silver prices to rupiah is one of the main factors in the formation of silver jewelry prices in Indonesia. When the rupiah exchange rate weakens or the spot price of silver rises, price adjustments at the retail level are usually made gradually.

Factors Affecting the Price of Silver Jewelry

The price of silver jewelry today is influenced by several important factors. First is the world silver price which moves with global economic conditions, inflation, and monetary policy. Second, the exchange rate of the rupiah against the US dollar also determines the final price in the domestic market.

In addition, non-market factors such as production costs, silver purity levels and seasonal demand also affect prices. Jewelry with complex designs or high quality craftsmanship generally sells for more than regular silver bars.

Silver as an Alternative Asset

In the context of asset diversification, silver is often seen as an alternative to gold and modern instruments such as crypto and cryptocurrencies. Although not as popular as gold as a hedge asset, silver has higher volatility and the potential for dynamic price movements.

However, silver jewelry should be viewed as a consumptive asset with intrinsic value, not merely a short-term investment instrument. The difference between the purchase price and the resale price needs to be a major consideration before making a transaction.

Conclusion

Silver jewelry prices today, January 21, 2026, are in the range of IDR 51,900 per gram and are relatively stable compared to the previous day. This price movement reflects calm global market conditions and consistent domestic demand.

For consumers, monitoring silver prices regularly can help determine the right time to buy or sell silver jewelry. It is also important to understand the difference between the spot price of silver and the jewelry price to make more rational transaction decisions.

Also Read: 7 Facts XRP Longs Liquidated $5 Million: Analysis of Impact and Crypto Market Direction

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- I Love Gold. Latest Precious Metal & Jewelry Prices. Accessed January 21, 2026.