Is the fear of quantum computing the cause of the Bitcoin price crash?

Jakarta, Pintu News – Bitcoin’s price drop to $87,895 on Tuesday has resurrected an old market habit: attributing one clear narrative to complex and diverse price action. This time, the issue in the spotlight is quantum computing, which is being touted as an existential threat that explains why Bitcoin is underperforming gold, which reached a new high of $4,888.

Quantum Computing: Real Threat or Just a Market Narrative?

Quantum computing is often perceived as a threat that could shake the foundation of Bitcoin’s (BTC) security. However, not everyone agrees that this is the main reason behind Bitcoin’s price drop. Vijay Boyapati, a Bitcoin advocate, acknowledges that quantum computing is a real problem, but rejects it as the main explanation for Bitcoin’s price stagnation.

Boyapati argues that the market structure can self-destruct when a certain price level triggers distribution and trust begins to crack. According to him, an increase in price is like a wave hitting a glacier-eventually, a certain amount of supply will slip away and fall onto the order book.

Also Read: Is Gen Z Investing Only in Crypto a Smart Decision or Not? Here’s What Analysts Say!

On-Chain Analysis and Its Impact on Bitcoin Price

James Check, a well-known Bitcoin on-chain analyst, argues that while quantum risk may be limiting some capital, it is not the main driver of the divergence between gold and Bitcoin. Check points out that gold is gaining demand because sovereign nations are buying it as a substitute for securities.

Furthermore, Check highlighted the supply-side pressure that Bitcoin has absorbed. According to him, Bitcoin has been subjected to selling pressure from HODLers in 2025 which should have crushed every previous bull market multiple times.

Market Structure and Its Impact on Bitcoin Price

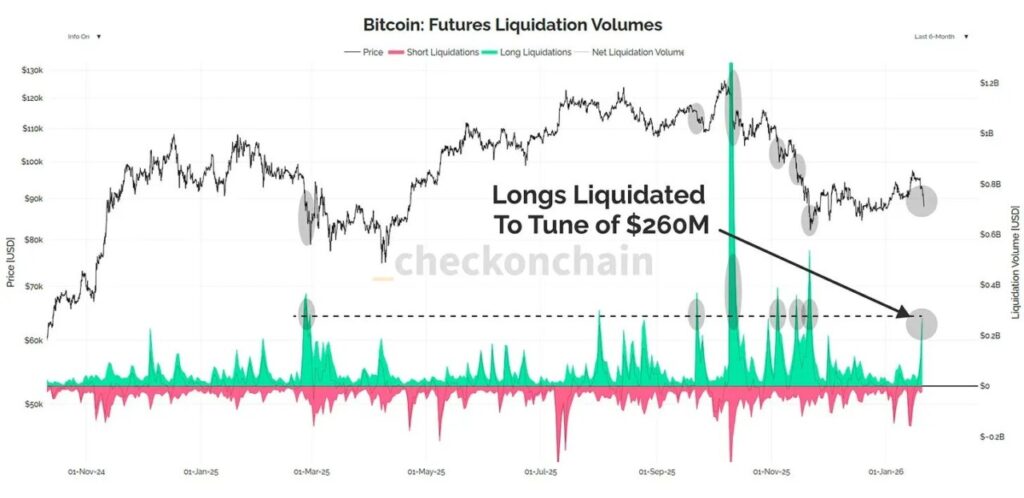

In a brief market update, posted by analytics brand Checkonchain, the immediate trigger for the price movement was explained as being more due to the use of leverage than existential risk. Bitcoin “sold back to the high $80,000s range,” with “bears taking out long traders using leverage.”

Technically, the market structure still resembles a bear flag, with “obvious supply air pockets” between $70,000 and $81,000, indicating thin supply support if sellers take control.

Conclusion

Ultimately, while quantum computing may be a concern in the background, the Bitcoin market is affected by a variety of more complex factors. Understanding these dynamics requires a more in-depth analysis than simply attributing each dip to one single cause.

Also Read: XRP price slumps, will it surge at the end of January 2026?

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Selling Off on Quantum Fears: Reality Check. Accessed on January 23, 2026