Bitcoin (BTC) regains ground, breaks $90,000 amid ETF outflows

Jakarta, Pintu News – Bitcoin has shown significant price recovery, reaching back to the $90,000 mark despite a large outflow of funds from Bitcoin ETFs. In the past week, the Bitcoin (BTC) market showed quick reactions to changes in position and sentiment, with increased volatility and buying by short-term investors.

Bitcoin Seller Patterns: A Historical Pattern

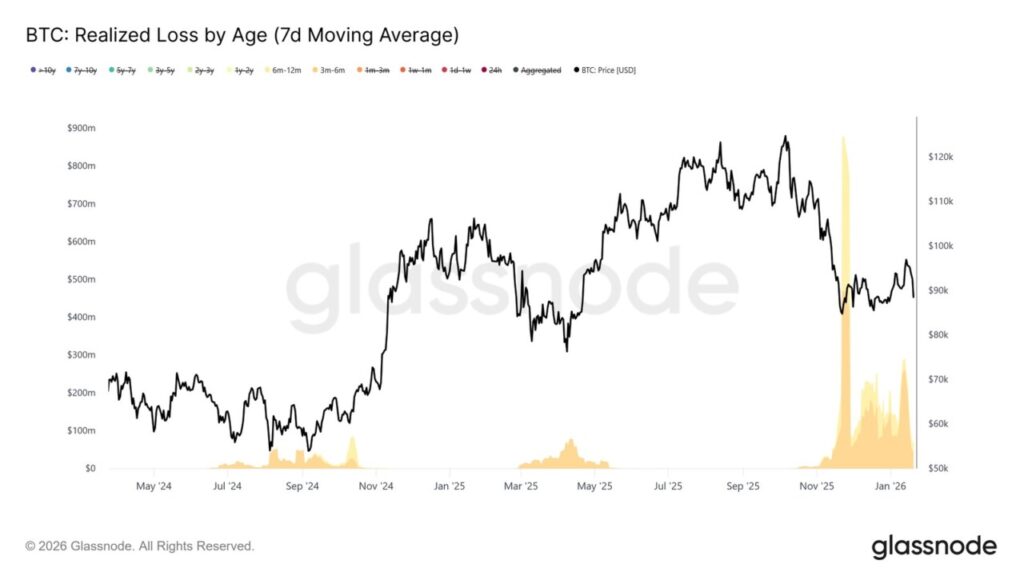

Recent on-chain data shows that realized losses are currently concentrated in the group of Bitcoin (BTC) holders between three to six months, with secondary contributions from six- to twelve-month holders. This group is generally those who bought at the peak of the cycle, particularly above $110,000, and are now having to face a downturn as the price returns to their cost base.

This loss reflects significant selling pressure in the market, which may affect short-term price stability. However, it also offers opportunities for investors looking for potential entry points, as the current price may be attractive to those seeking long-term value.

Also Read: Is Gen Z Investing Only in Crypto a Smart Decision or Not? Here’s What Analysts Say!

Buyback Pressure Faster than Expected

From a momentum standpoint, market conditions have improved faster than many expected. The Money Flow Index (MFI) has shown a sharp increase in the last 48 hours, signaling renewed buying pressure. The MFI indicator, which combines price and volume, is a solid proxy for real demand during periods of volatility.

This increase suggests that investors may be starting to see Bitcoin (BTC) as an attractive asset again, despite several factors still pressuring the market. This increase could also be an early indicator of a trend change, which could bring more investors into the market.

ETFs Continue to Lose Capital

Despite a recovery in Bitcoin (BTC) prices in the past two sessions, outflows from Bitcoin ETFs continue to show a less than encouraging picture. Spot Bitcoin ETFs have recorded consistent outflows this week, totaling around $1.6 billion over three trading days.

Wednesday alone saw redemptions of $708 million-the largest single-day outflow since November 2025. This outflow suggests that investors may still be skeptical of Bitcoin’s (BTC) near-term prospects, despite some signs of price recovery. It also signals that the market may still be in an adjustment phase, with investors reassessing their positions in the face of market uncertainty.

Conclusion

With market dynamics constantly changing, Bitcoin (BTC) is still showing resilience in the face of pressure. Although the ETF experienced outflows, increased buying activity suggests that interest in Bitcoin (BTC) has not completely died out. Investors are advised to stay alert to technical and fundamental indicators to make informed investment decisions.

Also Read: XRP price slumps, will it surge at the end of January 2026?

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Regains $90,000 Even as BTC ETFs Record 2-Month High Outflows. Accessed on January 23, 2026