7 XRP Shocking Facts: Burn is Up, Price is on Hold, What’s the Impact for Crypto in 2026?

Jakarta, Pintu News – Burn activity on the Ripple network is back in the spotlight after token destruction metrics showed a significant spike amidst a price correction phase. This phenomenon has led to a new discussion about the supply-demand dynamics in the cryptocurrency ecosystem, particularly for Ripple . This article summarizes the key facts in a neutral and informative manner to help readers understand its context in the global crypto landscape.

1. XRP Burn Spike Reaches Monthly Highs

On-chain data shows that the amount of XRP burned per day increased sharply compared to the previous week’s average. The burn occurred as part of the transaction fee mechanism on the Ripple network, where a small percentage of XRP is permanently destroyed.

This increase indicates a rise in network activity, both in terms of retail and institutional transactions. In the context of cryptocurrencies, burn is often viewed as a technical signal, rather than the sole price-determining factor.

Also Read: Silver Price Prediction 2026-2030, How will it fare in the next 5 years?

2. Limited Deflationary Burn Ripple Mechanism

Unlike the aggressive burn model of some other cryptos, Ripple applies a very small amount of burn per transaction. The average transaction fee is around $0.00001 or about Rp0.17 at an exchange rate of 1 USD = Rp16,763.

The model is designed to prevent network spam, not to drastically reduce supply. Therefore, XRP’s burn impact is more relevant as an indicator of network usage than a deflationary tool.

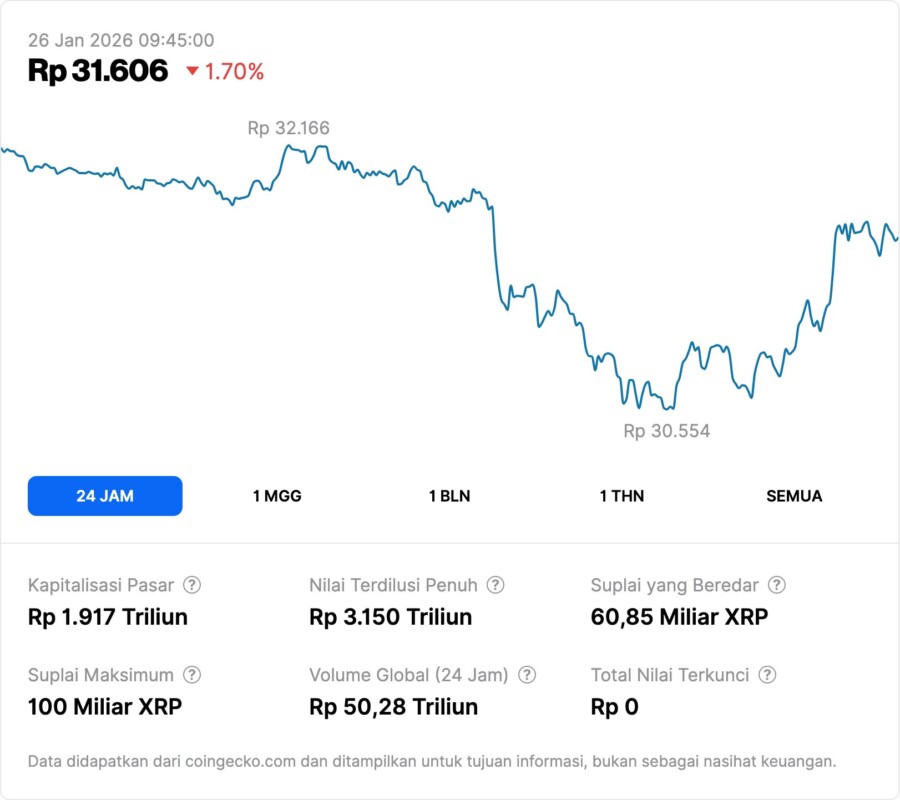

3. XRP Price Still in Pullback Phase

Despite the rising burn, the price of Ripple (XRP) is still moving in a short-term correction phase. This suggests that the market is currently more influenced by macro sentiment and global liquidity than on-chain metrics alone.

In the crypto world, directional differences between network data and prices are nothing new. This situation often arises when market participants are waiting for confirmation of a stronger trend.

4. Network Activity Becomes a Fundamental Signal

The burn spike indirectly reflects an increase in the number of transactions on the Ripple network. This can be interpreted as the increasing utility of the network in the cross-border payments ecosystem.

For fundamentally-oriented cryptocurrency investors, this data can be complementary to analysis. However, its interpretation still needs to be combined with regulatory factors and institutional adoption.

5. Comparison with Other Crypto

When compared to Ethereum , which implemented a burn through EIP-1559, XRP’s burn scale is relatively much smaller. Ethereum can burn millions of dollars worth of ETH per day, equivalent to hundreds of billions of rupiah.

This difference confirms that each cryptocurrency has a unique economic design. Therefore, the XRP analysis approach cannot be directly equated with smart contract-based cryptos.

6. Relevance of Burn to Market Psychology

Although the direct impact to price is limited, burn spikes often affect short-term market perception. Many crypto market participants monitor this metric as a signal of activity, not as a trigger for FOMO.

In the context of news, burn data is more appropriately positioned as supporting information. Neutrality is important so that readers understand that this metric is not a guarantee of price movement.

7. What it Means for the Cryptocurrency Market Going Forward

If Ripple’s network activity continues to increase consistently, XRP burn is likely to remain at high levels. This could strengthen the network utility narrative in the medium term.

However, price direction will still be determined by a combination of technical, macroeconomic, and global crypto industry policy factors. As such, the XRP burn should be seen as one part of the big picture.

Also Read: 3 Cryptocurrencies that are Ready to Rise Again in 2026

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. XRP Burn Metric Surges as Prolonged Price Pullback Nears End. Accessed January 26, 2026.