BTC Weakens Below US$88,500 & Gold Breaks US$5,000

Jakarta, Pintu News – The digital asset and precious metals markets showed different dynamics on January 27, 2026, where Bitcoin remained consolidated below the US$88,500 level, while gold managed to set a record above US$5,000 per ounce. These movements reflect the divergence in investor sentiment between risky and safe haven assets amid the current global economic uncertainty.

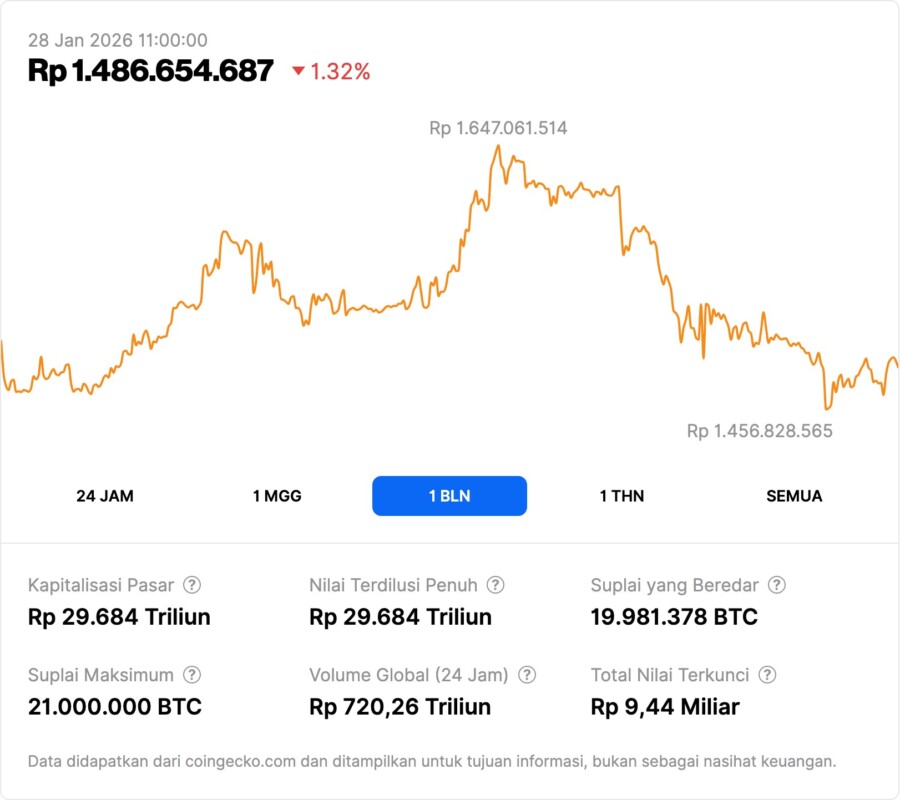

1. Bitcoin Pressured Below US$88,500

Bitcoin showed weak movement in early week trading sessions, with the price dipping below US$88,500 after losing around 4 percent in the past week. This decline coincided with weakness in most other major crypto tokens, reflecting cautious market sentiment towards the high-beta asset.

BTC’s stagnant movement in this range shows that the short-term bullish trend still hasn’t managed to break through important resistance. Technical pressure and short-term profit-taking are the factors holding back Bitcoin’s upward momentum.

Also Read: Gold Dominates, Bitcoin (BTC) Slumps on Yen Intervention Fears, Why?

2. Gold Sets Record Above US$5,000

While Bitcoin was held back, gold managed to record a price above US$5,000 per ounce, indicating strong demand for safe haven assets. This increase in gold prices was largely driven by rising macroeconomic and geopolitical concerns, including fiscal policy risks in the US.

Growing demand for gold often indicates investors’ preference for hedging, especially when riskier assets like stocks and crypto are under pressure. This momentum is a major highlight for commodity traders and investors.

3. Volatile Silver Movement

Apart from gold, silver prices also recorded a significant increase before giving back its gains in recent sessions. The white metal had recorded sharp gains in a short-term bullish trend but then corrected from its highs.

The movement of silver illustrates that interest in safe haven assets is not only in gold, but also in other metals, although their volatility is still greater than gold.

4. Crypto Assets vs Precious Metals

The divergence in performance between Bitcoin and gold during this period highlights the different character of the two as different asset classes. Bitcoin, which is often viewed as a speculative asset with high volatility, did not show the ability to sustain price momentum below key technical resistance levels.

In contrast, gold, which is seen as a safe haven asset, has received strong support from demand from investors seeking hedging instruments against economic and geopolitical risks. These movements suggest that in certain market phases, precious metals can outperform cryptocurrencies in terms of price stability.

5. Factors Affecting Market Volatility

Several macro factors such as the uncertainty of US monetary policy, the risk of a government shutdown, and sentiment towards inflation are part of the drivers of the direction of price movements in both asset classes. This kind of uncertainty often leads to capital flows from risky assets to safe havens.

In addition, the global economic calendar and interest rate decisions are also important components awaited by market participants in determining their short and medium term investment stance.

Also Read: Ripple (XRP) Drastic Decline: Analysis and Outlook in 2026

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Bitcoin Remains Coiled Under $88,500 as Gold Tops $5,000, Silver Gives Back Gains. Accessed January 28, 2026.