7 Important Facts: Impact of Whale Sale on XRP Price

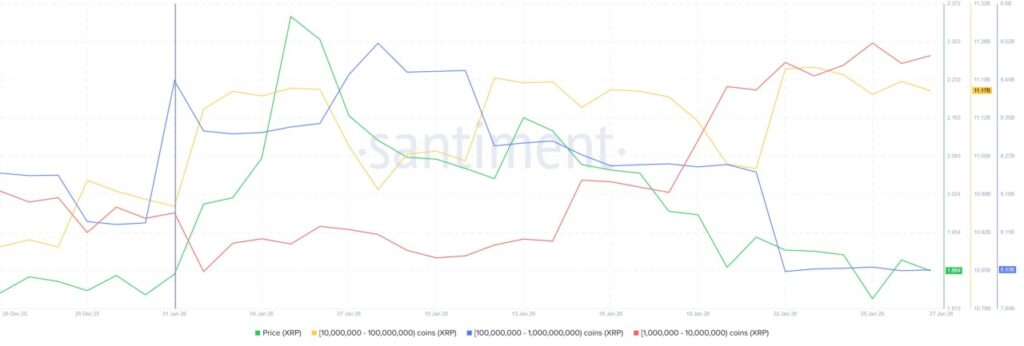

Jakarta, Pintu News – The price of XRP has recently shown noticeable market pressure, largely influenced by selling activity among large whales. Recent on-chain data reveals how token distribution by these large addresses has the potential to depress the price in the short-term, as well as how the response from long-term holders can buffer the effect. This analysis is important for both young and novice crypto investors looking to understand the relationship between whale activity and XRP’s price structure.

1. Big Whale Sells Over $800 Million XRP

In the past one-month period, whales with large holdings sold over $800 million worth of XRP, making this one of the largest distributions recorded in recent times. This selling activity typically creates significant supply pressure, as large units of tokens enter the market quickly. However, most of these sales were absorbed by other whales with smaller holdings sizes, so the increase in supply on exchanges was not as large as expected.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

2. Sales Not Only Increase Downside Pressure

Large distributions by whales generally increase the risk of sharp price corrections if there are no significant buyers ready to absorb the supply. However, in the case of XRP this time, most of the tokens sold did not go directly to the public spot market, but were absorbed by other whales who tend to have long-term holding tendencies. Therefore, the downward pressure is more muted than if the tokens were fully released to the public market.

3. Declining Liveliness Indicates Long-term Accumulation

XRP’s on-chain Liveliness indicator is at a three-month low, meaning many tokens that once moved are no longer moving in the near future. This decline in Liveliness is likely to reflect long-term accumulation by existing holders, rather than active distribution. This phenomenon helps to contain downside volatility while signaling the confidence of large holders in XRP’s long-term prospects.

4. Selling Pressure Remains If XRP Fails to Maintain Key Levels

Despite long-term accumulation, downside risk remains relevant if XRP price fails to break and hold above certain technical resistance levels. Critical levels such as ~$1.93 and support around ~$1.86 are referred to as lines that determine the next direction. If prices break below these supports, selling pressure from whales and the general market could intensify and push prices down further.

5. Whale Selling Previously Pressured XRP Price

There has also been a history of whale selling activity in the past: in a particular week whales sold almost $783 million worth of tokens, and similar activity has seen XRP drop close to the $2.00 level. Heavy selling has also held back XRP’s breakout momentum, causing the price to consolidate in an important technical area again. This phenomenon shows that heavy selling pressure from whales remains a dominant factor in determining short-term price dynamics.

6. Whale Activity is Not Always Bearish

While whale selling is often associated with bearish pressures, whale activity does not always have a long-term negative effect. In previous cycles, large whales have also made large accumulations that contributed to crypto price rallies, including XRP. Therefore, it is important to distinguish between profit-taking distributions and strategic accumulation by long-term investors.

7. Implications for Crypto Investors

For novice investors, whale activity is an important signal but not the only indicator for price predictions. A combination of on-chain analysis, supply conditions on exchanges, and macro market sentiment needs to be combined to understand the broader outlook for XRP.

Investors should monitor key technical levels and liquidity metrics to assess whether whale selling pressure will continue to affect prices or will be offset by accumulation.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Aaryamann Shrivastava/BeInCrypto. Large XRP Whales Sold $800 Million, Will Price Drop Again? Accessed January 30, 2026.