Optimism Voters Give the Green Light to OP’s Revenue-Backed Buyback Plan

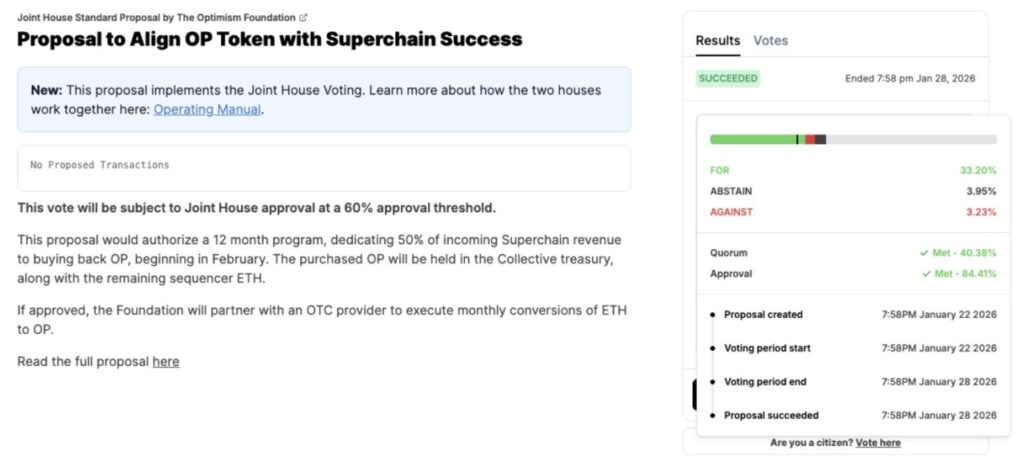

Jakarta, Pintu News – Optimism token holders have approved a proposal submitted earlier this month to launch a 12-month OP token buyback program. The proposal passed the quorum with the support of more than 84% of the participating votes.

Majority Support Optimism’s Buyback Proposal

Read also: XRP Eyes a Rebound as Whales Buy Aggressively Amid 21% Decline

The vote – which reached quorum on today, January 28, with a large majority of voters expressing approval, just moments before the deadline expired at 13:58 ET – provided authorization to allocate 50% of Superchain’s sequencer revenue for OP token purchases on a monthly basis.

Now, this decision still has to pass one final stage, namely a vote in the Joint House, which requires a 60% majority.

If this final stage is successfully passed, then Optimism Foundation will start converting revenue in ETH into OP from February. Repurchased OP tokens will be kept in the Collective’s treasury. The initial implementation of this program will be done through over-the-counter (OTC) providers, and each transaction will be announced through a public dashboard.

Proposal Triggers Debate

This proposal aims to tie the OP token more closely to activity on the Optimism Superchain, which is a Layer 2 chain ecosystem for Ethereum that includes Coinbase’s Base and World Chain.

In Optimism’s proposal, first published on January 7, it was stated that the Superchain generated approximately 5,868 ETH (about $17.6 million at current prices) in revenue over the past year.

Data from DefiLlama also shows that the total revenue of the Superchain protocol throughout 2025 reached $17.27 million.

In the proposal, the Foundation stated that using 50% of that revenue for buybacks would push the OP token beyond being just a governance token and create demand directly connected to the protocol.

However, this proposal sparked sharp debate during the voting period.

Read also: Aster Crypto Stage 4 Airdrop: Early Claims Opened, 754,041 ASTER Wiped Out!

Some oppose this proposal, arguing that funded buybacks alongside ongoing token issuance “financially negate each other and destroy value.” Others support the intent of the proposal, but warn that off-market purchases could undermine trust if not done on-chain.

The Optimism Foundation responded to the discussion on the forum by stating that this buyback program is intended to “associate OP tokens with the growth of Superchain and demonstrate a significant change in the role of tokens,” without reducing the funds allocated for ecosystem development.

Today’s OP price has not changed much, although in the last 30 days it has risen by 8%. However, over the past year, the token has plummeted by 79%.

Crypto Project Introducing Buyback Mechanism

In recent months, a growing number of crypto projects with native tokens have introduced buyback mechanisms, seemingly in an effort to prop up token prices and align platform success with the interests of token holders.

In a recent example, on-chain trading platform Magic Eden announced last week that it would begin a buyback of its ME tokens, while back in November, DeFi giant Aave approved an annual allocation of $50 million of protocol revenue for AAVE token buybacks.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. DAO Optimism Passes OP Buyback Proposal With 84% Approval – What’s Next? Accessed on January 30, 2026

- The Defiant. Optimism Voters Approve OP Buyback Plan Tied to Superchain Revenue. Accessed on January 30, 2026