7 Facts about Whale’s Record Accumulation of Tether Gold (XAUt) & Its Impact on Market Capitalization

Jakarta, Pintu News – Tether Gold token recorded a huge accumulation surge by whale addresses, making the market capitalization of this blockchain-based gold token rise to a new high. This phenomenon reflects growing investor interest in assets that combine the value of physical gold with the liquidity and transferability of digital assets, especially amid volatile global market conditions. Here are seven key facts about the latest XAUt dynamics.

1. Whale Accumulation Sets a Record

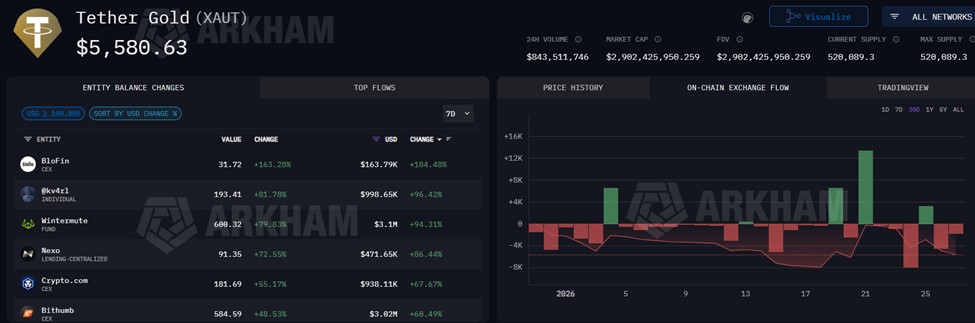

On-chain data shows that large whales have added significantly to their Tether Gold (XAUt) holdings in the short term. This accumulation caused addresses holding large amounts of XAUt to rise to unprecedented levels.

Spikes in whale accumulation are often interpreted by the market as a signal of confidence in long-term assets.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. XAUt Market Capitalization Reaches New Record

The large accumulation by whales had a direct impact on the market capitalization of XAUt, which rose to the highest level in the token’s history. The increase in market capitalization indicates that demand for Tether Gold has increased dramatically, especially beyond the typical retail investor. This sentiment put positive pressure on the price of XAUt relative to the underlying physical gold.

3. Tether Gold as a Tokenized Asset

Tether Gold (XAUt) is a token that represents ownership of physical gold held in vaults, providing exposure to gold price movements in the global market.

Each XAUt reflects one troy ounce of physical gold held digitally.

The token combines the benefits of digital liquidity with the value of real assets, thus appealing to investors looking for a combination of stability and accessibility.

4. Whales Start Moving from Other Assets to XAUt

Capital flow analysis shows that some large whales are moving their exposure from other assets, including some high-risk cryptocurrencies and bonds, to Tether Gold. This capital shift reflects a more conservative capital re-allocation strategy amid financial market volatility. Institutional investors and large whales often use instruments like XAUt to reduce risk and preserve value during periods of uncertainty.

5. XAUt Demand in Relation to Global Gold Price

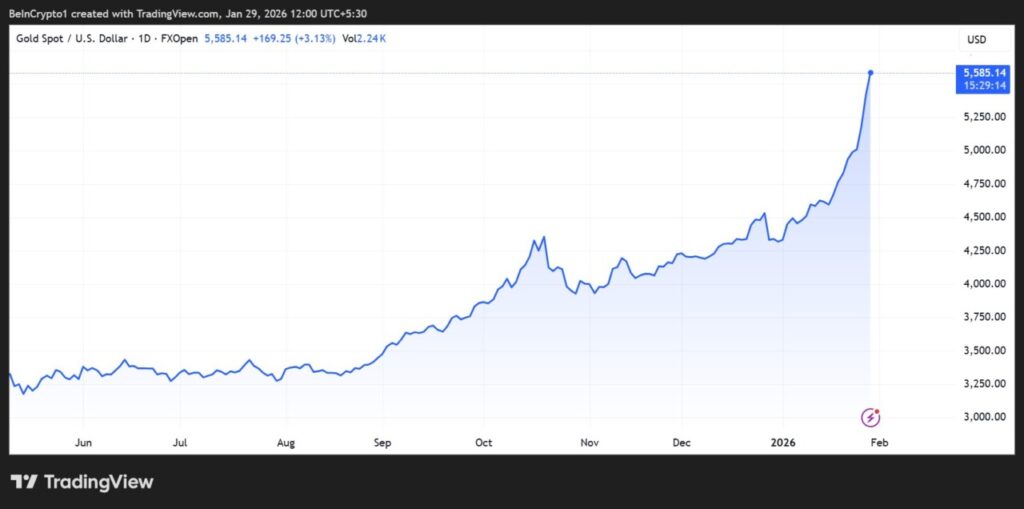

The surge in XAUt accumulation also correlates with the movement of spot gold prices on world markets, which have recorded historically high levels in recent weeks. Strong gold prices increase the appeal of gold tokens such as XAUt, as investors see opportunities to hold assets directly linked to the precious metal. The positive correlation between gold prices and demand for XAUt reinforces the fundamental link between digital assets and physical commodities.

6. Liquidity and Accessibility in Digital Markets

One of the factors driving XAUt accumulation is the higher liquidity compared to traditional physical gold holdings. Whales and large investors can enter or exit positions more quickly through digital markets than through physical mechanisms.

This provides flexibility in portfolio allocation strategies that traditional physical gold can’t compete with.

7. Implications for Investors

For young investors or beginners in the crypto and tokenized asset space, the trend of XAUt accumulation by whales shows that real-world assets (RWAs) such as gold tokens are increasingly becoming part of diversification strategies.

While the volatility of digital assets remains a risk, these tokenized assets offer an avenue of access to real-world commodities with a digital edge.

Investors need to consider fundamental factors such as global gold prices, whale demand, and digital market liquidity when assessing XAUt’s prospects.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Oihyun Kim/BeInCrypto. Tether Gold (XAUt) Whale Accumulation Hits Record, Boosting Market Cap. Accessed January 31, 2026.