5 Interesting Facts: Strategy shreds Bitcoin during market crash, what does it mean for BTC?

Jakarta, Pintu News – The crypto and cryptocurrency market is back on a high as the price of Bitcoin fell sharply by more than 13% in a single weekend. Amidst the selling pressure that pushed BTC near the bottom in recent weeks, Strategy, the corporate company with the world’s largest Bitcoin holdings, signaled that it may buy more Bitcoin as the market weakens. This signal is an important highlight for young and novice investors who want to understand institutional accumulation patterns amid market corrections.

Strategy starts adding bitcoin after price drop

Michael Saylor, co-founder of Strategy, has signaled on social media that his company has increased its Bitcoin holdings. The signal came as BTC prices fell and temporarily pushed Strategy’s cost basis position into negative territory.

Posts featuring a graph of Bitcoin accumulation by Strategy are often taken as an indication of additional purchases or plans to buy. The move is the fifth time the company has bought Bitcoin so far this year, indicating a strategy of continued accumulation despite the market downturn.

Also Read: 7 Ethereum (ETH) 2026 Price Predictions: Bullish Targets, Risks & Projections

Weekend downturn pressures Bitcoin price

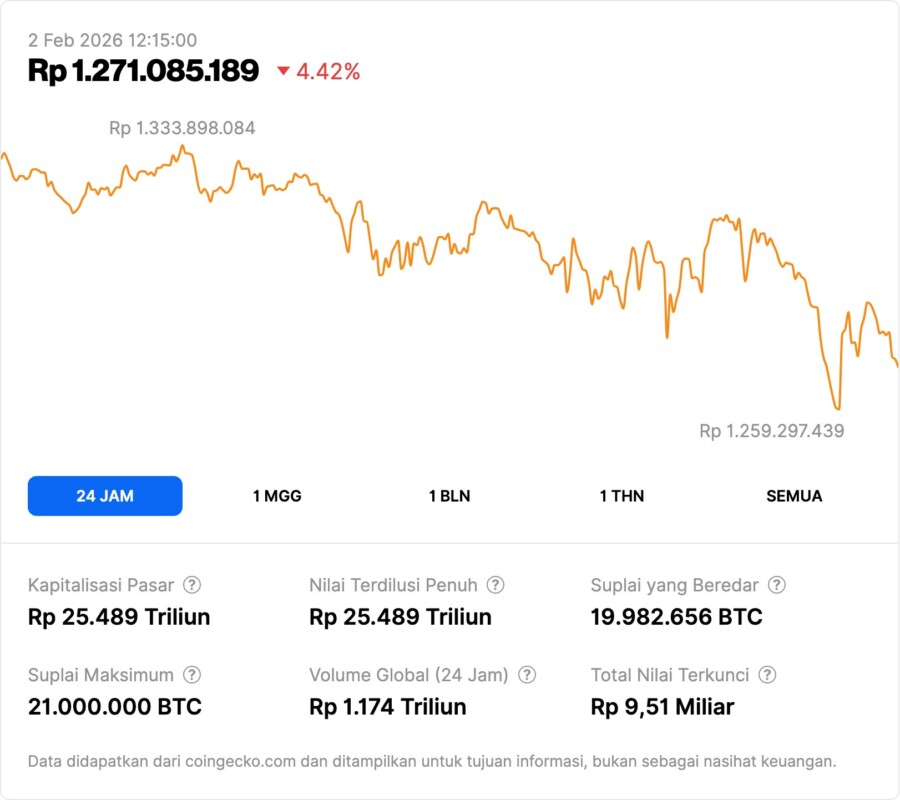

Bitcoin price dropped from around USD 87,970 to around USD 75,892 in one weekend, reflecting significant selling pressure in the crypto market. This drop came after macroeconomic policy announcements that affected global risk sentiment, including interest rate decisions and market expectations.

This sharp decline briefly put Strategy’s Bitcoin position below their average cost basis, which is around USD 76,040. But after a small rebound, the price of BTC is back above that position.

“Buy the Dip” strategy is not a one-time thing

Strategy’s accumulation strategy is not a new phenomenon in the crypto industry. Since 2020, the firm has consistently added to its Bitcoin holdings as part of a long-term treasury strategy. This action reflects the institutional belief that Bitcoin has long-term fundamental value, despite short-term price fluctuations.

This latest gesture, if realized as a purchase, would be further evidence that large institutions see moments of market correction as accumulation opportunities. This is in contrast to the approach of short-term traders who respond speculatively to price volatility.

Implications for Broader Crypto Market Sentiment

The buying signal from Strategy comes as the crypto market sentiment index is at a six-week low. This suggests that, despite weakening short-term sentiment, some major players still have faith in crypto assets, particularly Bitcoin.

However, such signals do not automatically guarantee that Bitcoin price movements will reverse in the near future. Corporate strategies are usually based on long-term goals, so their impact on spot prices is not always immediate.

What does this mean for young and novice investors?

For young investors and beginners in the crypto market, Strategy’s move provides an important lesson on the difference between long-term strategies and short-term market responses. Looking at institutional accumulation can help understand how Bitcoin supply can grow from a large demand side.

However, investors should also be careful to distinguish strategic signals from institutions from broader market dynamics. Bitcoin accumulation by Strategy is not an investment recommendation, but part of a large-scale corporate strategy.

Also Read: 7 Gold Price Predictions for February 2026: Rise, Scenarios & Risk Factors!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Strategy’s Saylor hints it bought Bitcoin dip after weekend crash. Accessed February 3, 2026.