3 Factors that Allegedly Triggered the Latest Bitcoin Crash Below $60,000

Jakarta, Pintu News – Bitcoin has experienced one of the biggest sell-offs in recent months, falling more than 40% to hit its lowest level of the year around US$59,930. In total, the price is now down more than 50% from its October 2025 record high near US$126,200.

Amidst the panic, analysts put forward three main theories as to why prices plummeted: liquidation pressure from hedge funds in Hong Kong, hedging obligations of structured products of large banks such as Morgan Stanley, and structural pressure from the mining sector as it shifts to AI infrastructure.

Theory 1: Hong Kong Hedge Fund and Yen Carry Trade

The first theory is that Bitcoin’s sharp correction originated in Asia, specifically hedge funds in Hong Kong that placed aggressively leveraged positions on the assumption that BTC prices would continue to rise. According to Parker White of DeFi Development Corp. some of these funds used options on spot Bitcoin ETFs such as BlackRock’s IBIT, financed by borrowing cheap Japanese yen (carry trade). The yen is then swapped into other currencies and allocated to riskier assets, including crypto, in the hope that the rally continues.

The problem arose when Bitcoin stopped rising and yen borrowing costs increased, making these leveraged positions quickly deteriorate. Lenders then demanded additional collateral (margin), forcing hedge funds to sell Bitcoin and other assets aggressively. This forced sell-off deepened the price decline in the spot and derivatives markets, creating a liquidation spiral that accelerated BTC’s fall below US$60,000.

Also read: 23% of Traders Convinced of Fed Rate Cut in March, but Warsh Makes Markets Wary?

Theory 2: Forced Hedging of Bank Structured Products

The second theory comes from former BitMEX CEO Arthur Hayes, who highlights the role of major banks issuing structured products related to spot Bitcoin ETFs. In products like these, banks offer clients Bitcoin price exposure-sometimes with principal protection-and then hedge through the purchase or sale of Bitcoin and derivative contracts.

When BTC prices fall sharply and break a certain level (for example, around US$78,700 on one of Morgan Stanley’s products), the risk model forces dealers to delta hedge by selling BTC or futures.

This phenomenon creates what is called “negative gamma”: the more prices fall, the greater the volume of selling that must be done to maintain the risk profile of the product. As a result, banks that normally act as liquidity providers turn into forced sellers in an already depressed market. The additional selling pressure from this automated hedging mechanism magnifies volatility and deepens the correction already triggered by other factors.

Read also: New Era of Crypto: Tom Farley Forecasts a Wave of Large Acquisitions

Theory 3: Miners Turn to AI and Stress Production Costs

The third theory, which is less dominant but still relevant, relates to the shift of some Bitcoin miners to the data center and AI business. Analyst Judge Gibson said the increasing demand for power and infrastructure for AI prompted some large miners to shift focus, which is reflected in a decline in hash rate of around 10-40%.

For example, Riot Platforms in December 2025 announced a broader data center strategy and sold BTC for around US$161 million, while IREN last week also announced a pivot to AI data centers.

On-chain, the Hash Ribbons indicator shows the average 30-day hash rate fell below 60 days, a classic signal that miners’ earnings are being squeezed and the risk of capitulation is increasing.

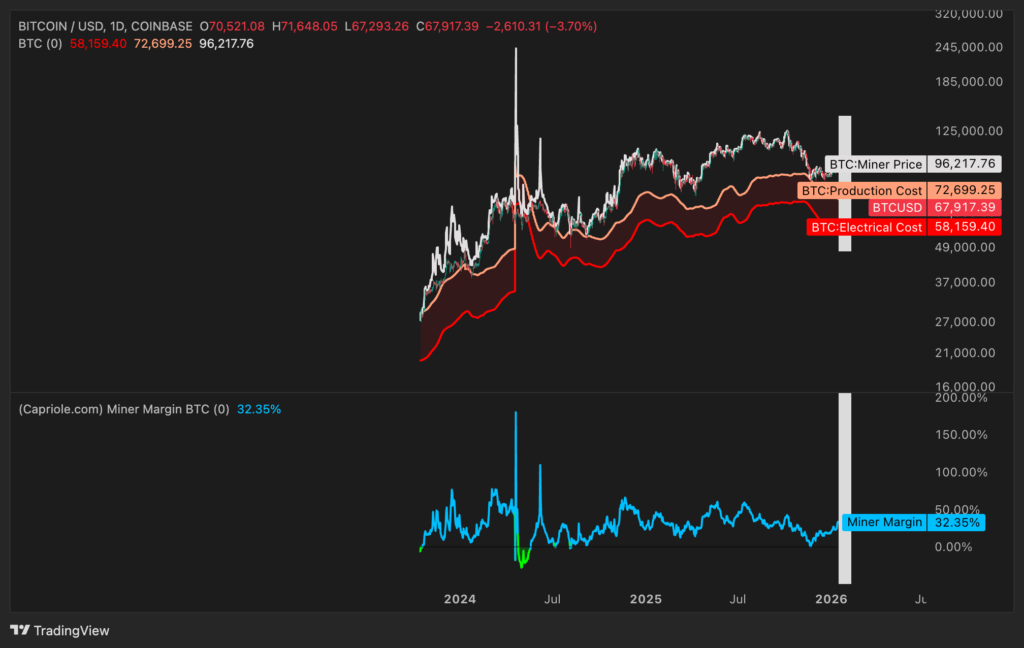

Capriole Investments’ calculations estimate the average electricity cost of mining one BTC at around US$58,160, while the total net production cost is close to US$72,700. If the Bitcoin price stays at or below US$60,000, miners’ margins narrow sharply and could potentially trigger sales of their spare BTC, adding to selling pressure on the spot market.

Conclusion

Three main theories – hedge fund liquidation in Hong Kong, forced hedging of big banks’ structured products, and structural pressure from miners turning to AI – suggest that Bitcoin’s fall below US$60,000 is not just another retail panic sell. The combination of leverage, complex financial products, and production cost pressures make this correction systemic.

At the same time, data showed medium-to-large holders (10-10,000 BTC) reduced their holdings to a nine-month low, signaling a more cautious stance. Whether the zone near miners’ production costs will become a new price floor or just a temporary pit stop, will largely depend on how quickly these liquidity and leverage pressures ease.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. What crashed Bitcoin? Three theories behind BTC’s trip below $60K. Accessed February 9, 2026.

- Featured Image: Generated by Ai