5 Shiba Inu Considerations: Depressed Prices, Rebound Potential, Risk of Selling Down in Crypto 2026

Jakarta, Pintu News – The crypto market is still in a stressful phase in early 2026, and Shiba Inu is one of the cryptocurrencies most affected by negative sentiment. The sluggish price performance throughout 2025 continued into this year, as global macroeconomic uncertainty and liquidity tightened. These conditions have led many investors to ask whether selling Shiba Inu now is the right decision.

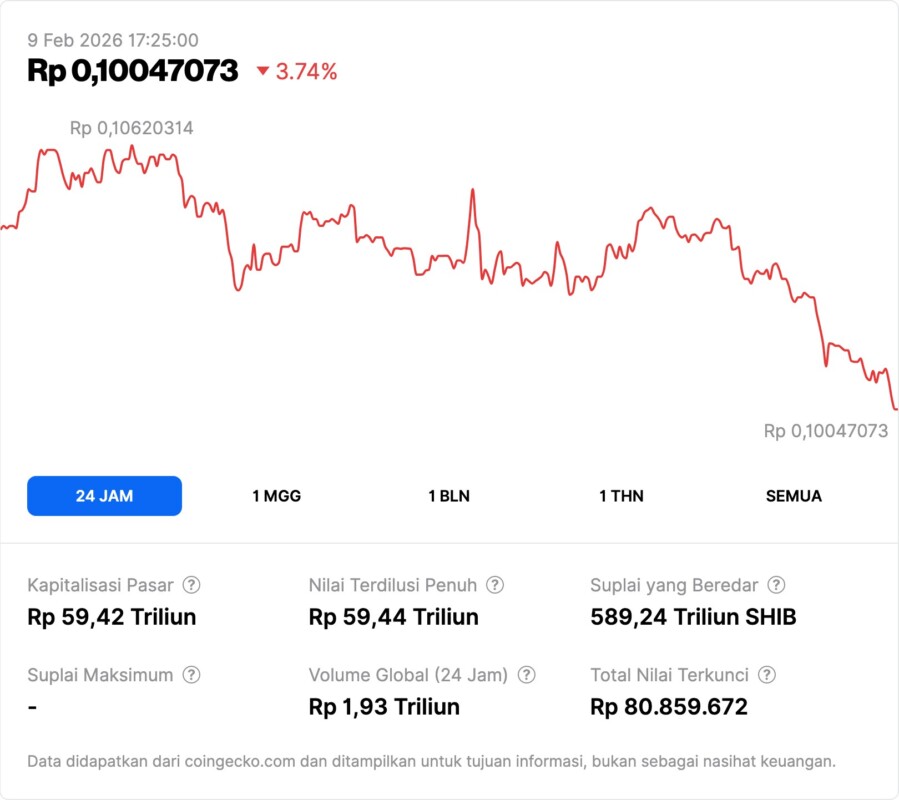

1. SHIB Downtrend Occurs Amid Global Market Pressure

The price of Shiba Inu (SHIB) has not shown any significant recovery since last year. This pressure is not only an internal factor, but also influenced by the overall crypto market conditions.

Global economic uncertainty, geopolitical tensions, and decreased liquidity have made many cryptocurrencies move lower. In situations like these, sentiment-based assets like SHIB tend to be more vulnerable to selling pressure.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

2. Crypto Cycles Show Repeating Patterns

The history of the cryptocurrency market shows repeated cyclical movements. In 2021, the market experienced a huge rally before plummeting sharply in 2022.

For example, Bitcoin fell to USD15,000 in November 2022. Two years later, Bitcoin surged to USD100,000 or around Rp1.69 billion in December 2024, confirming that down phases are not always permanent.

3. SHIB Has Followed the Market Recovery Pattern

Shiba Inu has also experienced significant spikes as the market rallied. In the same period as Bitcoin’s rise, SHIB was trading at around USD0.000032.

The experience shows that SHIB is highly dependent on the momentum of the crypto market at large. When sentiment turns positive, the asset has the potential to get a boost despite a long period of pressure.

4. Utility Development is Still Ongoing

Beyond price movements, the Shiba Inu team continues to develop its ecosystem. Some of the initiatives introduced include ShibOS, Shib Metaverse, and the rumored launch of a stablecoin.

In addition, there are plans for a new burn mechanism that is rumored to be able to reduce supply by trillions of tokens per year. Increased utility and reduced supply are often considered as factors supporting long-term value in the cryptocurrency world.

5. Risk of Selling in a Distressed Phase

Selling SHIB when prices are under pressure means locking in potential losses. For investors who entered at higher prices, this decision needs to be carefully considered.

However, holding assets is not without risk. The crypto market remains volatile, and the recovery could take longer than expected.

A Neutral Overview for Beginner Investors

Shiba Inu’s current state reflects the general dynamics of the cryptocurrency market. Short-term pressure is still dominant, but history shows recovery opportunities always exist in market cycles.

For beginner investors, understanding the macro context and crypto cycle is more important than reacting to momentary price movements. Decisions regarding SHIBs should be tailored to your individual risk profile and investment objectives.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Paigambar Mohan Raj / Watcher Guru. Know This Before Selling Your Shiba Inu (SHIB) Coins. Accessed February 9, 2026.