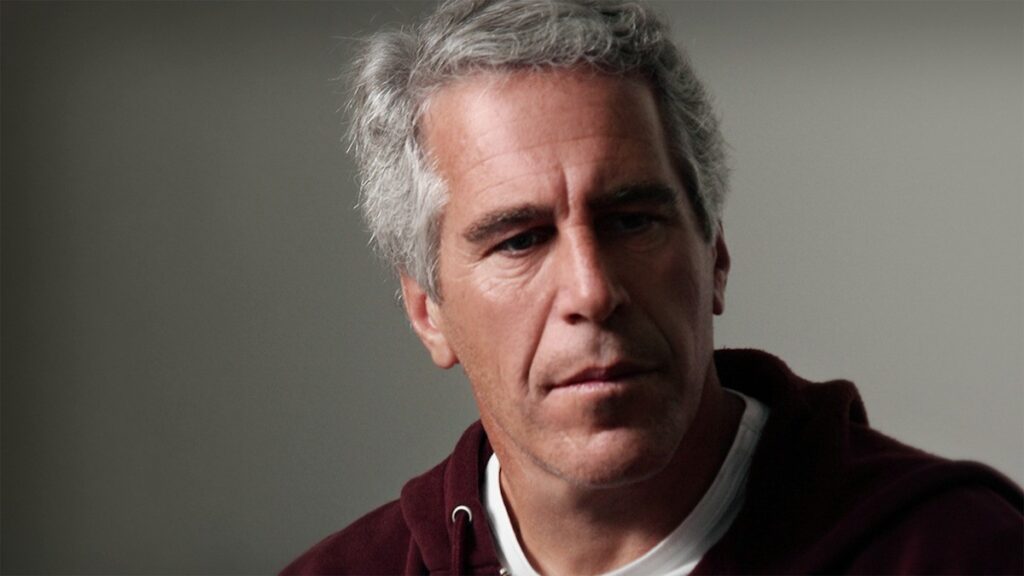

7 Epstein & Crypto Facts: From Dark Fund Issues to Unanswered Questions

Jakarta, Pintu News – The Jeffrey Epstein case has sparked another global discussion, including among crypto and cryptocurrency watchers. While Epstein is known as a controversial figure in the world of traditional finance, there has been speculation about his possible links to digital assets. While not all questions have definitive answers, the following facts help provide some context.

1. No Direct Evidence of Epstein Holding Crypto

To date, no official evidence has been found that Jeffrey Epstein directly owns Bitcoin or any other cryptocurrency. There are no public records, blockchain wallets, or legal acknowledgments confirming such ownership.

Some analysts think this absence of evidence is important to emphasize. Many narratives on social media often mix speculation with fact without any clear basis.

Also Read: 5 Fun Facts: Bitcoin Often Rebounds in February – Lessons from Historical Data

2. Epstein Case Comes Before Crypto Adoption Boom

Most of Epstein’s illegal activities came to light before the widespread adoption of crypto globally. During that period, the traditional financial system was still the main channel for cross-border transactions.

Bitcoin itself only became widely known after 2017. This makes Epstein’s alleged use of cryptocurrency less chronologically relevant.

3. More Crypto Issues Arise from Public Speculation

Epstein’s name often comes up in crypto discussions due to the pseudonymous nature of blockchain. Some assume that crypto can be used to hide illegal transactions.

However, that assumption does not automatically link Epstein to crypto. Without on-chain data or legal documents, the claim remains in the realm of speculation.

4. Blockchain is Easier to Track than Traditional Systems

Ironically, many experts consider blockchain to be more transparent than a closed banking system. Crypto transactions can be publicly traced even if the identity of the user is hidden.

In many modern criminal cases, law enforcement has been able to trace the flow of crypto funds. This undermines the notion that crypto is the perfect tool for major financial crimes.

5. “Epstein Crypto” Narrative Often Used for Sensationalism

Some articles and online posts use the keywords Epstein and crypto to attract readers’ attention. This pattern is common in the click-based digital media ecosystem.

Unfortunately, that approach often obscures the facts. Novice crypto investors need to distinguish between data-driven reports and speculative content.

6. Epstein Case More Relevant to Traditional Finance

Legal documents and official investigations show that Epstein’s financial network operated through banks, trust funds, and conventional financial institutions. There is no evidence that cryptocurrencies played a significant role.

This only strengthens the argument that large-scale financial crime is not dependent on any particular technology. Abuse can happen on both old and new systems.

7. Lessons for Crypto Investors

The Epstein case is often used as an example in the crypto ethics and regulation debate. However, it is important to separate the legal facts from the viral narrative.

For cryptocurrency investors, transparency and literacy are key. Understanding how the financial system works is far more important than following baseless rumors.

Conclusion

To date, there is no concrete evidence linking Jeffrey Epstein to crypto or cryptocurrency. Most of the narratives circulating are speculative and sensationalized rather than data-driven.

This case shows that complex financial crimes are more common in the traditional financial system. For readers and investors, a critical approach to information is the most rational step.

Also Read: 5 AI Perspectives: Will XRP Fall Below $1 in February 2026?

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CBS. How Jeffrey Epstein Made His Money. Accessed February 9, 2026.