Bitcoin’s Sharpe Ratio Plunges into the Minus Zone: Sign of Bear Market’s End Nearing?

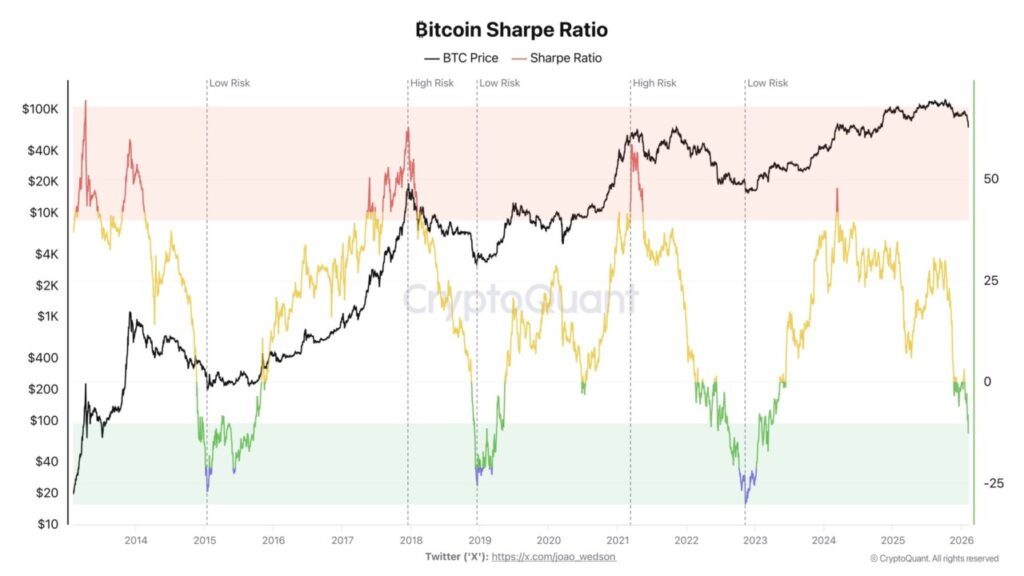

Jakarta, Pintu News – Bitcoin is under pressure again after the Sharpe ratio indicator fell into negative territory that usually appears in the final phase of a bear market. According to CryptoQuant analyst Darkfost, this sharp drop in the risk-reward ratio shows that Bitcoin’s risk-reward profile has become very extreme, although it does not automatically signal the end of the current bear market.

Sharpe Ratio Drops to Extreme Levels

Bitcoin’s Sharpe ratio now stands at around -10, its lowest level since March 2023. This indicator measures Bitcoin’s performance relative to the risk taken, giving an idea of how much return should be expected per unit of risk. A negative value means that the return achieved is not worth the volatility investors have to endure.

Darkfost believes that, in practical terms, the risk of investing in Bitcoin is still high compared to the returns recently seen. He emphasizes that this ratio is still deteriorating, so Bitcoin’s performance is not yet attractive enough for conservative market participants. However, moves like this often appear when the market approaches its historical turning point zone.

Read also: Antam Gold Price 10 Gram Today, February 10, 2026

Patterns that Appear at the Bottom of Previous Bear Markets

Historically, Bitcoin’s Sharpe ratio scored even lower values in late 2018-early 2019 and late 2022-early 2023, two periods known as the bottom of previous bear market cycles. When the price briefly touched the local low zone, the ratio confirmed the highly depressed market conditions. In November 2025, this metric dropped to zero when BTC touched the area around US$82,000.

The pattern provides context that negative Sharpe values often serve as a signal that the market is entering a phase of capitulation. According to Darkfost, this kind of dynamic “tends to emerge near market turning point zones,” when sellers begin to run out of steam and risk-reward begins to turn in favor of long-term buyers. However, this signal is more of a supportive condition than an immediate trigger for a new rally.

Read also: Antam, UBS and Galeri24 Gold Prices Today, Tuesday, February 10, 2026

Analysts Still See Major Downtrend Surviving

Despite the extremes in indicators, some research houses remain cautious. In a market update, 10x Research judged that sentiment and technical indicators are indeed approaching extreme levels, but the larger downtrend is still intact. Without a clear fundamental catalyst, they think there is no strong urgency for institutional investors to aggressively re-enter.

In recent days, the price of Bitcoin briefly plummeted to around US$60,000 before bouncing to the US$71,000 range. However, the asset is still down about 44% from its October peak near US$126,000, so the bear market narrative remains dominant. For now, analysts expect this pressure phase to last for the next few months before a more convincing trend reversal is formed.

Conclusion

The decline in Bitcoin’s Sharpe ratio into extreme negative territory indicates that the risk-reward profile is starting to approach the zone historically associated with the end of bear markets. However, on-chain data and research institutions’ views suggest that the selling pressure and medium-term downtrend have not yet fully abated. For investors, this situation represents a phase of the market with high risk but growing reward potential, where patience and risk management are key before a new catalyst emerges and changes the direction of the market.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin Sharpe ratio slides to levels seen in previous market bottoms. Accessed February 10, 2026.

- Featured image: Generated by AI