6 Weekly US Economic Agendas that Could Shake Crypto Prices Up to 20%

Jakarta, Pintu News – The movement of crypto and cryptocurrency markets this week is expected to be heavily influenced by the release of US economic data. Global investors are watching a number of macro indicators that have the potential to trigger volatility in major digital assets such as Bitcoin and Ethereum . For both novice and experienced investors, understanding this economic agenda is important to read market direction more rationally.

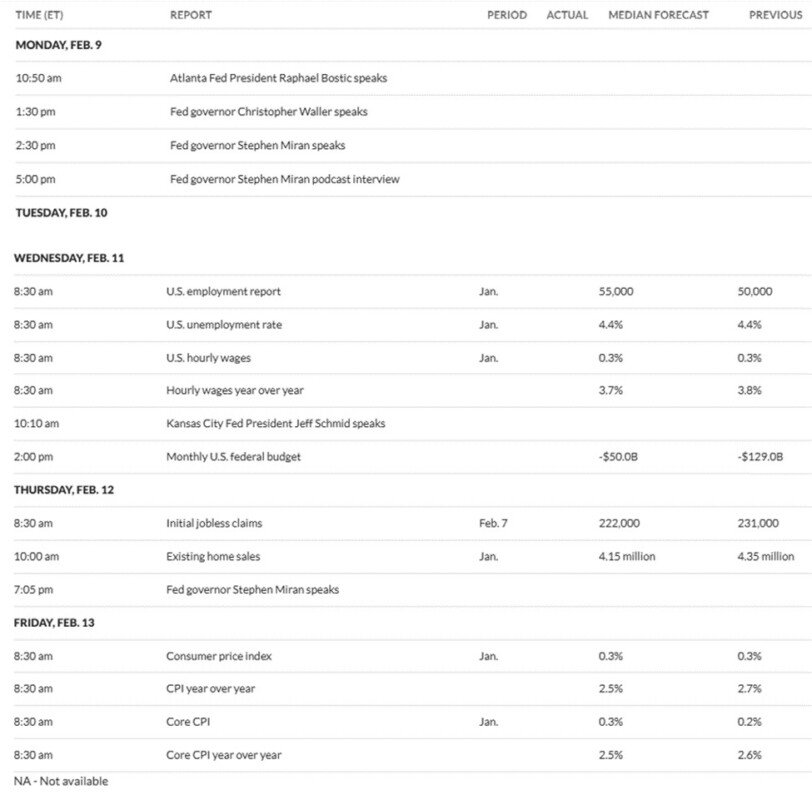

1. US Inflation Data Tops Crypto Market’s Spotlight

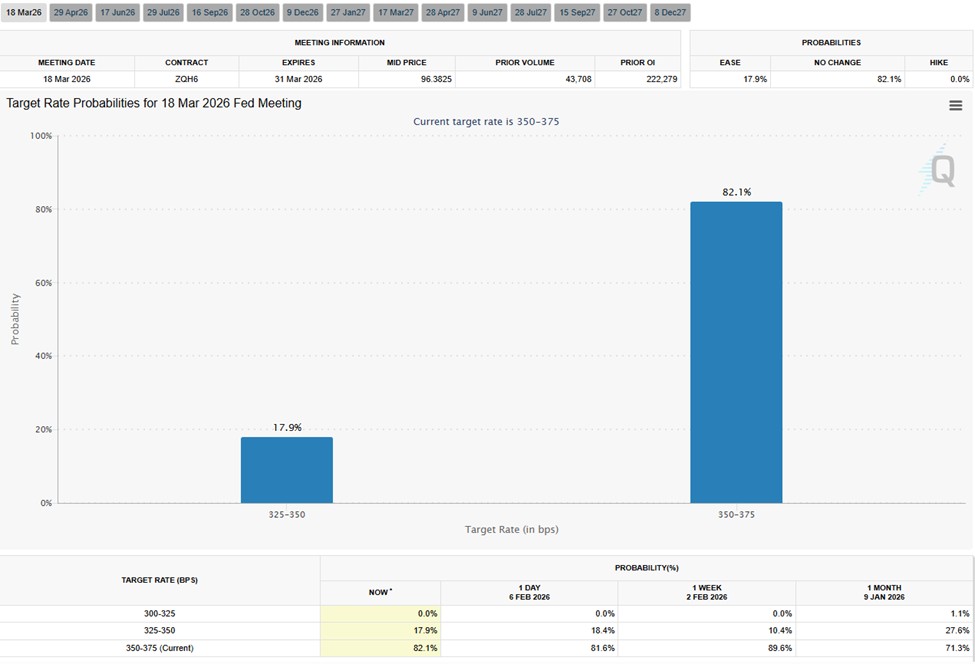

US inflation is again a concern as it has a direct influence on monetary policy. If inflation slows down, markets tend to speculate that interest rates will be lowered faster. This is generally seen as positive for crypto as a risky asset.

Conversely, higher-than-expected inflation may depress cryptocurrency prices. Investors will anticipate a longer-lasting high interest rate policy. Such a situation could potentially reduce interest in speculative assets like crypto.

Read More: 7 Impacts of Japan’s Political Victory on BTC & Gold Prices

2. Federal Reserve Official’s Statement Could Trigger Volatility

Speeches and statements by Federal Reserve officials often catalyze market movements. Hawkish or dovish signals from the US central bank are often responded to quickly by crypto investors. This is because the direction of monetary policy determines global liquidity.

If the Fed hints at a looser stance, crypto could potentially rally. Conversely, a tight tone regarding inflation could pressure the cryptocurrency market. Investors usually respond to these statements within hours.

3. US Labor Data Influences Risk Sentiment

Employment reports such as the unemployment rate and weekly jobless claims are also watched. Strong labor data indicates a solid economy and supports a high interest rate policy. These conditions tend to be unfavorable for crypto.

However, weak labor data is often perceived as an opportunity for risky assets. The market perceives the potential for monetary policy easing is growing. This sentiment could boost interest in cryptocurrencies.

4. Relationship between Inflation, Interest Rate, and Bitcoin Price

Bitcoin (BTC) is often positioned as a hedge against inflation, although the correlation is not always consistent. In the short term, BTC is more sensitive to interest rate expectations than the hedging narrative. Therefore, the release of inflation data greatly influences its movement.

When interest rates are high, the yield of interest-bearing assets becomes more attractive. Crypto that does not provide a fixed yield tends to lose appeal. This explains why macro data is so influential on BTC prices.

5. Impact to Altcoins and the Broad Cryptocurrency Market

Not only Bitcoin, altcoins such as Ethereum (ETH), Ripple , and Pepe Coin are also affected by macro sentiment. Changes in interest rate expectations usually trigger simultaneous movements in the cryptocurrency market. Volatility can increase in a short period of time.

Altcoins with small capitalization are generally more sensitive to negative sentiment. In unfavorable macro conditions, investors tend to reduce risk exposure. As a result, selling pressure on altcoins can be greater than BTC.

6. Rational Strategies for a Week Full of Economic Agenda

For novice investors, a week with a lot of economic data releases should be treated with caution. Crypto price fluctuations can occur suddenly without any change in project fundamentals. A risk management approach is key.

Long-term investors usually utilize volatility for portfolio evaluation. Focusing on investment goals and not short-term movements can reduce emotional decisions. By understanding the macro context, cryptocurrency investors can make more measured decisions.

Also Read: 5 Facts Robert Kiyosaki is Ready to Buy Bitcoin if it Falls to the Level of IDR101 Million

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Investors Should Watch These US Economic Signals. Accessed February 10, 2026.