What is Profitability?

Jakarta, Pintu News – Profitability is a measure of a company’s ability to generate profits from its business operations after taking into account all costs and expenses. This indicator reflects how efficiently the company uses its resources and capital to create profits. Profitability is not only about nominal profits, but also the quality of profits that indicate long-term financial health.

Profitability analysis is important because it helps stakeholders understand whether the company is operating effectively and is able to sustain profit growth over time. Companies that have a high level of profitability are usually more attractive to investors and creditors as they indicate lower risk and stronger business resilience.

What is the difference between profit and profitability

Profit is the absolute amount of profit earned by a company after deducting all costs in a certain period, for example, a net profit of Rp1 billion in a certain fiscal year. Profit describes the absolute value of profit without considering the size of the company’s operations.

Meanwhile, profitability is a ratio or percentage that shows the efficiency of a company to generate profits relative to sales, assets or capital. In other words, profitability compares profits to their constituent factors, making it easier to compare between periods or different companies without being influenced by absolute size.

Functions and Benefits of Profitability Analysis

Profitability analysis serves to assess a company’s operational effectiveness in creating profits from sales, assets and capital. It helps management see areas for improvement to maximize profits.

Other benefits of profitability analysis include evaluation of management performance, comparison among competitors in the same industry, and indication of investment attractiveness for shareholders or potential investors. A consistently high profitability ratio is often considered a positive signal in investment decision-making.

Types of Profitability Ratios

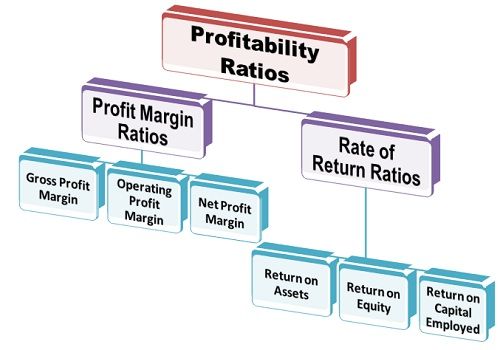

Some commonly used profitability ratios include Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Gross Profit Margin shows how much gross profit from sales after deducting the cost of goods sold.

In addition, there is Return on Assets (ROA) which measures net income relative to total assets, and Return on Equity (ROE) which shows net income relative to shareholders’ equity. These ratios help measure the efficient use of the company’s assets and capital.

Read also: What is Silver Bullion and Why is it Expensive?

How to Calculate Profitability

Profitability is calculated through ratio formulas appropriate to the indicator being analyzed. For example, Net Profit Margin is calculated as net profit divided by total sales, then multiplied by 100 percent to show the efficiency of net profit to revenue.

Return on Assets (ROA) is calculated by dividing net income by total assets, while Return on Equity (ROE) is net income divided by shareholders’ equity. These formulas provide an overview that is easy to compare between periods or companies in similar industries.

Profitability Influencing Factors

A company’s profitability is influenced by various factors such as its operating cost structure, production efficiency, as well as the pricing strategy applied in the market. Relatively high costs without an increase in sales will suppress profitability ratios.

In addition, market conditions and industry competition also affect profitability – for example, pricing pressure from competitors can reduce profit margins. External factors such as fluctuations in exchange rates and interest rates also affect a company’s cost of capital and profitability.

Also read: What is 75% Gold Grade?

Tips to Increase Company Profitability

To increase profitability, companies can implement operational cost efficiencies, such as optimizing production processes and minimizing waste. Regular cost evaluations help ensure effective use of resources.

Other strategies include proper pricing, product diversification to increase revenue, and service innovations that can attract more customers. Analysis of sales data and consumer behavior also helps identify the most profitable market segments.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Featured Image: GoTrade