MicroStrategy Stock Downside Risk Amid Crypto Market Volatility

Jakarta, Pintu News – MicroStrategy (MSTR) shares have fallen dramatically by 40% from their peak, as the price of Bitcoin has come under pressure. This has raised concerns among investors, especially those who see MSTR as a form of leveraged investment in Bitcoin.

Despite the major correction, MicroStrategy stock is still trading 60% above its fair value. However, this differential is narrowing, prompting questions as to whether the premium given to the stock is still worth it. With uncertainty from Federal Reserve policy and increasing outflows from Bitcoin-based exchange-traded funds (ETFs), the market is becoming increasingly cautious.

Bitcoin and its Impact on MicroStrategy

Bitcoin experienced a 96% surge between September and December 2024, fueled by expectations of interest rate cuts by the Federal Reserve. However, when the rate cut finally happened in December, the cautious attitude of the US central bank made the market euphoria fade. As a result, Bitcoin price began to enter a prolonged consolidation phase.

In addition, February 2025 was a tough month for Bitcoin-based ETFs, with outflows reaching a record high of $1.3 billion (IDR 21.19 trillion). Many institutional investors who had previously utilized short-term arbitrage strategies began to pull out, causing renewed selling pressure that helped drag down Bitcoin price and MicroStrategy shares.

Also Read: El Salvador’s President Closes Bitcoin Animal Hospital: Controversy and Impact

MicroStrategy and the Looming Risks

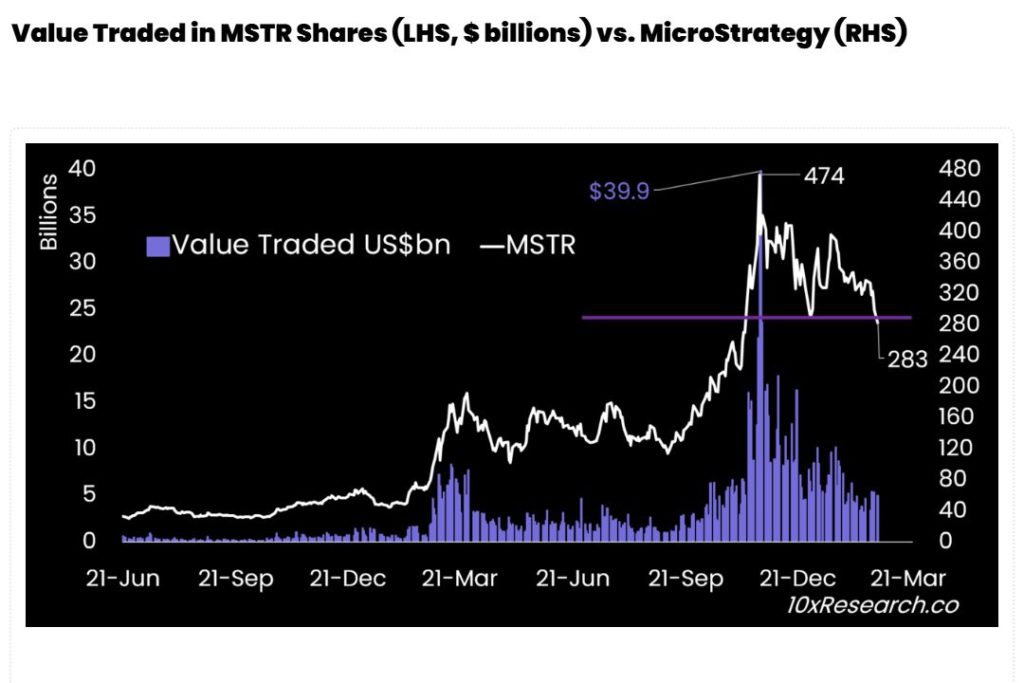

MicroStrategy has maintained its aggressive Bitcoin accumulation strategy, with an additional $6 billion worth of purchases since December 2024. However, analysts from 10x Research highlighted a worrying trend, namely the decline in MicroStrategy’s share premium to its net asset value (NAV).

At its peak, MicroStrategy shares were trading at a premium of 3.4 times its net asset value. However, this figure has dropped dramatically to just 1.6 times, indicating that its fair value is now estimated at $156 per share (IDR 2.54 million). This contrasts with MSTR’s highest price in November 2024, which reached $453 per share (IDR 7.38 million) when Bitcoin was also on a high.

The Outlook Ahead for MicroStrategy and the Crypto Market

Bitcoin is currently showing a worrying technical pattern, with the price breaking out of an ascending broadening wedge pattern, which is often a bearish signal. If Bitcoin fails to regain momentum, analysts predict the price could drop further to near MicroStrategy’s average purchase price of $66,300 (Rp1.08 billion) per BTC.

If this scenario plays out, MicroStrategy shares could potentially come under further pressure, especially as investors increasingly question whether the company’s aggressive strategy is still relevant in uncertain market conditions. With interest rate uncertainty, increasing ETF selling pressure, and crypto market volatility, investors are expected to be more cautious in making investment decisions.

Conclusion

The significant drop in MicroStrategy shares reflects the complex dynamics between the company’s investment in Bitcoin and the constantly changing crypto market conditions. While the Bitcoin accumulation strategy remains viable, pressures from monetary policy and changes in investor sentiment may continue to affect the company’s share price. With so many factors at play, investment decisions in both MicroStrategy shares and Bitcoin require more in-depth analysis and extra caution.

Also Read: Cardano and Check Point Collaborate for AI-Based Blockchain Security!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News Flash. MicroStrategy’s Stock at Risk: 40% Crash. Accessed March 11, 2025.

- Featured Image: CoinPro.ch