Bitcoin Hits $114K — Is a Drop to $95K Next, or Will It Rally to $119K?

Jakarta, Pintu News – As of August 6, the market is at a crucial point, with the Bitcoin price level approaching $112,600 and signals from the RSI indicator showing two possible directions of movement.

The first scenario is “profit-taking” which could push the price down towards the $95,000 range, especially if technical selling pressure increases and the historical pattern repeats itself (although it has yet to be fully proven).

The second scenario is a “bullish rebound” towards the $119,000 area, provided that the current lower level manages to hold and there is confirmation of bullish divergence.

Then, how is the current Bitcoin price movement?

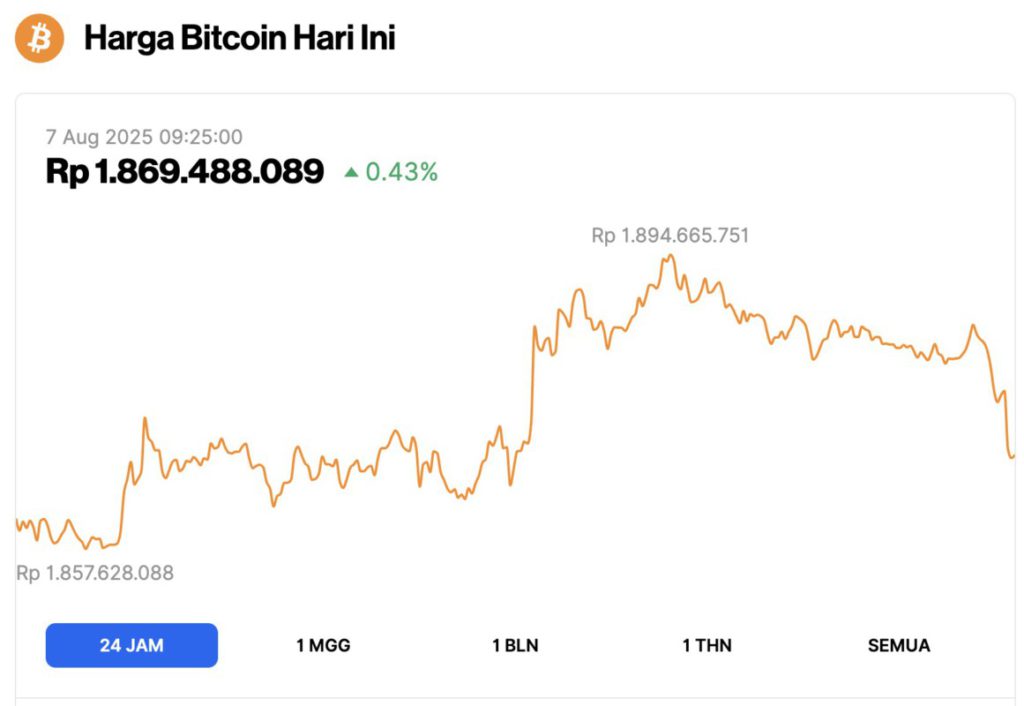

Bitcoin Price Up 0.43% in 24 Hours

As of August 7, 2025, the price of Bitcoin stood at $114,743, or approximately IDR 1,869,488,089, marking a 0.43% increase over the past 24 hours. During this timeframe, BTC dipped to a low of IDR 1,857,628,088 and climbed to a high of IDR 1,894,665,751.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.28 trillion, with trading volume in the last 24 hours down 8% to $55.91 billion.

Read also: Altcoin Season Makes a Comeback as Bitcoin Dominance Falls Near 60%

Technical Signals Point to Short-Term Market Sentiment Divergence

Bitcoin (BTC) is currently facing two possible conflicting directions, formed by momentum indicators-mainly the RSI (Relative Strength Index) across multiple time frames.

According to analyst Ali, in the previous two instances when the weekly RSI fell below the 14-period SMA, Bitcoin price corrected between 20% to 30%.

“If this pattern repeats, we could see a drop to around $95,000,” Ali said.

Previously, analyst Arthur Hayes had also predicted a sharp correction in the crypto market, with Bitcoin predicted to hit $100,000 and Ethereum around $3,000.

Meanwhile, Sykodelic analysts observed that the daily RSI is currently at a level similar to the previous low around $98,000, even close to the low at $76,000. This indicates that the short-term selling pressure is starting to ease and this area could be an accumulation phase.

Analyst Caleb Sees Potential Rebound to $119,000

From the other side, analyst Caleb Franzen highlighted that Bitcoin has broken the low previously identified by the bullish RSI divergence.

In this case, the price prints a lower low but the RSI doesn’t follow – indicating a weakening downward momentum. Conversely, a bearish divergence appears when the price rises but the RSI falls, signaling a potential downward reversal.

Read also: 3 Cryptos Sold by Whales Before Donald Trump’s Global Tariffs Take Effect!

Looking at this formation, Caleb thinks there is potential for a rebound to $119,000. However, this level is also a crucial limit-if it is broken below, then the bullish scenario can be considered canceled.

In this context, a drop to $95,000 could be a “reset” phase to re-gather buying strength. On the other hand, the support level at $112,600 is now key to sustain the recovery scenario.

If the price is able to stay in this zone and the bullish divergence on the RSI is confirmed, then the chances of a bounce to the $119,000 area will get stronger.

Additional confirmation from volume, moving averages (MAs) and daily closes above important technical levels will help reduce the risk of false signals.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin RSI Signals Mixed Momentum. Accessed on August 7, 2025