Bitcoin Surges to $121,000 Level Today (August 11): Where is BTC Headed Next?

Jakarta, Pintu News – Bitcoin price remained stable over the weekend, rising to the critical resistance level of $118,000 as various factors driving price increases emerged.

Bitcoin was trading around $118,500 at last check Sunday, up sharply from last week’s low of $112,000. This trend is likely to continue this week, and observers expect new record highs.

Then, how is the current Bitcoin price movement?

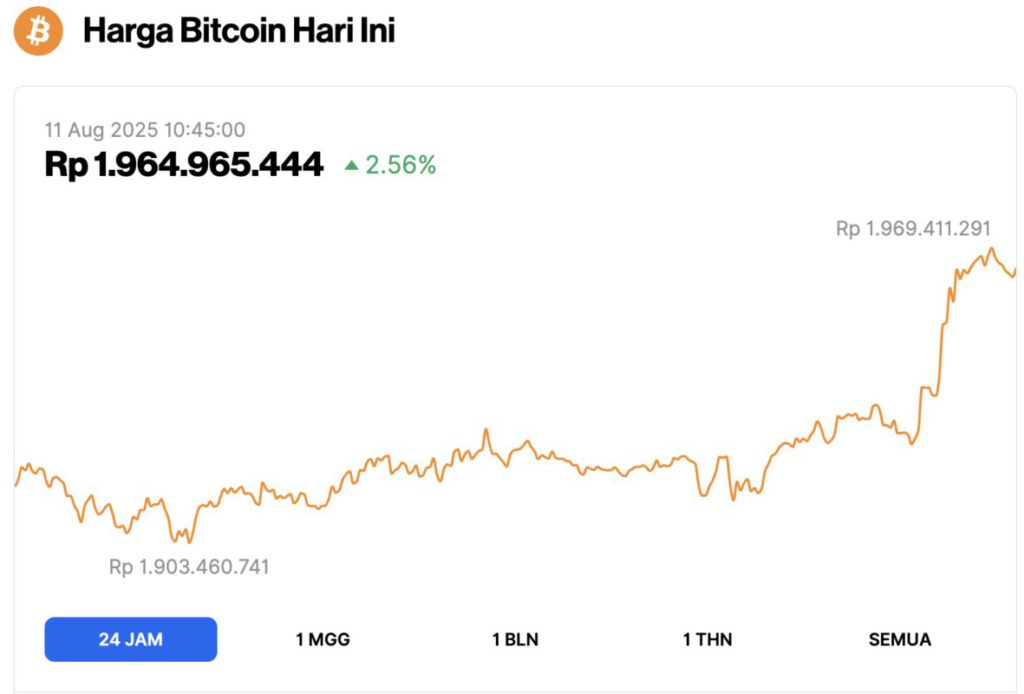

Bitcoin Price Rises 2.56% in 24 Hours

On August 11, 2025, Bitcoin’s price stood at $121,907 or equivalent to IDR 1,964,965,444, marking a 2.56% gain over the past 24 hours. During the day, BTC dipped to a low of IDR 1,903,460,741 and climbed to a high of IDR 1,969,411,291.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.42 trillion, with trading volume in the last 24 hours rising 21% to $72.46 billion.

Read also: 5 Largest Crypto Coin Rankings Right Now Based on Market Cap!

Bitcoin was trading around $118,500 at last check Sunday, up sharply from last week’s low of $112,000. This trend is likely to continue this week, and observers expect new record highs.

Bitcoin Price to Reach ATH as Bullish Flag Pattern Activates

According to Crypto News (10/8), the daily chart shows that the price of BTC has formed a bullish flag pattern, which often precedes strong price spikes. This pattern started forming on June 22 when it hit a low of $98,320 and an all-time high peak of $123,200, with a high of nearly $25,000.

This flag pattern is forming, which is characterized by a descending channel. Currently, there are signs that the price will break above the upper side of the flag.

The price target in a bullish flag pattern is calculated by adding the height of the flag to the breakout point, which in this case is at $117,000. The addition of the two numbers results in a price target of $142,000.

Another factor driving Bitcoin’s price is its position that remains above the 100-day exponential moving average. Bitcoin has also formed a break-and-retest pattern by dropping to the support level at $112,000, which was the previous record high.

Key indicators also point to further upside potential in the short term. The Relative Strength Index (RSI) has surged and broken the neutral point at 50. Other oscillators, such as MACD and MFI, are also showing an uptrend.

US Central Bank Cuts ETF Expectations and Fund Flows

Bitcoin price has potential catalysts that could propel it to record highs this week. For example, data shows that American investors continue to accumulate Bitcoin.

Read also: 3 Cryptocurrencies Gaining Buzz Ahead of the Next Bull Run — and Why

ETF fund flows surged by more than $246 million last week, a huge reversal from the $643 million net outflow in the previous week.

The surging demand for Bitcoin, including from treasury companies, comes as supply on exchanges plummets to its lowest level in years, which is a bullish signal.

Meanwhile, the chances of the Federal Reserve starting to cut interest rates in its September meeting have increased. These odds surged after the US released weak non-farm payroll data earlier this month.

The odds are likely to increase if the US releases weaker-than-expected consumer price index (CPI) data on Tuesday. Economists expect the data to show that headline CPI rose to 2.8% in July as the impact of tariffs begins to be felt.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Here’s why Bitcoin price may jump to ATH this week. Accessed on August 11, 2025