5 Things You Should Know About Sell Wall in Cryptocurrency

Jakarta, Pintu News – In the cryptocurrency world, a sell wall is one of the most important concepts that every trader should understand. A sell wall is a large pile of sell offers at a certain price that can affect market price movements.

This often creates barriers that prevent the price of assets like Bitcoin or Ethereum from rising further.

This phenomenon not only affects market psychology, but also the trading strategies used by traders. This article will discuss what a sell wall is, how it forms, and how it affects the crypto market.

1. What is a Sell Wall?

A sell wall is a collection of large sell orders placed at a specific price in the cryptocurrency order book. Typically, this is done by a single whale (large holder of the asset) or by a number of smaller traders placing sell orders at the same price.

This phenomenon creates a strong resistance for the price to pass a certain price point. In other words, if there are a lot of sell offers at $50,000 for Bitcoin (BTC), it ‘s difficult for the price to rise past that mark unless there is very strong buying pressure.

The effect of a sell wall on the market is huge, because with a large pile of sell offers, the price will not move upwards unless there is a large enough volume of buying to break through the wall of offers. In some cases, sell walls can persist for a long time and prevent prices from continuing their uptrend.

Also Read: Alpaca Finance (ALPACA) Price from Initial Release, Highest Peak (ATH), and Year-to-Date Development

2. How is a Sell Wall Formed?

A sell wall can be formed from one large trader placing a large sell order, or from multiple traders pooling their sell orders at the same price.

Big players in the cryptocurrency market, known as whales, often use this strategy to influence price movements. They know that if they place a large number of coins for sale at a certain price, the price will not go past that level unless there is enough buying demand.

In some cases, traders may also form sell walls for market manipulation purposes. By placing large sell orders, they can create the perception that prices can’t go any higher, causing other traders to follow the trend and sell faster. This can create a temporary downward price cycle.

3. The Effect of Sell Wall on Price Movement

A sell wall serves as resistance for the price of a cryptocurrency. As the price approaches the sell wall level, many traders will stop buying as they see that the price is unlikely to rise further.

However, if there are enough strong buyers to break the sell wall, the price may rise beyond that point, creating bullish momentum. But, if the sell wall remains and cannot be broken, the price is likely to correct or move down.

Market behavior is often influenced by the perception of a sell wall. Many traders will avoid buying when they see a large resistance at a certain price, assuming that the price will not be able to break through it. This serves as a psychological barrier that influences buying and selling decisions in the market.

4. How to Identify a Sell Wall?

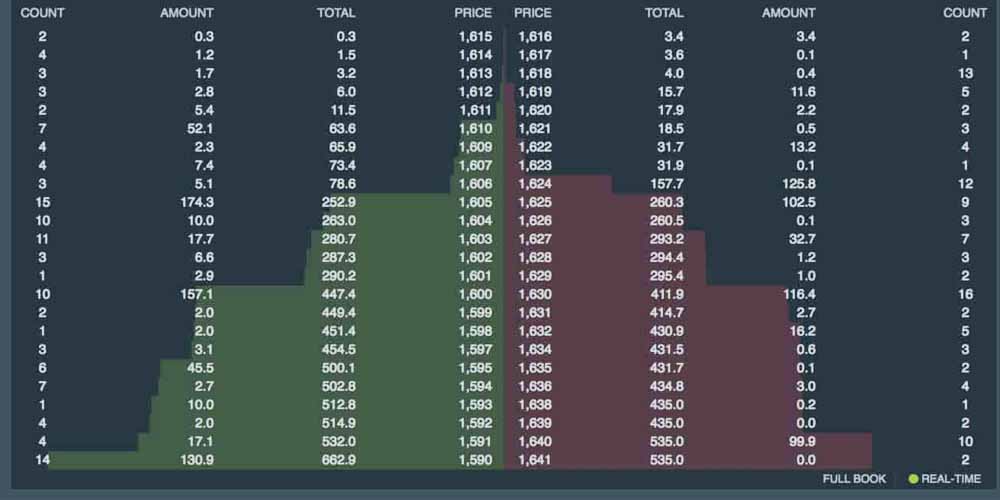

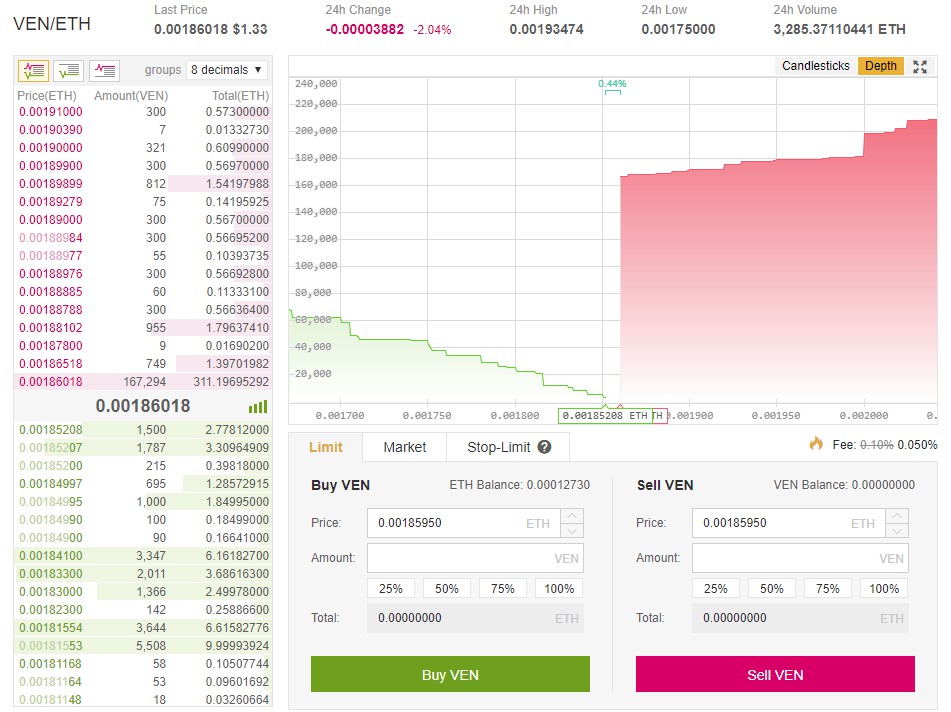

Careful traders can use depth charts to identify a sell wall. Depth charts are charts that show buy and sell orders at various price levels.

By looking at the depth chart, traders can easily see where the sell wall is and how it can affect price movements. On many cryptocurrency trading platforms, a sell wall is seen as a large stack of sell orders at a certain price level.

This gives traders an idea of the resistance point and helps them decide whether to continue buying or wait for the price to move further.

5. Strategy to Deal with Sell Wall

Knowing the presence of a sell wall allows traders to design smarter trading strategies. One approach is to monitor the trading volume around the sell wall.

If the buying volume increases and it seems that the sell wall is about to be broken, this could be a signal to buy. Conversely, if the sell wall remains solid, it may be better to wait or even go short selling to capitalize on the price drop.

Also Read: Moo Deng Price Initial Release, Highest, Year to Date

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bitget. What is a Sell Wall in Cryptocurrency. Accessed August 13, 2025.