Weekly Gold Price Predictions from FXStreet: Geopolitical Tensions Ease, Mixed US Data Curbs Volatility

Jakarta, Pintu News – Gold (XAU/USD) saw a sharp decline after a bearish start to the week, triggered by easing geopolitical tensions and mixed US macroeconomic data. These conditions limited gold price volatility.

Comments from Federal Reserve (Fed) officials and data related to activity in the US are expected to influence gold price movements in the near term.

Check out FXStreet’s complete gold analysis and predictions in this article!

Gold Price Decline and US Inflation Data

At the beginning of the week, gold experienced strong selling pressure and lost more than 1.5% of its daily value. Growing optimism regarding the potential resolution of the Russia-Ukraine conflict has reduced demand for gold as a safe haven asset.

However, gold found support near $3,350 after July inflation data from the US fueled expectations of three Fed rate cuts in the rest of the year, which in turn pressured US Treasury bond yields.

Data from the Bureau of Labor Statistics (BLS) showed annual inflation, measured by the change in the Consumer Price Index (CPI), remained steady at 2.7% in July.

Monthly CPI and core CPI rose 0.2% and 0.3%, respectively, in line with analysts’ estimates. Annual core inflation accelerated to 3.1%, faster than the 2.9% rise recorded in June.

Read also: Vanguard Cuts Stake in MicroStrategy, What’s the Impact?

Market Reaction to Mixed Economic Data

Despite producer inflation data showing a rise, the market reaction to the mixed data release from the US was not very significant, and gold remained in the lower half of its weekly range.

Retail sales in the US rose 0.5% on a monthly basis in July, while industrial production shrank 0.1%. The University of Michigan’s preliminary Consumer Confidence Index for August fell to 58.6 from 61.7 in July.

This data shows a mixed picture of the strength of the US economy, which could affect the Fed’s monetary policy. However, hot producer inflation data in July, with PPI rising sharply to 3.3% from 2.4% in June, has caused markets to reassess the Fed’s policy outlook.

Read also: The US is Seriously Monitoring DeFi: Digital Identity as a Solution to Prevent Crime?

Technical Outlook and Market Expectations

From a technical point of view, gold shows a neutral stance with the Relative Strength Indicator (RSI) moving flat around 50, and gold fluctuating close to the 20-day and 50-day Simple Moving Averages (SMAs).

If gold fails to reclaim the $3,355-$3,360 level, technical sellers may remain interested. On the other hand, if gold stabilizes above the level and turns it into support, the next resistance level could be seen at $3,400.

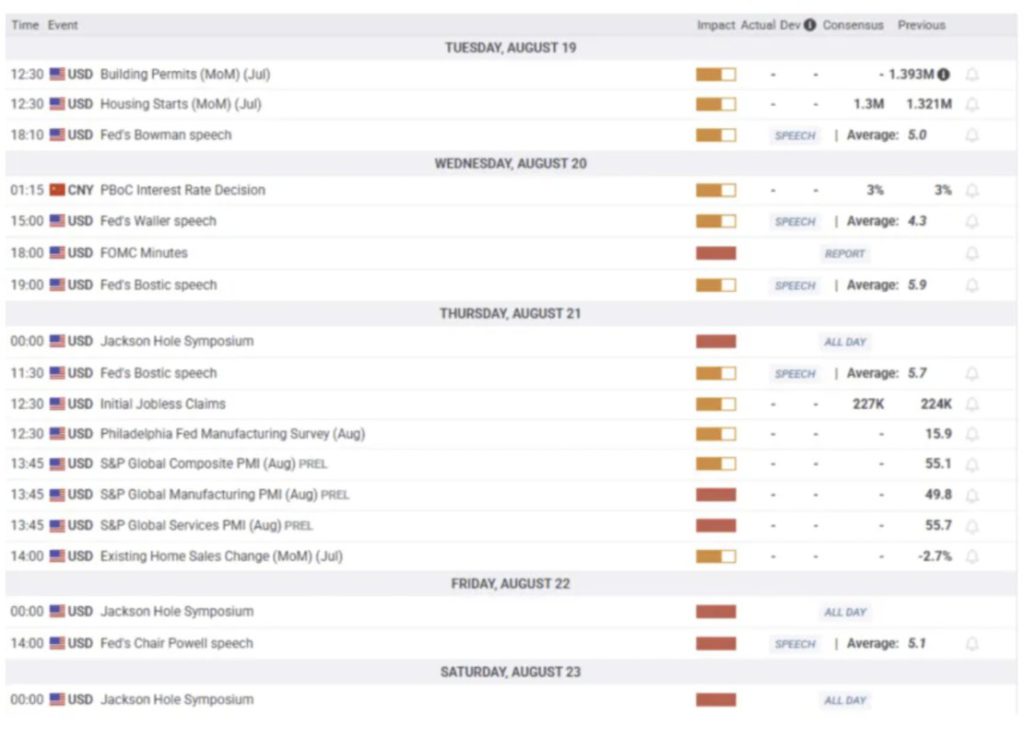

Gold investors are looking forward to PMI data and Jerome Powell’s speech at the Jackson Hole Symposium. Powell’s comments could trigger a large reaction in US T-bond yields and increase gold volatility towards the end of the week.

Conclusion

This week, gold faces pressure from various factors including US economic data and geopolitical dynamics. Investors will continue to monitor various indicators to take the right position in gold trading, paying attention to any developments that could affect global financial markets.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Gold Forecast: Easing Tensions, Mixed Data. Accessed on August 19, 2025

- Featured Image: Generated by AI