Antam Gold Price Chart August 18, 2025: Stable at Above Rp1.8 Million per Gram

Jakarta, Pintu News – The price of Antam gold bars on Tuesday, August 18, 2025, was recorded to remain at around Rp1.8 million per gram, despite showing a slight downward trend compared to the previous period.

Data from Brankas LM shows that the physical gold purchase price is at the level of Rp1,897,000/gram, up Rp3,000 from the previous price of Rp1,894,000/gram. Meanwhile, the price of Corporate Safe gold is priced at Rp1,837,600/gram, also up Rp3,000 from Rp1,834,600/gram.

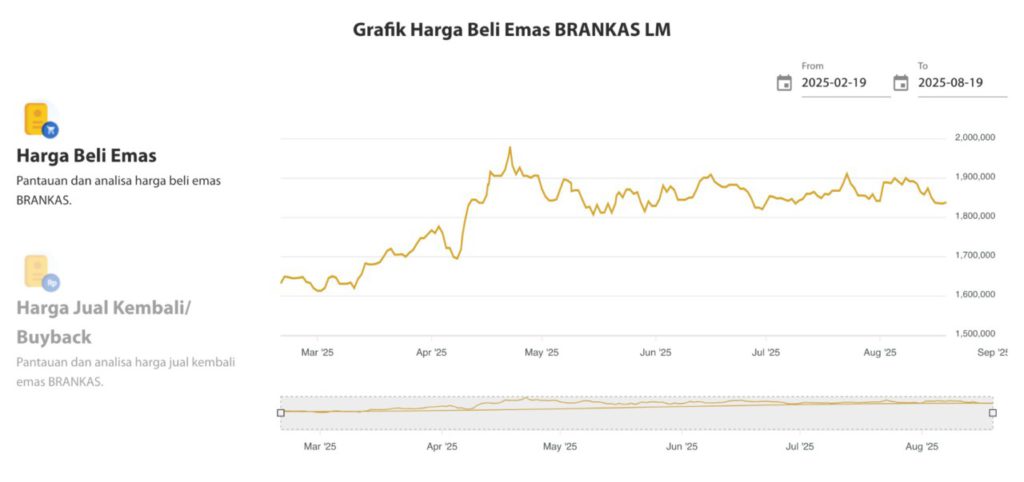

Gold Price Trends in the Last 6 Months

Based on the LM Brankas chart for the period February to August 2025, gold prices experienced a significant increase in April-May 2025, approaching the level of Rp2 million/gram. However, after reaching the peak, gold prices began to correct and fluctuate in the range of Rp1.8 million to Rp1.9 million/gram.

Price increases in the first half of the year were driven by global sentiment, including geopolitical uncertainty and expectations of lower interest rates from the world’s central banks. However, ahead of August 2025, gold prices were relatively weak as the US dollar strengthened and investment outflows from safe haven assets.

Also Read: CHILLGUY Price Prediction 2025-2030: Meme Coin Viral TikTok, Is it Still Worth Buying?

Factors Affecting Gold Prices

Some of the major factors that continue to influence gold price movements include:

- Global monetary policy – expectations of interest rate cuts are usually a positive catalyst for gold.

- Economic and geopolitical uncertainty – encouraging investors to seek safe assets.

- Theexchange rate of the rupiah against the US dollar – affecting domestic gold prices in Indonesia.

With gold prices remaining stable at over Rp1.8 million/gram, retail investors still see gold as a long-term hedging instrument amid global financial market volatility.

Conclusion

As of August 18, 2025, Antam’s gold price still stands at around Rp1.8 million-Rp1.9 million/gram. Despite fluctuations, the long-term trend of gold remains attractive for investors looking for stability. Investors are advised to keep monitoring global economic developments and the movement of the US dollar to determine future gold investment strategies.

Also Read: Worldcoin (WLD) Price Prediction 2025-2031: Bullish Potential or Just Hype?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- LM vault. Gold Price Dashboard. Accessed on August 19, 2025