BNB Chain outperforms Ethereum as the most active chain, will it push for new record highs?

Jakarta, Pintu News – In the dynamic world of cryptocurrencies, BNB Chain recently recorded a significant achievement by surpassing Ethereum in terms of the number of active addresses.

This increase not only indicates a shift in user preference but also the potential for significant price increases. With the support of an influx of funds and high trading volumes, BNB seems set to reach new heights.

Activity and Volume Show Bullish Signals

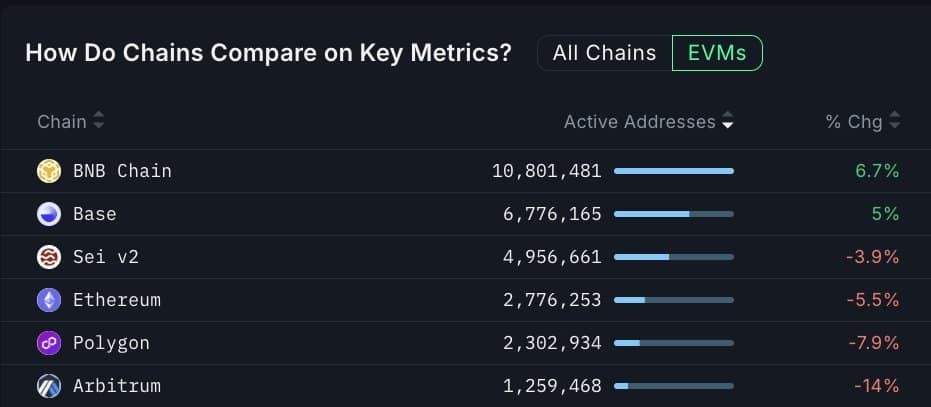

Last week, BNB Chain led the EVM chain in the number of Active Addresses, according to data from Nansen. Currently, the number of Active Addresses has reached 10.8 million, an increase of 6.7% in a week, giving it a significant lead over Base which has 6.7 million and Ethereum (ETH) which has only 2.7 million.

This increase not only reflects the growth in usage but also increases BNB Chain’s trading volume which reached $1.988 billion in daily volume.

This increased activity is also reflected in the performance of the last 30 days, with total volume reaching $58 billion according to DeFiLlama. This increase shows that there is a huge increase in trust and interest in BNB, which could encourage more transactions and investments in the long run.

Also Read: Ondo Finance (ONDO): RWA Project Claimed to be 10x in 2026, Is it True? Here’s the Analysis!

Liquidity Flows Support the Rally

The strength of this activity has also impacted liquidity flows. In the last 48 hours, around $20 million BNB was withdrawn from exchanges to private wallets, signaling high investor confidence. In addition, derivatives traders have also participated in this rally.

The Open Interest Weighted Funding Rate remained in positive territory with a reading of 0.0099%, indicating that traders taking long positions are paying funding fees to traders taking short positions. This indicates a bullish sentiment in the market, where the market tends to favor long positions. Short-term analysis by AMBCrypto assesses the potential effects of this bullish trend on BNB prices in various markets.

New Record Highs Still Possible

Although the outlook is bullish, chart patterns suggest that BNB may experience a short-term drawdown before targeting new record highs. The first support lies in the $855-$850 range. In the event of a drop into this zone, it could be a jumping-off point for another rally and potentially a new record high.

However, if supply diminishes, BNB may drop to the rising support line that has triggered the previous six rallies. For now, the chart shows a “decline-to-rally” setup as the base case.

Conclusion

With increasing activity and the support of strong liquidity flows, BNB Chain shows the potential to not only outperform Ethereum (ETH) in terms of activity but also in reaching new highs. Investors and users around the world will continue to monitor this development with enthusiasm.

Also Read: Notcoin (NOT): Why 100 Billion Supply Could Be a Strength and Risk in the Crypto World

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. BNB overtakes Ethereum as the most active chain; will it fuel a new ATH?. Accessed on August 25, 2025