Antam Gold Price Chart Today September 1, 2025: Down per Gram, Still Above Rp1.9 Million

Jakarta, Pintu News – Based on official BRANKAS LM data, the price of gold on Monday, September 1, 2025 at 08:11 WIB experienced a slight correction of IDR 2,000 per gram.

- BRANKAS Corporate gold buying price: IDR 1,918,600/gram (previously IDR 1,920,600/gram)

- Physical gold buying price: IDR 1,978,000/gram (previously IDR 1,980,000/gram)

This correction signaled a mild decline after a steady upward trend in recent weeks.

Price Trend of Last 6 Months

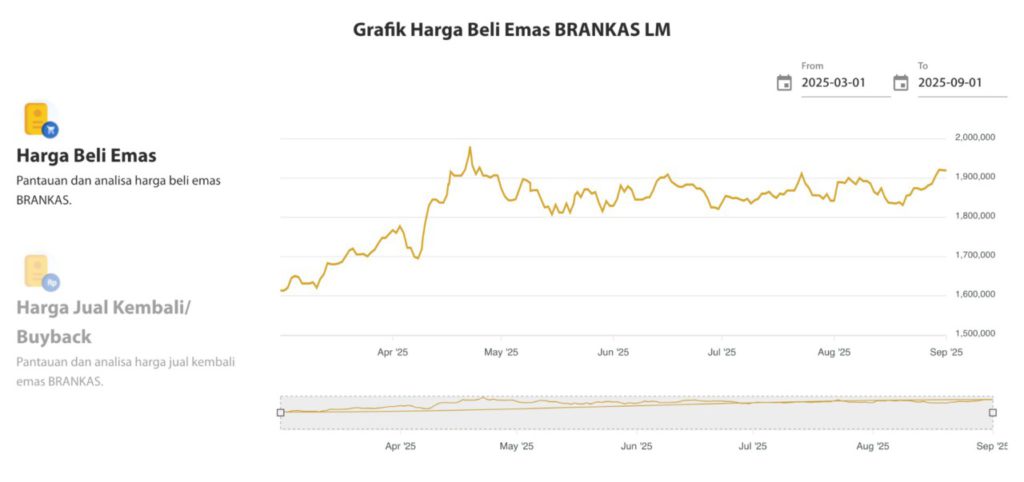

Looking at the chart for the period March 1, 2025 – September 1, 2025, the price of Antam gold has experienced quite dynamic movements:

- March – April 2025: Prices start to creep up from around IDR 1,600,000/gram to IDR 1,800,000/gram.

- May 2025: There was a significant spike, even touching a high of close to IDR 2,000,000/gram.

- June – July 2025: Prices fluctuated with several corrections, stabilizing in the range of Rp1,850,000 – Rp1,900,000/gram.

- August 2025: Prices were relatively consolidated, but the trend slowly increased again until early September.

In general, Antam gold prices are still on a medium-long bullish path, despite daily corrections.

Factors Affecting Price

Some of the factors driving gold’s current movement include:

- Global Interest Rate Policy

Expectations of an interest rate cut by the Fed in September provide positive sentiment for gold, as a weakening dollar usually pushes gold prices up. - Geopolitical & Economic Uncertainty

Volatility in global stock markets and uncertainty in Asian economies have helped keep gold in demand as a safe haven asset. - Domestic Demand

Physical gold in Indonesia remains widely sought after as a long-term investment instrument, both by individuals and corporations, through services such as BRANKAS LM.

Conclusion

Antam’s gold price today, September 1, 2025, experienced a slight correction of IDR 2,000 per gram, but still holds strong above IDR 1.9 million. With an upward trend in the last six months, gold remains an attractive asset amid global economic uncertainty.

For retail investors, the current price can be viewed as a long-term accumulation momentum, while for corporates, BRANKAS gold remains a solid hedging instrument.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. Gold Price Dashboard. Accessed on September 1, 2025