Bitcoin Price Steady at $111K Today as Bulls Maintain Market Grip

Jakarta, Pintu News – Since August 25, Bitcoin has been struggling with the resistance level around $112,000. Every time it tries to break and stay above that mark, the price is met by repeated sell-offs.

However, despite the pressure, some investors continue to show confidence. Instead of retreating, they are adding to their BTC holdings, further strengthening optimism about the potential for price recovery in the short term.

Then, how is the current Bitcoin price movement?

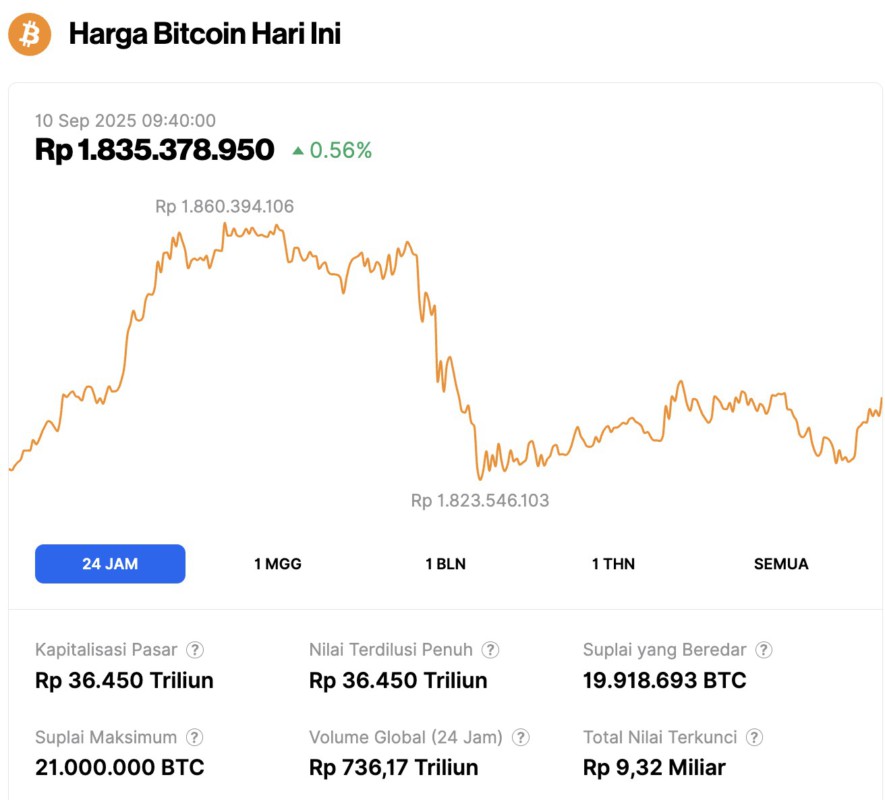

Bitcoin Price Up 0.56% in 24 Hours

On September 10, 2025, Bitcoin was trading at $111,495, equivalent to IDR 1,835,378,950, marking a modest 0.56% increase over the past 24 hours. Within this period, BTC dipped to a low of IDR 1,823,546,103 and climbed to a high of IDR 1,860,394,106.

At the time of writing, Bitcoin’s market capitalization is estimated at IDR 36,450 trillion, while its 24-hour trading volume has surged 12%, reaching IDR 736.17 trillion.

Read also: Bitcoin Price Stuck at $110,000, These 3 Altcoins Are Starting to Steal the Show

2 On-Chain Signals Show Bitcoin Bulls Still Dominate

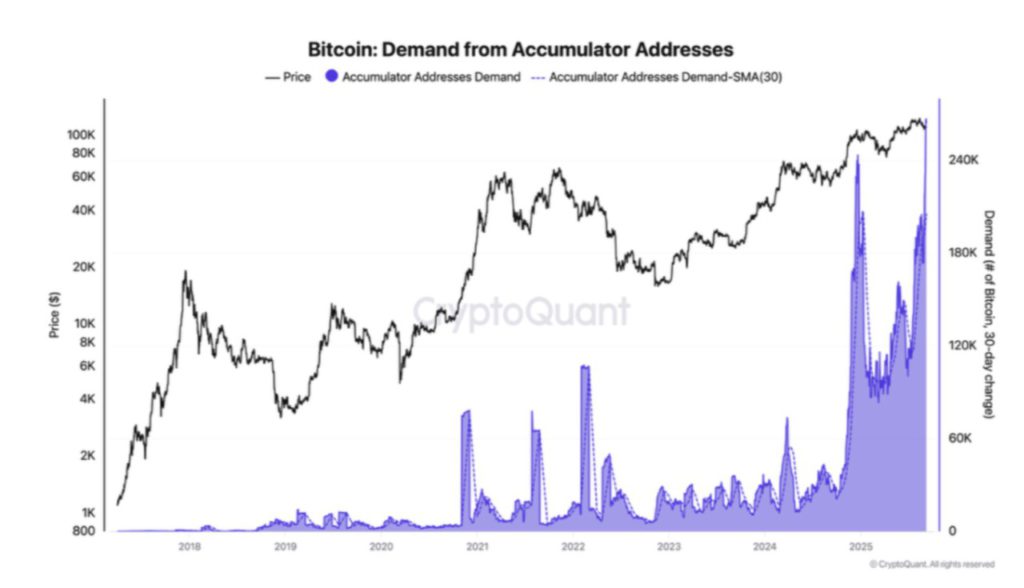

According to a recent report from CryptoQuant’s pseudonymous analyst Darkfost, demand from BTC address-accumulators is currently “soaring.”

These addresses are defined as wallets that have made at least two transactions for a minimum amount of BTC, without ever making a single sale. Now, they are setting an all-time record high in the number of holdings.

“We can attribute this type of address to long-term investor behavior. In an era where many companies are incorporating Bitcoin into their balance sheets, adoption continues to grow, and Bitcoin is recognized as a store of value, it’s clear that a lot of BTC is now being collected with the intention of being held for the long term,” Darkfost explains.

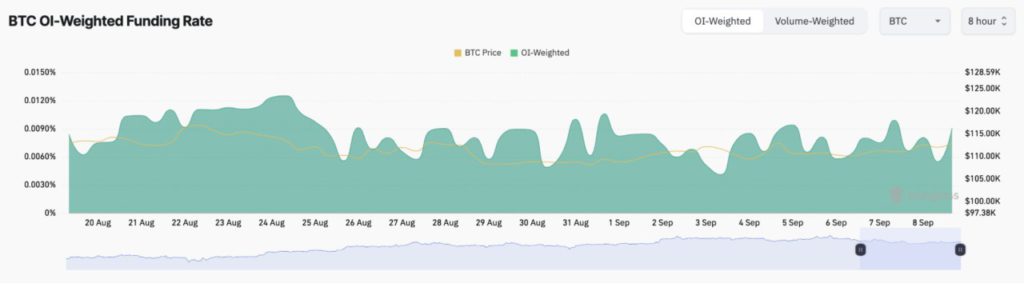

In addition to the surge in long-term accumulation, BTC’s funding rate on major exchanges also remains positive, despite the recent lackluster price performance. Based on Coinglass data, the funding rate is currently recorded at 0.0091%.

The funding rate itself is used on perpetual futures contracts to keep the price in line with the BTC spot price. This figure represents the periodic cost between traders in long positions (who bet on the price going up) and short positions (who bet on the price going down).

Read also: 3 Most Popular Stablecoins, Are They in Your Portfolio?

When the funding rate is positive, it means that long traders are paying off short traders-a signal that the majority of traders are bullish and anticipate the rally to continue.

As such, BTC traders’ willingness to continue paying premiums to maintain long positions further reinforces the trend seen from the address-accumulator, which is the dominance of bullish sentiment in the market.

Bullish Still Optimistic, but Bears Aim to Break the $110,000 Level

These two signals confirm that despite BTC’s repeated difficulties in breaking through the $112,000 level, both retail investors and derivatives market participants are still bullish. This indicates that the upward push is just waiting for momentum.

If demand continues to increase, Bitcoin price has the potential to climb up to $115,892. On the other hand, if the sell-off dominates again, BTC could fall below $111,961 and continue towards the $110,034 area.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Struggles at $112,000, But 2 Signals Show Bulls Are Not Backing Down. Accessed on September 10, 2025