How to Read Altcoin Season Index for Trading Strategy

Jakarta, Pintu News – The crypto market is back in the spotlight after the Altcoin Season Index approached an important level that indicates a potential trend shift from Bitcoin to altcoins. This index is often used as a reference by analysts to read the dynamics of the cryptocurrency market and determine the direction of the next strategy. Here’s how to read the altcoin season index for a trading strategy!

What is Altcoin Season Index?

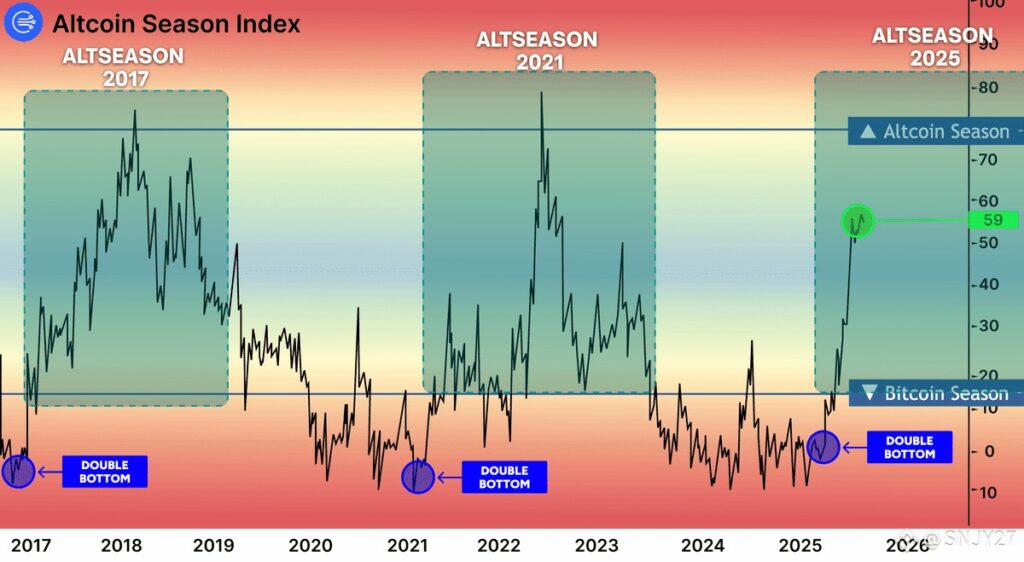

The cryptocurrency market often moves in repetitive cycles. During certain periods, Bitcoin’s (BTC) dominance may weaken, allowing altcoins to outperform. To measure these conditions, an indicator called the Altcoin Season Index is used.

The Altcoin Season Index assesses the performance of the 50 largest altcoins by market capitalization within a 90-day period. If more than 75% of altcoins record higher performance than Bitcoin, it is called an altcoin season. The index does not include stablecoins or assets pegged to a specific value, so it focuses more on assets with significant price movements.

How to Read and Interpret the Index

The Altcoin Season Index has a value range of 0 to 100. The number 0-25 signifies Bitcoin Season, which is when BTC is more dominant. Numbers 26-74 indicate neutral conditions with no clear dominance. Meanwhile, numbers 75-100 signify altcoin season, where altcoins are superior to Bitcoin.

Read also: Altcoin Season Index reaches 73, when is the right time to enter altcoins?

Although it is calculated from historical data, it provides a snapshot of current market conditions. Traders and analysts usually use it as a confirmation tool, rather than a predictive indicator. This means that the Altcoin Season Index helps understand whether the market tends to favor altcoins or Bitcoin, so it can be a consideration in reading trends.

Use with Other Indicators

The Altcoin Season Index will be more effective when combined with other indicators. One of them is Bitcoindominance (BTC Dominance). When BTC dominance decreases along with the rise of the Altcoin Season Index, it usually indicates a market shift to altcoins.

In addition, other analyses such as liquidation heatmaps are also often used. This tool displays areas of potential large liquidations that could trigger sudden price changes. By combining various indicators, crypto market analysis can become more balanced and not rely solely on a single source of information.

Altcoin Rotation and Sector Dynamics

Not all altcoins move simultaneously during altcoin season. Generally, there is a rotation of capital from Bitcoin to Ethereum , then to mid-cap altcoins, and finally to small-cap altcoins. This pattern is known as altcoin rotation.

Read also: 3 Cryptos that were Most Wanted in the 4th Week of September 2025

In addition, rotations often occur between sectors. For example, at one period DeFi tokens were ahead, then shifted to memecoins like Pepe Coin , or to certain standards-based tokens like Ripple and Stellar . Some additional indices are even customized for certain sectors, such as the DeFi Season Index or Meme Season Index, to help monitor trends more specifically.

Determining Trading Access

For those who want to take advantage of altcoin season, the availability of crypto trading platforms is an important factor. Exchanges with a diverse number of altcoins and adequate liquidity help reduce the risk of slippage. Additional features such as derivatives trading, staking, or non-KYC access can also be considered based on user needs.

Choosing the right platform is not only related to profit opportunities, but also to the security and efficiency of transactions. By considering these factors, the analysis based on the Altcoin Season Index can be better applied in practice.

Conclusion

The Altcoin Season Index is one of the widely used indicators to understand the shifting trends between Bitcoin and altcoins. Although based on historical data, this index can help read the current market conditions. When combined with other indicators and an understanding of altcoin rotation, the Altcoin Season Index can provide additional insights in crypto analysis strategies.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Whale Portal. Altcoin Season Index Explained: How to Use This Indicator to Profit from Alt-Season. Accessed September 24, 2025.

- Featured Image: Generated by AI