2026 Is Just Around the Corner, but These 3 Cryptos Are Still Stuck in Place!

Jakarta, Pintu News – As the end of 2025 approaches, the crypto market is filled with renewed optimism after several key assets such as Bitcoin and Solana showed signs of recovery. However, not all coins are enjoying similar momentum.

Amidst market rallies and increasing adoption of Web3, there are still a number of cryptocurrencies that have stagnated, seeminglyunaffected by the positive sentiment surrounding them. Despite having strong fundamentals and large communities, the performance of the following three assets has been flat throughout the year. The question is, what makes these three still “so-so” even though 2026 is on the horizon?

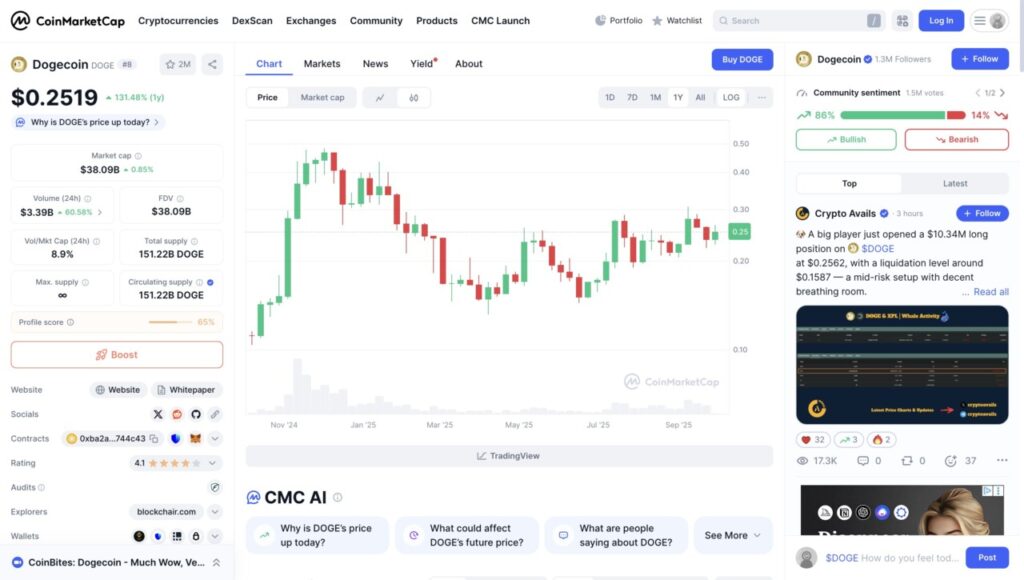

1. Dogecoin (DOGE)

The Dogecoin price chart above shows quite an interesting trend over the past year. Currently, the price of DOGE stands at $0.2519, registering a 131.48% increase on an annualized (1Y) basis with a market capitalization of $38.09 billion. While the crypto market has experienced periods of high volatility, Dogecoin has managed to show price resilience and positive momentum since mid-2025.

After briefly touching the peak area around $0.50 at the end of 2024, DOGE experienced a long correction phase until it reached $0.15 in the second quarter of 2025. However, from July to October 2025, the price stabilized and moved sideways in the $0.22-$0.28 range, signaling an accumulation phase before the next potential big move.

Market activity also showed a significant increase with 24-hour trading volume reaching $3.39 billion, up more than 60% compared to the previous day. The Volume to Market Cap ratio of 8.9% signifies strong liquidity, reinforcing DOGE’s position as one of the most actively traded assets.

In terms of sentiment, around 86% of the community is bullish, while only 14% are bearish, illustrating the dominance of optimism among investors. In fact, a report from Crypto Avails noted a $10.34 million long position at $0.2562, indicating market participants’ strong belief in further upside potential.

Read also: 3 Altcoins Predicted to Outperform Bitcoin in October 2025

Technically, DOGE appears to be forming a higher low pattern in the $0.20-$0.22 area which serves as strong support, while the main resistance is around $0.30-$0.32. If this level is successfully broken, the opportunity for an increase towards the $0.40 to $0.45 range becomes increasingly open.

With increasing volumes, positive community sentiment, and support from institutional traders, Dogecoin is now in a bullish consolidation phase, waiting for new momentum to resume its rally in the last quarter of 2025.

2. Polygon (POL)

The chart above shows the price movement of Polygon – previously known as MATIC – over the past year on the CoinMarketCap platform. Currently, POL is trading at $0.2370, a decrease of about 37.48% in a year (1Y). While it’s still down on an annualized basis, the chart shows signs of a gradual recovery after experiencing considerable selling pressure since late 2024.

At its peak at the end of 2024, the POL price was above $0.70, but since the beginning of 2025 it has been on a consistent downward trend until it bottomed out at around $0.18 by mid-year. Since July 2025, the price movement began to stabilize and showed a consolidation pattern in the $0.22-$0.25 area, signaling an accumulation phase after a major correction.

In terms of market fundamentals, POL capitalization now stands at $2.49 billion, a slight increase of 0.2%, while daily trading volume increased by 15.85% to $133.47 million. The Volume to Market Cap ratio of 5.35% reflects healthy market activity with maintained liquidity. The number of token holders stands at around 73.45K, indicating a community of users that remains active despite the price being in a consolidation phase.

In terms of sentiment, around 83% of investors are bullish, while 17% are bearish, reflecting the market’s optimism towards Polygon’s potential recovery. The latest news from Polygon’s official side also mentions that $POL staking now offers a more attractive yield, which could be a positive catalyst to boost token demand in the coming quarters.

Technically, the chart shows a weakening long-term downtrend pattern, with strong support in the $0.20 area and resistance around $0.30. If the price is able to break the resistance area, the potential upside towards $0.35-$0.40 is wide open.

With volumes starting to pick up, strong community support, and renewed staking incentives, POL is now at a potential point of reversal towards a recovery phase in the next few months.

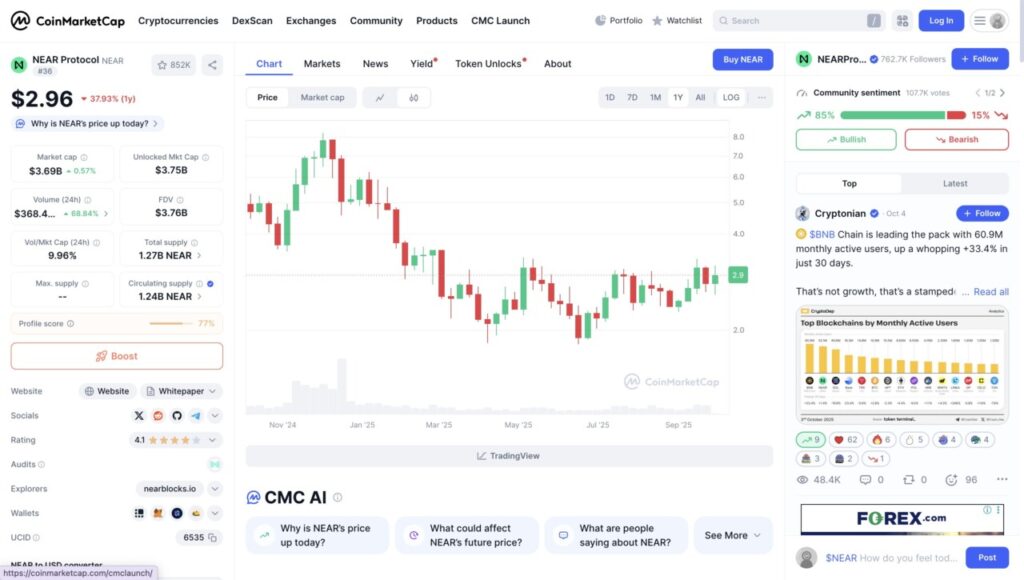

3. Near Protocol (NEAR)

The chart above shows the price movement of NEAR Protocol over the past year on the CoinMarketCap platform, with the current price at $2.96. On an annualized basis, NEAR is still recording a decline of around 37.93% (1Y), but recent movements indicate a gradual recovery after going through a long period of selling pressure since early 2025.

At the end of 2024, NEAR prices briefly breached the $8.00 level, before falling sharply throughout the first quarter of 2025 to the $2.00-$2.20 area. Since July 2025, the chart began to show a reversal pattern with a series of higher lows, signaling renewed buying interest from market participants.

In terms of fundamentals, NEAR’s market capitalization currently stands at $3.69 billion, up 0.57%, with daily trading volume surging 68.84% to $368.4 million. The rise in volume reflects increased market participation, likely driven by staking activity and increased adoption of NEAR-based applications. The Volume to Market Cap ratio of 9.96% indicated solid liquidity, while total supply stood at 1.27 billion NEARs, with 1.24 billion tokens circulating in the market.

Also read: 3 World-Class Hackers that Make Crypto Investors Wary

Sentimentally, around 85% of the community is bullish, while 15% is bearish, illustrating the dominance of optimism towards NEAR’s prospects for the rest of 2025. This strong community support is backed by the development of its ecosystem, especially in the Web3 and AI sectors, which have been the focus of NEAR’s development in recent months.

From a technical perspective, NEAR appears to be forming strong support in the $2.40-$2.50 area, with major resistance around $3.20-$3.50. If the price is able to break the upper limit, the potential for an increase towards the $4.00-$4.50 area becomes increasingly open. With increasing volume momentum, stable consolidation trend, and positive market sentiment, NEAR is now in a healthy accumulation phase – signaling readiness for a new uptrend in the fourth quarter of 2025.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Featured Image: Generated by AI