Altcoin Momentum Builds as Market Quietly Starts to Shift

Jakarta, Pintu News – After experiencing one of the biggest liquidation actions of the year, traders seem to be starting to shift their funds back into altcoins.

Bitcoin’s market dominance fell to 60% in just two days, indicating that capital flows may be starting to move into higher risk assets. Ethereum led the market recovery, boosted by a large buyout from Bitmine earlier this week.

Although market movement figures still look sluggish, do altcoins still have a chance to rise?

Altcoin Market Stabilizes after Big Shock

Read also: Is Bittensor (TAO) Set for a Major Surge Thanks to Grayscale? Here’s What’s Happening

The crypto market just experienced one of the largest liquidation events in history – over $19 billion in leveraged positions were wiped out in a single day, resulting in over 1.6 million traders being liquidated.

The chart above shows how the total crypto market capitalization (excluding BTC and ETH) plummeted sharply before stabilizing around $1 trillion. But interestingly, this major shock could actually pave the way for a market revival.

According to Joao Wedson, CEO of Alphractal, funds exiting Bitcoin and leveraged positions being liquidated are now “pouring into other altcoins.”

If that’s true, next week could bring an unexpected surge in the altcoin market, as traders hunt for new opportunities in various cryptocurrencies.

BTC’s Dominance Begins to Subside

Bitcoin’s (BTC.D) market dominance has dropped to 60.45% at the time of writing, softening after the sharp spike earlier this week. The figure reflects uncertainty in the market, with momentum starting to weaken after the strong surge on October 10.

This situation has led traders to cautiously exit Bitcoin and re-examine opportunities in altcoins.

If this downward trend in dominance continues, it could open up the opportunity for a stronger recovery for altcoins in the next few days – especially if liquidity from Bitcoin starts to flow into other major cryptocurrencies.

Read also: Ethereum Hits $4,100 Today — Is a Cup Pattern Signaling a Further Rally?

ETH Becomes a Guidepost

Ethereum is often an early signal of altcoin movement, and Bitmine’s big $480 million buyout could be the first hint of market direction.

Data shows six new wallets – most likely related to Bitmine – withdrew more than 128,000 ETH from FalconX and Kraken shortly after the crash.

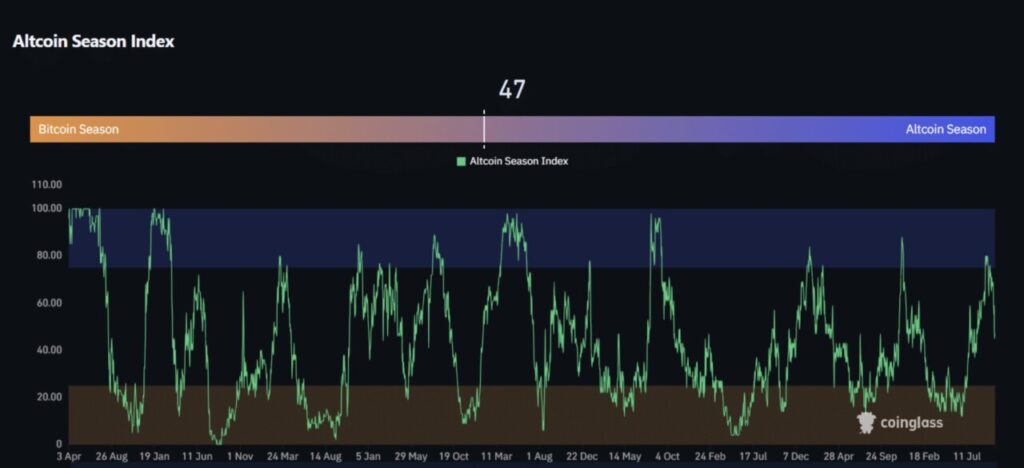

With the Altcoin Season Index still at 47, the market is not yet fully in high-risk mode. However, this accumulation could be a sign of investor confidence. If the inflows into ETH continue, it could be the start of a broader altcoin revival.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Altcoin rally on the horizon; these trends suggest rotation is already on. Accessed on October 14, 2025