3 BNB Signals Corrected Despite 45% Increase – Whale Investors Start Taking Profit?

Jakarta, Pintu News – The price of Binance Coin has been in the news after registering a price surge of up to 45% in the last 30 days. However, according to the latest technical and on-chain analysis, there are some important metrics that suggest that this momentum may not last.

Here are 3 reasons why the price of BNB (Binance Coin) could see a correction in the near future, despite currently being one of the top cryptos stealing the market’s attention.

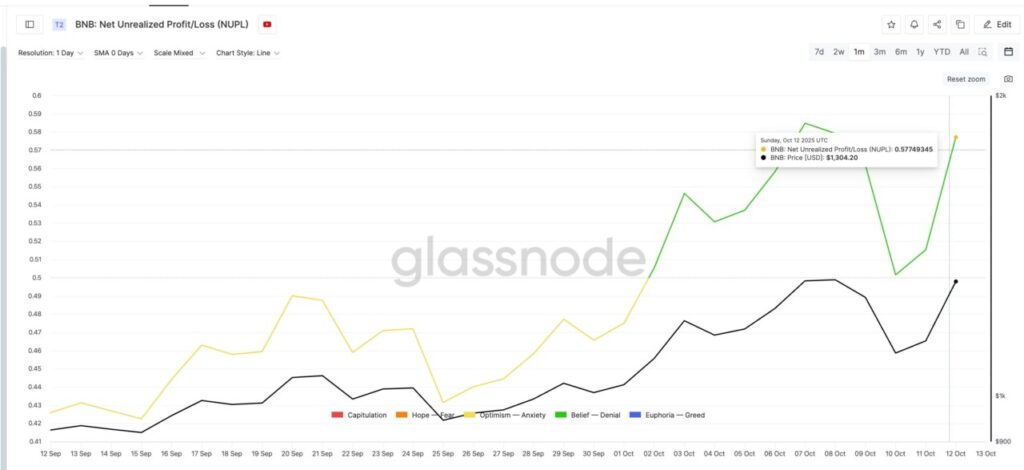

1. NUPL Metrics Show Whale Profit-Taking Is Happening

Based on data from Glassnode quoted by BeInCrypto on October 13, 2025, the Net Unrealized Profit/Loss (NUPL) metric for BNB is now at the level of 0.57. This figure shows that most investors are currently in a state of “unrealized profit” or have not realized their profits.

At similar levels earlier, on October 7, BNB had corrected from $1,300 (IDR 21,518,900) to $1,100 (IDR 18,208,300), a drop of around 15%. According to analyst Ananda Banerjee, NUPL peaks are often followed by profit-taking from whales and medium-term investors.

In addition, a similar spike on October 3 also triggered a small correction of about 3%. This data shows that when NUPL reaches a local peak, the market tends to experience a consolidation phase or short-term price decline.

Also Read: Memecoin Market Adds $10 Billion Post-Crisis: What’s Next for Traders?

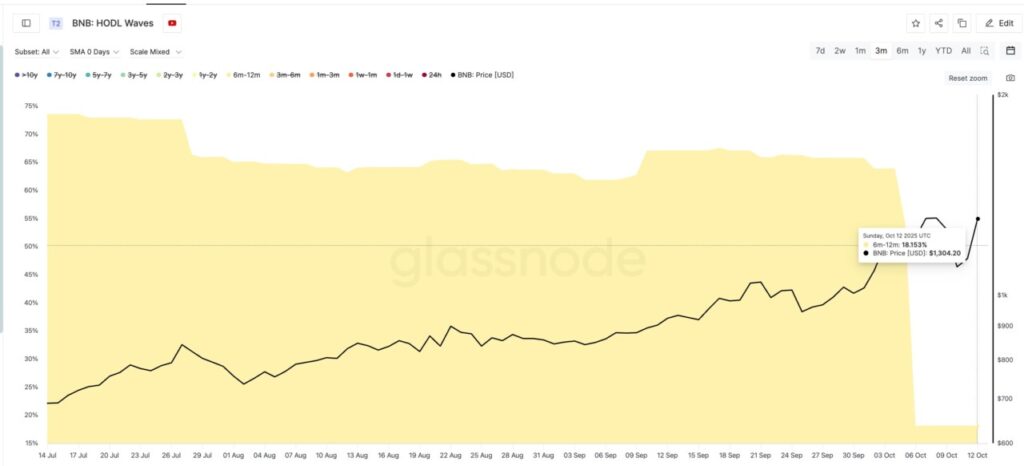

2. 6-12 Month BNB Holders Begin to Reduce Holdings

The next important signal came from the HODL Waves metric, which shows the age distribution of token holdings. The latest data reveals that the group of BNB holders over 6-12 months-which usually anchors the medium-term bullish trend-is experiencing a significant decline.

According to the BeInCrypto report, this group previously held 63.89% of the total BNB supply on October 4, but now only 18.15%. This means that the group that was previously “sitting pretty” has now started selling to realize profits.

This decline in participation from holders reflects a decline in medium-term confidence, and signals that the buying wave from retail investors has not been strong enough to sustain the upward momentum.

3. RSI Divergence: Technical Pressure Begins to Show

From a technical perspective, the Relative Strength Index (RSI) also shows a clear bearish divergence signal. BNB’s RSI formed a lower high, while BNB’s price formed a higher high between October 10-12. This is a classic pattern that usually precedes a short-term correction.

The BNB price is currently trading around $1,340 (IDR 22,180,020), close to the Fibonacci 0.382 resistance zone at $1,382 (IDR 22,879,946). According to Banerjee, if prices fail to break this level in the near term, then a potential correction to support at $1,320 (IDR 21,871,160) is very likely.

If the selling pressure gets stronger, the correction could continue to the $1,220 level (IDR 20,180,860), and even touch $1,140 (IDR 18,870,420) again.

Conclusion: BNB is still in the spotlight, but beware of correction

Although BNB is still one of the resilient and much-hunted altcoins after the massive rally, data shows that investors-especially whales and mid-term holders-have started to take profits.

With the combination of the NUPL peak, the decline of the 6-12 month holder group, and the RSI divergence signal, traders and investors are advised to remain wary of a potential short-term correction. However, this correction does not mean that the long-term bullish trend is over-it is rather a healthy cooling down phase before a potential rebound.

Also Read: BTC & ETH Rise After the “Biggest One-Day Wipeout in Crypto History”: Here’s Why!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ananda Banerjee / BeInCrypto. 3 Reasons Why BNB Price Could Dip Despite Beating the Crypto Market Crash. Accessed on October 14, 2025