5 Ways to Work Small Capital Big Profits in Crypto

Jakarta, Pintu News – Investing in digital assets has never been more affordable. With a small capital, you can still make big profits – as long as you know the strategy. In the crypto world, the potential for profit often depends not on the size of your initial capital, but on how you manage it.

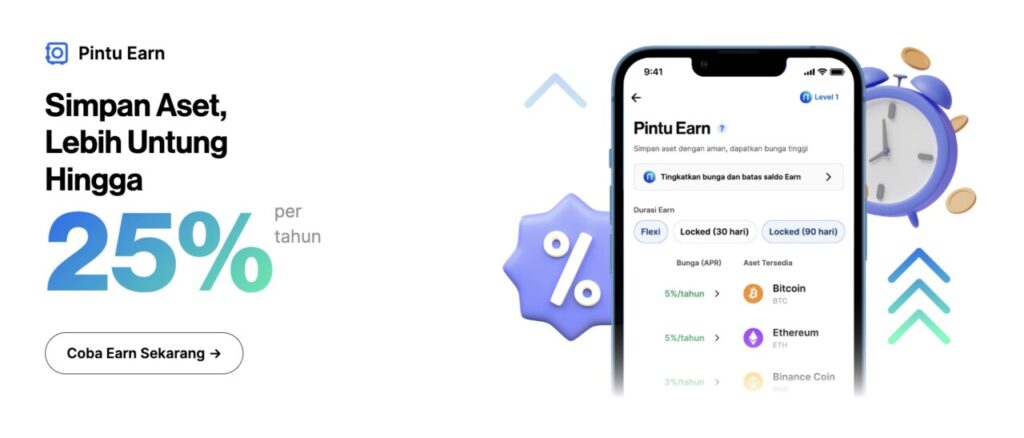

Many first-time investors have proven that with as little as hundreds of thousands of dollars, they can start building a consistently growing portfolio. One way that is increasingly being discussed is through the Pintu Earn feature, which allows you to earn up to 25% APY on your crypto assets.

Here are 5 smart ways to make small capital work harder in the crypto world:

1. Utilize Earn Feature: Interest Continues Without Trading

Instead of just keeping your crypto in your wallet, you can activate the Earn feature from apps like Pintu. With this feature, you can earn interest on your crypto assets every hour, without having to do any trading.

According to data from Pintu Earn users can earn up to 25% interest per annum (APY) depending on the asset type and lock duration (flexi vs locked). This is the easiest way to make your assets work to generate passive income, even while you sleep.

Also Read: $45 Million BNB Airdrop Ready to Rock the Meme Coin World in October 2025!

2. Choose Stable Assets for Minimal Risk, Maximum Profit

With small capital, it’s important to manage risk. One strategy many beginners choose is to hold stablecoin assets like Tether or USD Coin in the Earn feature. Since the value is stable (1:1 against USD), you can focus on earning interest instead of price speculation.

This means you can safely enjoy passive returns, without having to worry about prices dropping. Ideal for beginners who want to “play it safe” but still grow.

3. Combine Earn + Dollar Cost Averaging (DCA)

With the DCA strategy, you can regularly buy crypto in small amounts – such as Rp50,000 or Rp100,000 – every week or month. This helps you avoid buying at peak prices and build a long-term portfolio consistently.

Now, after buying, immediately activate the Earn feature so that the coins you collect are immediately productive in generating interest. According to market analysis data, the DCA + Earn strategy is able to provide more stable asset growth than active trading.

4. Use Locked Earn for Higher Interest

If you have crypto assets that you won’t be using anytime soon, you can choose the Locked Earn option on Pintu. By locking your assets for 30 or 90 days, you can earn a much higher APY rate than Flexi Earn.

For example, if you keep USDT stablecoins in Locked Earn, you can earn more than 15%-25% interest per year, far exceeding conventional bank deposits. Maximum profit, minimal risk.

5. Start Small Now – Because Time = Money

One of the keys to success of “small capital big profits” is to start early. The sooner you start, the longer your assets will take to grow. Even the interest from Earn on the Door runs hourly, so timing really does play a big role.

Let’s say you start with Rp100,000 today and keep adding little by little while enjoying the interest – you will be surprised to see the growth of your portfolio in the next 6 months to 1 year.

Capital may be small, but strategy must be smart

Crypto isn’t just for those with deep pockets. With the right strategy, features like Pintu Earn can help you earn consistently – even from very limited capital.

From now on, let your assets work for you, not the other way around. Check out more at Pintu Earn and discover the best passive income potential from crypto.

Also Read: Michael Saylor’s Strategy: $27.2 Million Bitcoin Purchase Before the Crypto Market Crash

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.