Antam Gold Price Chart Today, October 22, 2025: Strengthening Amid Global Pressure!

Jakarta, Pintu News – The world gold price showed positive movement again in trading today, Wednesday, October 22, 2025. Based on data from HargaEmas.com, the spot gold price was recorded to have risen to US$4,126 . 90 per ounce, an increase of US$12.40 compared to the previous close. In Rupiah, the USD/IDR exchange rate was at IDR 16,628.35, making the gold price equivalent to IDR 2,206,298 per gram, with an increase of IDR 10,489.

The rise signaled a strong push from global demand for safe haven assets, amid geopolitical uncertainty and global economic pressures.

1. World Spot Gold Rises Above $4,100 per Ounce

The global gold price broke through the psychological level of $4,100/oz, marking a significant gain after stagnating around $4,000 in the previous week. This strengthening was triggered by increased investor interest in gold amid stock market volatility and geopolitical tensions between the US and the Middle East.

Conversion to Rupiah at an exchange rate of IDR 16,628 per USD results in a gold value of around IDR 68.56 million per ounce. This global price movement is the main reference in the formation of Antam’s gold price in the domestic market.

Also Read: Want to Buy Cheap Bitcoin? Check out this expert’s Buy Whale Zone!

2. Rupiah Exchange Rate Fluctuations Drive Domestic Gold Prices

The weakening Rupiah exchange rate against the US Dollar played a role in pushing up gold prices in Indonesia. On Wednesday morning, the Rupiah was trading at around IDR 16,628.35/USD, up slightly from the day before.

This reflects investors’ concerns over a potential Fed rate hike towards the end of the year. As the Rupiah weakened, domestic gold prices rose to IDR2,206,298 per gram, close to today’s high of IDR2,210,153, with a low of IDR2 ,154,958.

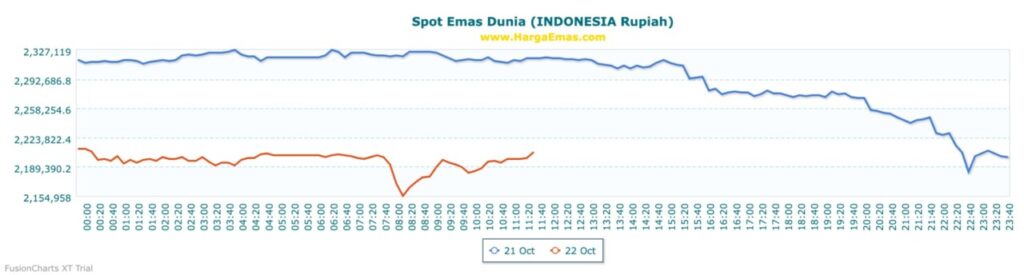

3. World Gold Spot Chart: Strong Trend After Correction

The world gold movement chart shows an upward trend since the beginning of trading on October 22, although it had corrected in the afternoon session. The red line on the HargaEmas.com chart shows price recovery after a sharp decline at 07:00-08:00 WIB, followed by a steady rebound until near noon.

Meanwhile, the October 21-22 price comparison chart shows that gold prices today (red line) are still lower than yesterday (blue line), signaling a consolidation phase after sharp gains earlier in the week.

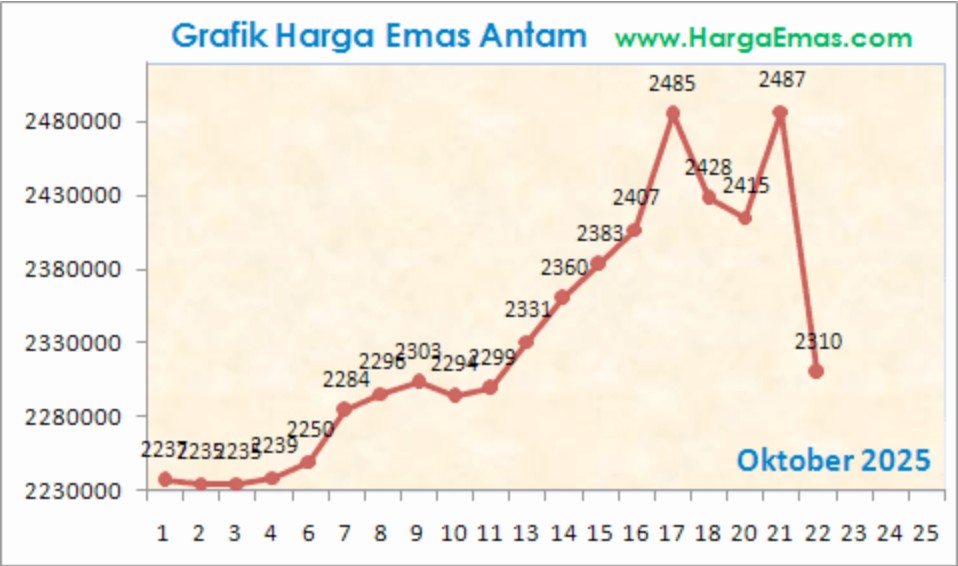

4. Antam October 2025 Gold Price Chart: Ups and downs after touching the highest level

Based on Antam ‘ s monthly gold price chart, the price of gold peaked at Rp2,487,000 per gram on October 18, 2025, before dropping sharply to Rp2,310,000 on October 22.

This movement illustrates profit-taking by investors after a strong rally in the middle of the month. However, the medium-term trend is still positive, with gold prices rising from IDR2,237 ,000 in early October to an average of IDR2,330,000 towards the end of the month.

5. Implications for Investors: Gold is Still a Safe Choice

The rise in gold prices amid exchange rate turmoil shows that the precious metal is still a key hedging instrument.

Despite crypto markets such as Bitcoin and Ethereum recording gains above 1%, many investors still view gold as a stable asset for portfolio diversification.

With high volatility in stocks and digital assets, Antam’s gold investments – both physical and digital (such as PAXG) – remain relevant to preserve wealth amidst global economic uncertainty.

Conclusion

Gold prices today, October 22, 2025, experienced a modest increase driven by strengthening global spot prices and a weakening Rupiah. Priced at around IDR2.206 million per gram, gold remains a safe haven asset for investors seeking stability amid market fluctuations.

Although it fell from a high of IDR2.487 million, the long-term trend is still positive, especially if geopolitical tensions and global inflation continue until the end of the year.

Also Read: John Bollinger’s Legendary Prediction: Ethereum & Solana Set to Surge in Late 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- HargaEmas.com. World GoldPricehttps://www.hargaemas.com/aand Antam Today, October 22, 2025. Accessed on October 22, 2025.