Hyperliquid Strategies Targets $1B Raise, Eyes HYPE Token Buy

Jakarta, Pintu News – Hyperliquid Strategies has filed documents with the US Securities and Exchange Commission (SEC) to raise up to $1 billion through a new share offering. The funds will be used to strengthen the company’s balance sheet, including the strategic accumulation of Hyperliquid tokens.

Hyperliquid Strategies prepares a large capital injection

Based on the S-1 filing document, Hyperliquid Strategies plans to offer up to 160 million shares of common stock through an agreed equity facility with Chardan Capital Markets. The proceeds from the offering will be used to support the company’s general operations as well as the possible purchase of HYPE tokens.

Also read: 16,000 ‘Sleeping’ Bitcoins Suddenly Move, Whale Loss Pressure Reaches $7 Billion?

The company was formed through the ongoing merger process between Nasdaq-listed biotechnology company Sonnet BioTherapeutics and special purpose acquisition company (SPAC) Rorschach I LLC. Once the merger process is completed by the end of this year, the combined entity will trade on the Nasdaq exchange under a new stock code that has yet to be announced.

The company’s leadership structure will include former Barclays CEO Bob Diamond as Chairman, and David Schamis as CEO.

The document also revealed that the company currently has 12.6 million HYPE tokens and $305 million in cash. The company stated that these digital assets will be used primarily for staking activities, which are expected to generate consistent returns over time.

“The company plans to selectively utilize its HYPE token holdings, primarily through staking almost all of its tokens,” the report reads.

This filing comes in the wake of institutional activity regarding HYPE tokens. Last month, Nasdaq-listed Lion Group announced its plans to convert its Solana and Sui holdings into HYPE tokens.

HYPE Token Gains Strength Despite Weak Crypto Market

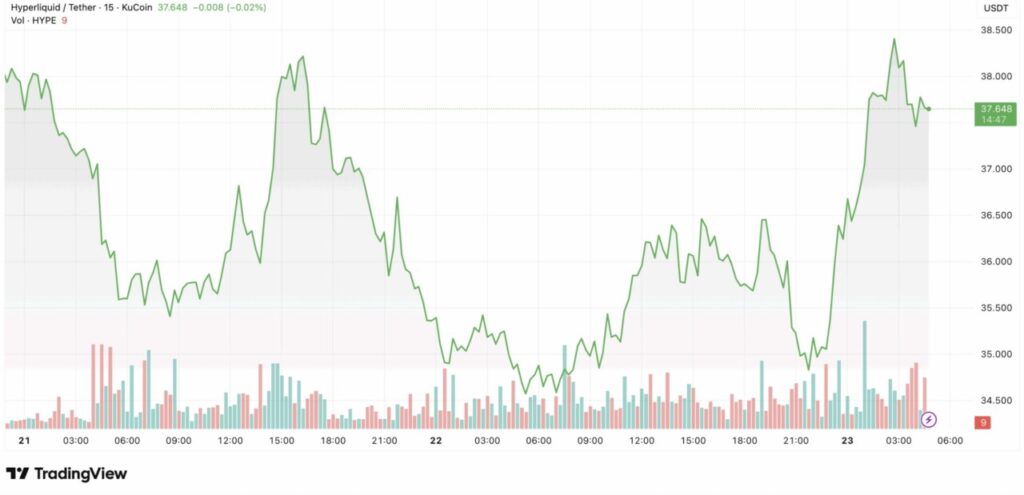

This announcement comes amidst the positive performance of the HYPE token which continues to outpace the overall crypto market. According to data from TradingView, the HYPE token recorded a gain of almost 7% in the last 24 hours, contrasting with the general crypto market’s small decline of -0.42%.

Read also: Aave DAO Proposes $50 Million Annual Token Buyback from DeFi Revenue

In comparison, the BNB Chain network’s Aster token fell by 7.6%. This shows the strength of the HYPE token even though the price of Bitcoin continues to fluctuate around $108,000.

Analysts attribute this strength to ongoing network upgrades and new institutional product launches. This has driven positive sentiment in the HYPE token ecosystem over the past few weeks.

For example, Bitwise Asset Management has filed an S-1 form for the Bitwise Hyperliquid ETF. This proposed structure offers a new way for investors to create and trade tokens. The aim is to lower costs and increase efficiency for traditional investors looking to invest in HYPE tokens.

Simultaneously, the development team also launched the HIP-3 network update. This update allows app makers to create new futures markets on HyperCore without the need for approval from a central authority.

This series of developments demonstrates the growing confidence in the fundamentals of the HYPE platform.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Just In: HyperLiquid Strategies Eyes $1B Capital Raise, Plans HYPE Token Accumulation. Accessed on October 23, 2025

- Coinpedia. HyperLiquid Files S-1 Registration to Raise $1 Billion to Buy HYPE Token. Accessed on October 23, 2025