Bitcoin Price Climbs to $114,000 Today as Signs of Consolidation Emerge

Jakarta, Pintu News – The price of Bitcoin is slowly recovering after its previous decline, and over the past few days it has been moving cautiously. While this recovery is still moderate, the underlying data points to potential challenges ahead.

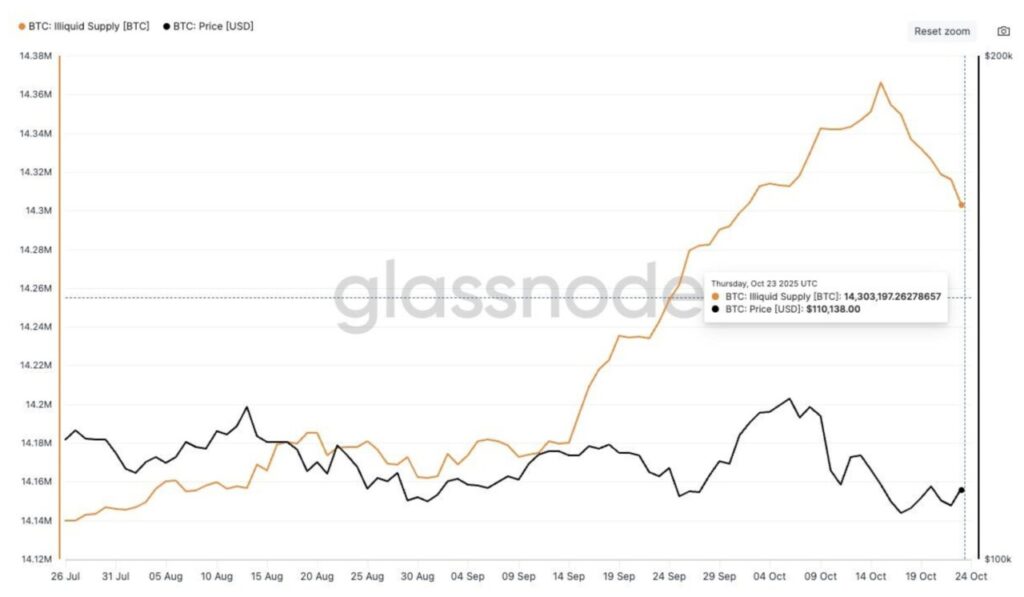

A decrease in illiquid supply – i.e. long-term holdings that rarely change hands – could be a drag on Bitcoin’s ability to maintain its upward trend.

Bitcoin Price Up 3.22% in 24 Hours

On October 27, 2025, Bitcoin was trading at $114,987, equivalent to IDR 1,915,899,830 — marking a 3.22% increase over the past 24 hours. During this period, BTC hit a low of IDR 1,853,776,466 and peaked at IDR 1,921,962,266.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 38,111 trillion, while its 24-hour trading volume has surged by 84% to IDR 786.54 trillion.

Read also: Bitcoin and Ethereum Explode, 5 Altcoins Rise Over 100% Today

Bitcoin Owners Start Releasing Their Assets

The supply of illiquid Bitcoin has decreased again, with around 62,000 BTC moving from inactive wallets since mid-October. This movement suggests that more coins are coming back into circulation in the market, potentially increasing selling pressure.

As the supply of illiquidity decreases, the liquidity available in the market increases. This often makes sustained price rallies more difficult to achieve.

Historically, reduced illiquid supply reflects weakening confidence from long-term holders. Unless there are new capital inflows capable of balancing these movements, Bitcoin risks running into obstacles in maintaining its recovery trend.

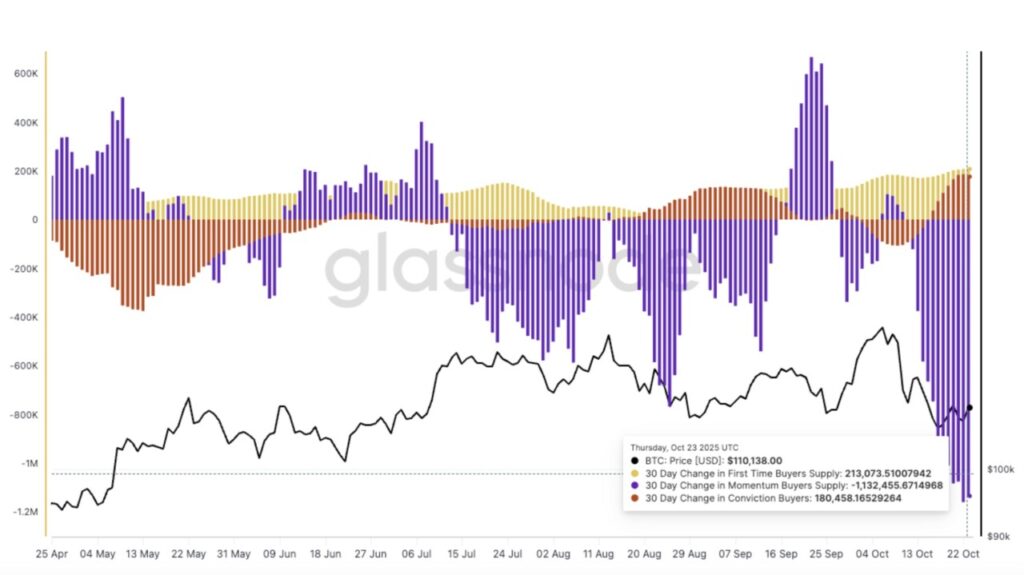

In terms of buyer and seller dynamics, it appears that most momentum traders have exited the market. Meanwhile, buyers who usually capitalize on price dips (dip-buyers) have not been aggressive enough to withstand the mounting selling pressure.

This imbalance weakens the upward momentum of Bitcoin’s price, making it vulnerable to price stagnation or short-term declines.

In addition, new buyers have yet to show any significant activity, signaling a lack of demand in the spot market. The lack of new capital flows continues to weigh on market strength.

Until a stronger wave of buyers emerges, the current balance between sellers and holders will most likely limit Bitcoin’s price breakout potential.

Read also: 10 Most Popular Blue Chip Stocks in Indonesia by 2025

BTC Price Has the Potential to Consolidate

On October 27, the price of Bitcoin was at $112,513, slightly above the important level of $112,500. Making this level a strong support is crucial to keep the recovery going.

However, weak capital inflows and still-cautious market sentiment could make it difficult for Bitcoin to stay at these levels, as traders wait for more convincing demand signals.

The current market structure indicates that Bitcoin may struggle to break the $115,000 level. Unless liquidity conditions improve, price movements are likely to stay within a limited range or consolidate above $108,000. Without a strong buying push, attempts to rally could quickly lose momentum.

For Bitcoin to target the $120,000 level, it needs renewed interest from both retail and institutional investors. A convincing move above $115,000 would most likely invalidate the bearish scenario, trigger new momentum, and attract fresh capital into the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Rise Delayed as Illiquid Supply Drops. Accessed on October 27, 2025