Dogecoin Sheds 4% in One Day, Testing Critical $0.18 Support

Jakarta, Pintu News – Dogecoin is showing renewed strength after its latest rebound, briefly trading at $0.2080-a 6.43% increase in 24 hours on October 27. This performance indicates that investor interest in the meme asset is returning amid dynamic market movements.

Then, how is the current Dogecoin price movement?

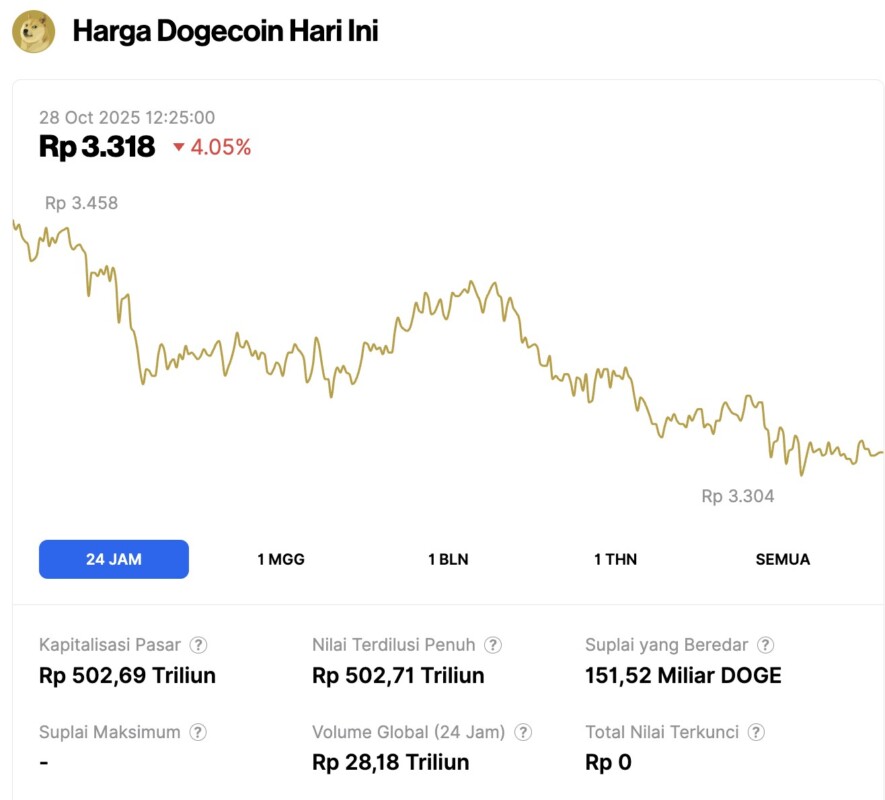

Dogecoin Price Drops 4.05% in 24 Hours

On October 28, 2025, Dogecoin’s price fell by 4.05% over the past 24 hours, trading at $0.1997, or about IDR 3,318. Throughout the day, DOGE fluctuated between IDR 3,458 and IDR 3,304.

At the time of writing, Dogecoin’s market capitalization is approximately IDR 502.69 trillion, with a 24-hour trading volume of around IDR 28.18 trillion.

Read also: Dogecoin Whale Back in Action with $2.9 Million Transaction: Bullish Signal for DOGE?

$0.18 Support Level is Key to DOGE’s Further Movement

Crypto analyst Ali Marteniz emphasized that the support level at $0.18 is a crucial area for Dogecoin’s future movement. If buying pressure is able to keep the price above this level, DOGE could potentially target the $0.25 to $0.33 area in the next few trading sessions.

Currently, market sentiment towards DOGE is bullish, driven by increased activity around the support zone.

Citing a TronWeekly report, Dogecoin’s current technical structure has even been dubbed a “heist in progress” by some analysts-describing how the bulls are carefully building momentum.

Strong support is at $0.185, while heavy resistance zones are listed at $0.218 to $0.220. Interestingly, the Triangular Moving Average (TMA) indicator is also in the same range, indicating a possible rejection or even a strong breakout.

In the analyst’s proposed strategy, the $0.185 level is the stop loss limit-also referred to as an “emergency exit” if market conditions worsen. Investors are advised to apply strict risk management, including locking in profits at $0.218 rather than waiting for further breakouts.

However, if DOGE is able to break $0.220 with significant volume, then the opportunity is wide open for a rally towards $0.25 and higher.

Read also: Ethereum Price Drops 3% Today: Can ETH Reach $4,500 by the End of 2025?

DOGE still affected by BTC and ETH trends

Dogecoin’s price is still highly correlated with Bitcoin and Ethereum movements. When Bitcoin rises, DOGE tends to follow suit, sometimes with even bigger spikes.

Conversely, if BTC’s dominance weakens, it could be a signal that funds are starting to flow into altcoins-opening up space for Dogecoin to score a rally of its own. But if BTC experiences a sharp correction, DOGE is also vulnerable to a decline.

For now, the Dogecoin market is still pointing in an upward direction, sustained by solid community support and active participation of retail investors. With market optimism on the rise and a strong support level at $0.18, a target to $0.25 seems realistic in the near future.

Dogecoin continues to prove itself as one of the most talked about crypto assets, thanks to the strength of its community. Once again, this token shows that it’s not done surprising the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Dogecoin Breakout Setup Hints at an Explosive $0.25 Surge Ahead. Accessed on October 28, 2025