7 Altcoins Crypto Whales Are Accumulating After the Fed Rate Cut — Set to Surge in November?

Jakarta, Pintu News – The 25 basis points interest rate cut by the US Federal Reserve didn’t do much to excite the crypto market. Bitcoin and Ethereum remained in the red, and the total market capitalization fell by 1.6%, suggesting that the decision was largely calculated in advance.

Even so, what the crypto “whales” bought after the FOMC rate cut is now the main topic.

Large investors have quietly started to shift into some tokens that are showing lower selling pressure and strong technical setups. Data shows there are seven assets that have seen increased accumulation by whales since the policy change – each showing signs of confidence starting to build ahead of November.

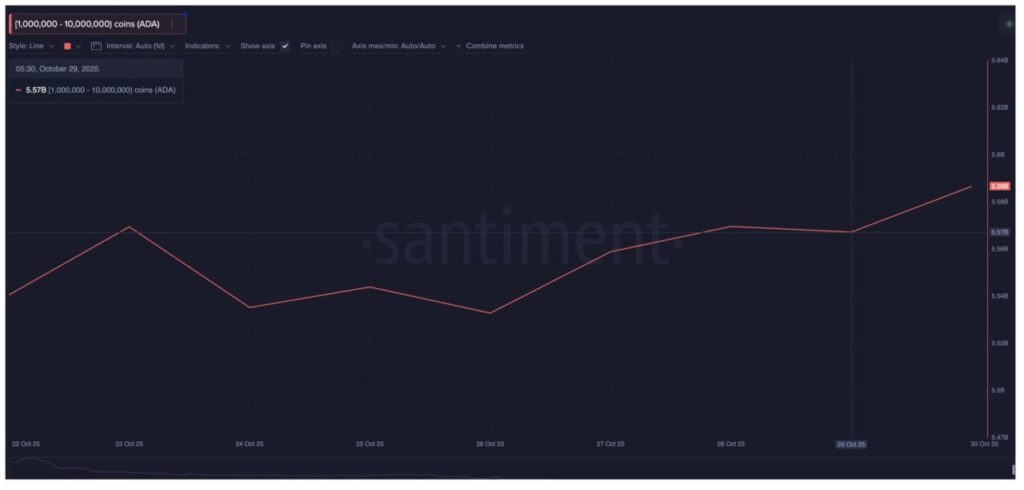

1. Cardano (ADA)

Whale who holds between 1 million and 10 million Cardano has continued to add to his holdings since yesterday, increasing from 5.57 billion to 5.59 billion ADA. That equates to an additional approximately 20 million ADA, worth about $12.8 million at the current price of $0.64 per coin.

Also read: 3 Crypto with Strong Catalysts in November 2025 According to Analysts

These smaller whale groups are often the pioneers in the initial buying cycle before other large investors step in. Although Cardano’s price has fallen by around 20% in the past month, the whale accumulation activity has picked up again, suggesting a potential price recovery.

In the 12-hour chart, ADA is currently trading in a symmetrical triangle pattern, which reflects uncertainty but also consolidation before a possible breakout. The token is still holding above the $0.64 support level, and if it is able to break $0.66, the price has a chance to rise towards $0.68 – a gain of about 6.5%.

If the momentum continues, the next resistance target is at $0.73. The Wyckoff Volume Chart, which analyzes buying and selling pressure based on volume patterns, shows that selling pressure started to weaken from October 29. A similar shift last October 22-23 led to a 9.37% surge in prices shortly after.

However, if ADA fails to hold the $0.64 level, the price could drop to $0.62 or even $0.60 – which would derail the optimism triggered by this whale buying spree.

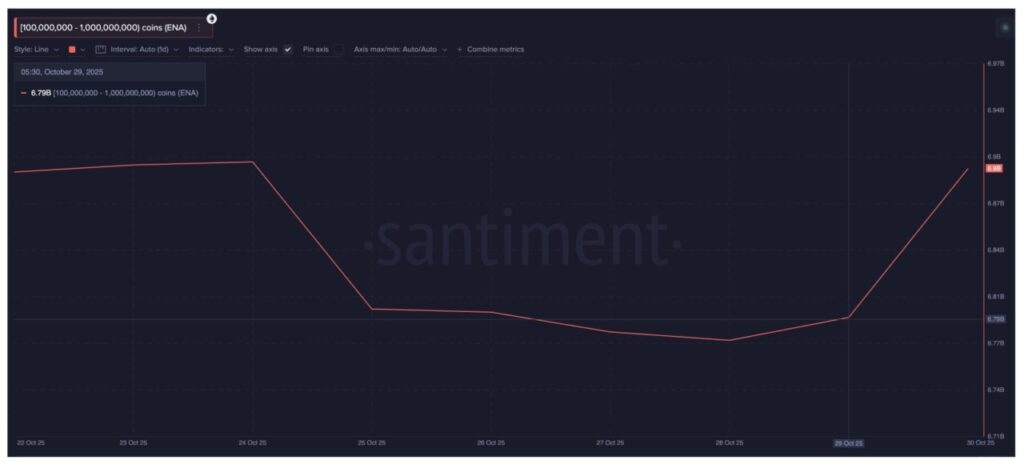

2. Ethene (ENA)

Large whale groups holding between 100 million and 1 billion Ethena (ENA) – groups that have the power to move the market significantly – were recorded adding to their holdings prominently in the 24 hours (30/10).

Their total holdings rose from 6.79 billion to 6.9 billion ENA, an increase of 0.11 billion ENA or about $46.2 million at current prices.

This accumulation comes after a fairly volatile month, during which Ethena’s price fell 21%, following a similar downward pattern to Cardano. However, recent buying indicates that the whales are positioning themselves for a potential upward trend reversal.

In the 12-hour chart, ENA is trading inside a falling broadening wedge pattern – a bullish technical pattern that usually signals a possible upward breakout after a narrowing structure. Ethena attempted a breakout on October 27, but failed due to the appearance of a hidden bearish divergence.

This divergence occurs when the price forms a lower peak, while the Relative Strength Index (RSI) – an indicator of buying vs selling strength – makes a higher peak instead. This signals that sellers are taking control again in the short term, derailing the price rally.

Even so, Ethena managed to bounce back from important support at $0.41. If this level continues to hold, a move towards $0.45 (initial resistance) and even $0.53 could occur. A sustained breakout above $0.49 – currently the upper trendline of the wedge – would confirm a bullish reversal signal, opening up opportunities towards $0.65.

Interestingly, now the RSI and price are starting to align again, neutralizing the previous divergence. If this alignment is maintained and the $0.41 level remains firm, the whale’s prediction could be correct: ENA may be preparing for a rebound from the post-FOMC low.

3. Aster (ASTER)

Crypto whales were seen aggressively buying Aster (ASTER) within 24 hours (10/30), adding 26.43% to their total holdings. Now, their total balance stands at 15.67 million ASTER, or about 3.27 million ASTER which is worth approximately $3.33 million at current prices.

Also read: Whale Accumulation Rising Sharply, Analysts Predict Parabolic Rally in Pepe Coin Price!

This sharp spike in accumulation indicates increased interest from large traders, making ASTER one of the most conspicuous purchases by whales following the rate cut.

Over the past month, ASTER’s price has dropped 43.2% from its peak, confirming that the token is in a clear downtrend. However, there are indications that the trend is starting to approach a turning point – and technical analysis supports this possibility.

On the 12-hour chart, ASTER is trading within a falling broadening wedge pattern, a bullish pattern that usually results in an upward breakout once the price breaks the upper trend line. The $0.93 level has been a strong support and is still holding.

If ASTER is able to stay above this level, the next immediate target is $1.12, then $1.28. A strong breakout above $1.79 would confirm a long-term trend reversal.

If ASTER manages to hold these key levels, the token could enter a significant recovery phase, making it a major highlight in this week’s crypto whale buy list. However, if the $0.93 level fails to hold, short-term bullish projections will be invalidated, and ASTER could fall to a new low.

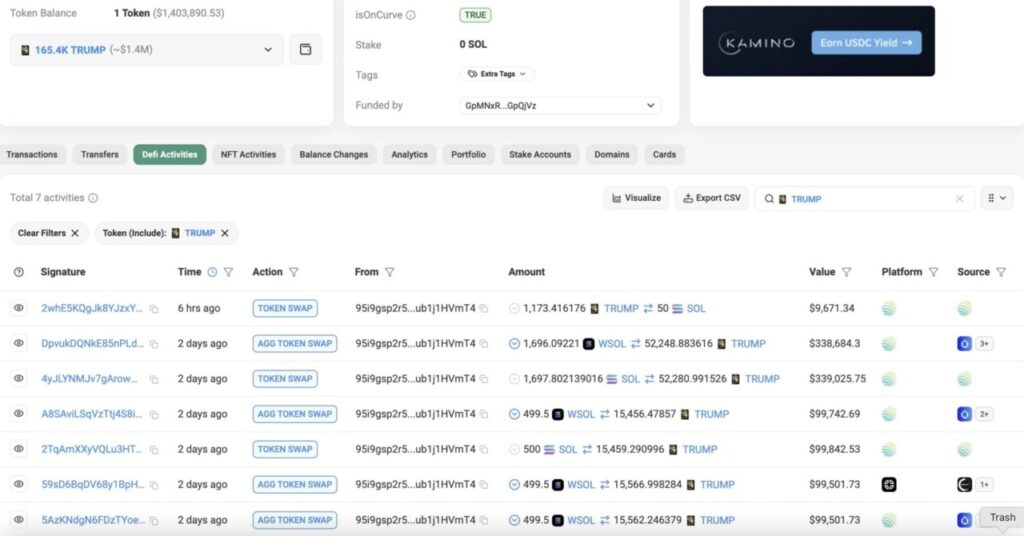

4. Official Trump (TRUMP)

According to data from Lookonchain, a large investor recently created several new wallets to accumulate Official Trump (TRUMP) on the Solana network , as well as opening a leveraged long position on Hyperliquid – and has now pocketed over $1.5 million in unrealized gains.

On the Solana network, the whale spent 5,346 SOL (approximately $1.07 million) to buy 165,401 TRUMP tokens which were then worth around $1.4 million, generating $335,000 in unrealized profit.

Meanwhile, on Hyperliquid (HYPE), the same trader deposited 485,669 USDC and used maximum leverage to go long 1.13 million TRUMP tokens (valued at approximately $9.5 million).

This aggressive strategy across blockchains reflects the high conviction of large-value traders in the potential of the TRUMP token. If this trend continues, the TRUMP price could resume its upward trajectory – having previously recorded a 40% surge in the last seven days.

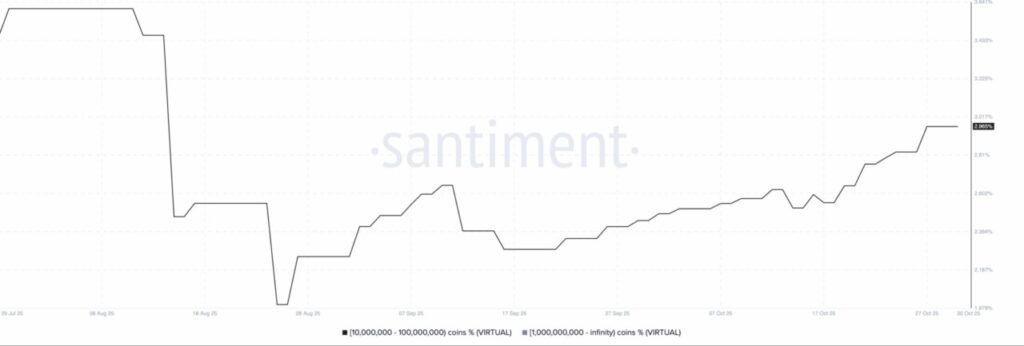

5. Virtuals Protocol (VIRTUAL)

Another altcoin that is attracting a lot of attention from crypto whales is Virtuals Protocl (VIRTUAL), mainly driven by the bullish sentiment surrounding the AI narrative.

Currently, VIRTUAL is trading at $1.37, registering a 78% surge in the last seven days as investor interest in AI-related assets increases.

Based on data from Santiment, the number of tokens held by whales – specifically those in the 10 million to 100 million VIRTUAL holder bracket – continues to show an increase.

This accumulation trend suggests that the whales are positioning themselves for further upside potential. If enthusiasm for AI-based projects remains high, VIRTUAL price momentum is likely to remain strong in the near future.

6. Maple Finance (SYRUP)

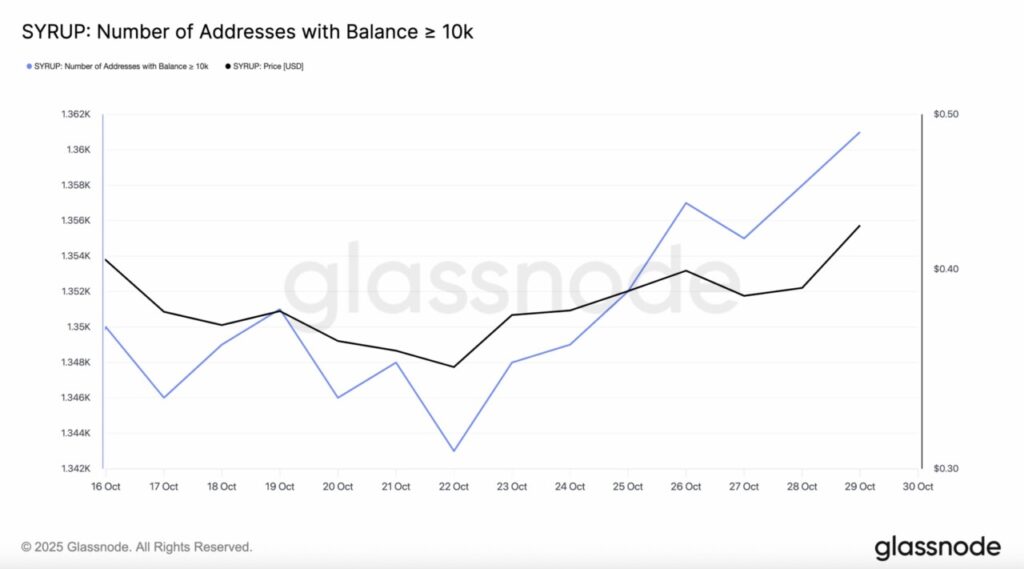

Lastly, the native token of the Maple Finance network, SYRUP, is also starting to be targeted for accumulation by crypto whales. Currently, SYRUP’s price has dropped 35% from its All-Time High, which could be seen as a discounted buying opportunity for large holders.

Supporting this view, data from Glassnode shows that the number of addresses holding more than 10,000 SYRUP tokens has increased to 1,361, reflecting a return to confidence from high net worth investors.

This increase in whale holders, despite the decline in prices, suggests that they are anticipating a potential rebound, especially if market sentiment towards the DeFi sector and yield protocols strengthens again in the coming weeks.

7. Chainlink (LINK)

Crypto whales have doubled down on their investments in Chainlink as the market begins to recover from the October 11 crash. According to data from Lookonchain, large investors have accumulated nearly 9.94 million LINK tokens – worth about $188 million – directly from Binance in the past two weeks.

This massive accumulation came from 39 new wallets, indicating a renewed confidence from whales in the long-term potential of this decentralized oracle network.

This wave of accumulation reinforces the narrative that Chainlink is still one of the main assets at stake for institutional and whale investors, especially amidst the overall crypto market recovery.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What Crypto Whales Are Buying After FOMC Rate Cuts. Accessed on October 31, 2025

- CCN. Fed Rate Cut Triggers Crypto Whale Accumulation: 3 Altcoins They’re Buying for November 2025 Gains. Accessed on October 31, 2025