Ethereum Holds Steady at $3,800 – Is a Rally to $6,500 on the Horizon After a Strong Rebound?

Jakarta, Pintu News – After experiencing consolidation until October, Ethereum is now showing signs of renewed strength.

This article discusses Ethereum’s renewed strength, where analysts state that ETH’s consolidation phase has formed the basis for a potential major surge, mainly due to the emergence of a bullish divergence on the ETH/USD chart as well as institutional fund flows that continue to drive the upward momentum.

Five key points:

- Ethereum price is holding at $3,847 as of November 3, 2025.

- Traders are advised to monitor ETH’s short-term resistance around $4,600.

- ETH on-chain data shows positive signals, supporting price movement in a bullish direction.

- Technical formations, whale accumulation, and on-chain data boost ETH’s bullish potential.

- If able to maintain support, ETH is predicted to reach a target of $6.5000.

Traders and investors are now closely watching the $3,800 support level, which could be the starting point for Ethereum’s next big rally. So, how will Ethereum price move today?

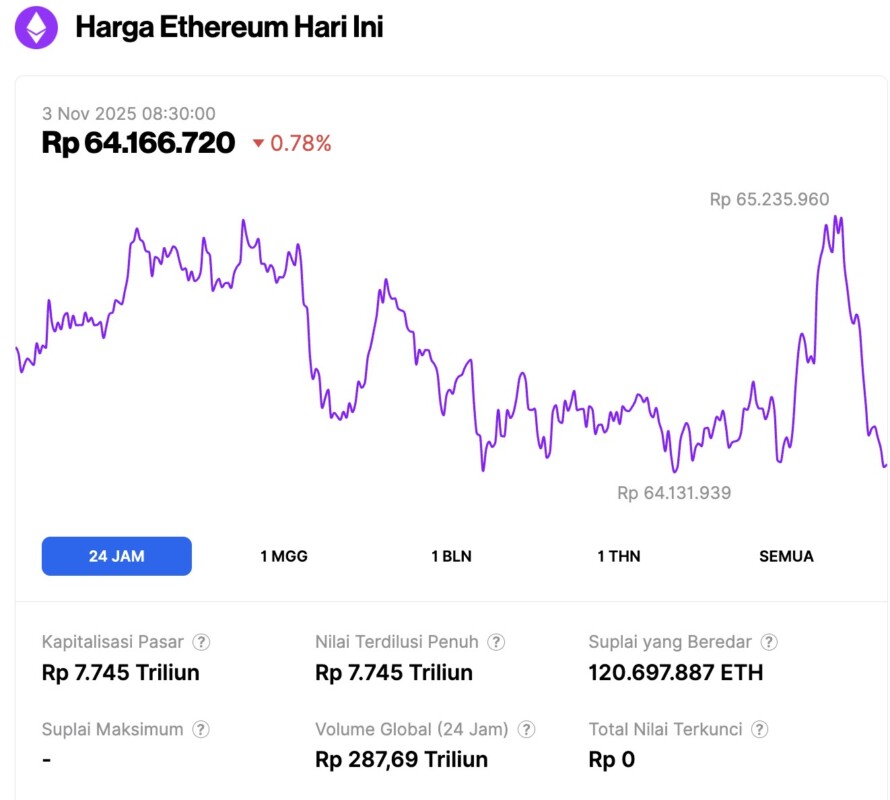

Ethereum Price Drops 0.78% in 24 Hours

On November 3, 2025, Ethereum was trading at approximately $3,847, or around IDR 64,166,720 — marking a 0.78% decline over the past 24 hours. During this period, ETH dipped to a low of IDR 64,074,169 and reached a high of IDR 65,235,960.

At the time of writing, Ethereum’s market capitalization is estimated at around IDR 7,745 trillion, while its daily trading volume has surged by 38% over the last 24 hours to IDR 287.69 trillion.

Read also: Bitcoin Hovers at $109,000 — Chart Looks Bullish, So What’s Holding Back the Breakout?

Technical Analysis: Bullish Divergence and Momentum Indicator

The weekly chart from TradingView shows extreme oversold conditions on the Stochastic RSI indicator (3,3,14), which currently stands at 3.76-far below the threshold of 20. Historically, similar readings often precede sharp rallies.

For example, in October 2023 when the ETH price was around $1,550, it spiked to around $4,100 in March 2024, registering a 165% increase in just five months.

Additional technical support comes from the descending triangle pattern that formed around the $3,500 level. As explained by crypto analyst Mister Crypto,

“The breakout of this triangle pattern is in line with the current price near $3,850. Whale accumulation and strong on-chain activity further reinforce the possibility of a price spike.”

Traders are advised to keep an eye on the short-term resistance around $4,600, which could be the next barrier before ETH resumes targeting higher levels.

On-Chain Insights: Supply Shocks Drive Ethereum’s Bullish Outlook

Ethereum’s on-chain data is showing positive signals that favor a bullish price movement. ETH reserves on exchanges are now at a multi-year low of 15.6 million ETH – indicating a supply shock that could ease selling pressure.

In addition, 35.7 million ETH are currently being staked, and the ongoing fee burn process continues to outpace the amount of new ETH issued, especially in periods of low activity.

CryptoGoos commented, “With Ethereum’s supply growth rate of less than 1% per year and the high amount of staking, the current conditions are highly favorable for a potential major rally.”

ETH outflows from exchanges, which reportedly reached the highest level in two years, have led to a 41% drop in supply since 2022. Based on historical trends, such supply contractions often precede price spikes.

If this momentum continues, Ethereum is expected to potentially head towards a price target of between $5,000 to $10,000 before the end of the year.

Market Sentiment: Community Optimism and ETF Outlook

The Ethereum community in general is showing a mix of optimism and caution. Analysts such as Micro2Macr0 and Mister Crypto highlighted a potential rally towards the $5,000-$6,500 level, driven by strong technical formations, accumulation by whales, and favorable on-chain data.

Read also: 7 Altcoins Bought by Crypto Whales After FOMC Rate Cut, Surge in November?

Social activity on crypto platforms also reflects the diverging views between bullish traders and those who are more cautious, creating a healthy discussion around short-term volatility and the long-term outlook.

Institutional interest remains a key factor. October inflows associated with Ethereum ETFs are reported to have surpassed $18 billion, indicating huge demand from institutional investors that could potentially support further ETH price gains.

Analysts noted that a clean technical breakout above the resistance level could trigger a new wave of buying, pushing Ethereum towards its mid-2025 price target.

Ethereum Price Prediction: Can ETH Reach $6,500?

Citing a Brave New Coin report, by combining technical analysis, on-chain dynamics, and market sentiment, Ethereum appears poised for a potential major rally.

Analysts predict that if ETH is able to maintain support around $3,800 and manages to break through resistance around $4,600, it could target the $6,500 level in the coming months.

Although the path is not risk-free-such as potential short-term volatility and the possibility of a death cross forming-theoverall outlookremains constructive. Ethereum’s technical rebound,supply shock, and institutional support provide a strong foundation for a significant upside move.

Traders are advised to watch the $3,800-$4,600 area closely as a leading indicator of the direction of the next move.

For investors and traders, current market conditions offer bullish opportunities with a cautious approach. The combination of a solid technical setup, reduced circulating supply, as well as institutional participation, indicates that the next breakout could be decisive in Ethereum’s direction towards 2025 and beyond.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Brave New Coin. Ethereum (ETH) Price Prediction: Ethereum Set for $6,500 Rally Following Technical Bounce at $3,800. Accessed on November 3, 2025