Bitcoin Falls to $106,000 Today as Miners Begin Offloading Holdings

Jakarta, Pintu News – The price of Bitcoin recently failed to break through the resistance level at $110,000, again sparking concerns among investors. The largest crypto asset has shown volatility throughout the past month, struggling to maintain its momentum due to profit-taking and weak market confidence.

These volatile market conditions now seem to be influencing the behavior of miners, indicating a change in on-chain dynamics.

Bitcoin Price Drops 1.70% in 24 Hours

On November 4, 2025, Bitcoin was priced at $106,970, equivalent to IDR 1,789,547,080 — marking a 1.70% decline over the past 24 hours. During this period, BTC reached a low of IDR 1,769,919,779 and a high of IDR 1,820,618,291.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 35,604 trillion, while its 24-hour trading volume has surged by 86% to IDR 1,284 trillion.

Read also: Altcoin Season 3.0 Has Arrived? Altcoin Market (TOTAL3) Breaks 4-Year Resistance at $1.13 Trillion

Bitcoin Miners Start Selling

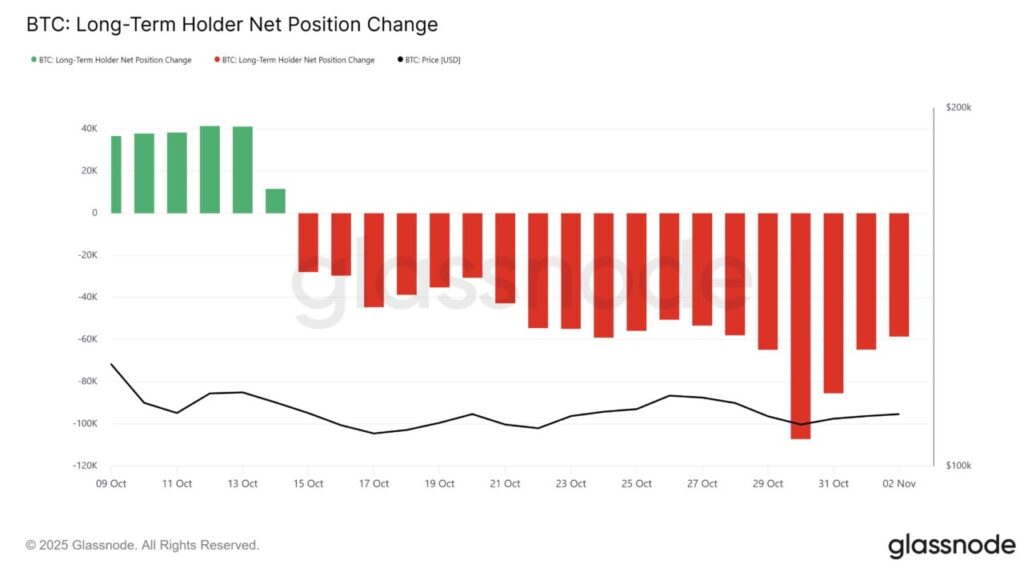

Long-term holders (LTHs), one of the most influential groups of Bitcoin investors, have started to slow down the pace of their sales.

On-chain data shows that the supply held by this group has been reduced by more than 46,000 BTC in recent days. While there are still traces of selling activity, this decline could signal a shift towards long-term conviction and less profit-taking.

This slowdown suggests two main possibilities: either LTHs are getting tired after months of selling, or they are getting more confident in the future recovery of the Bitcoin price. This slowing distribution provides some cushion against excessive selling pressure.

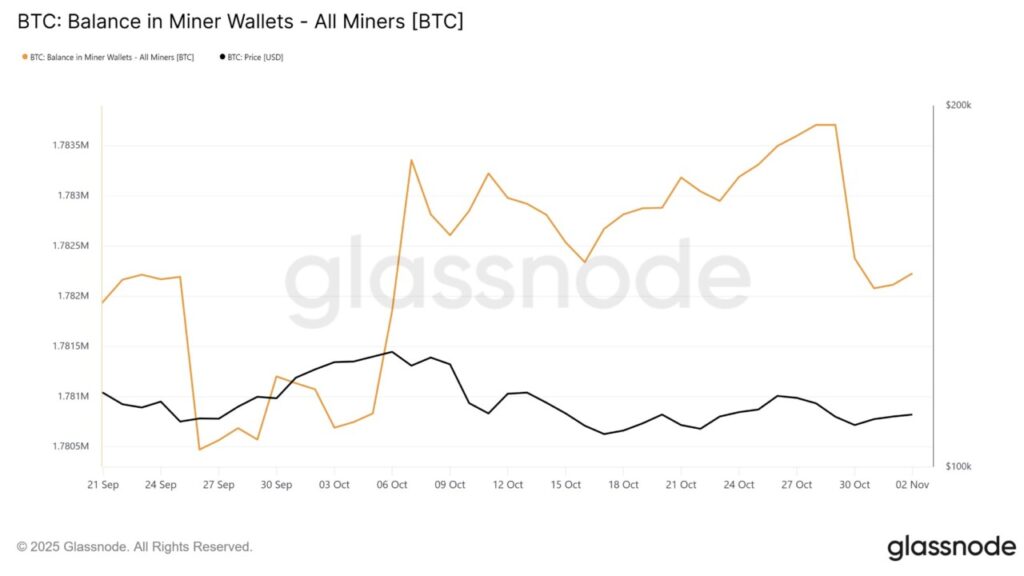

On the other hand, Bitcoin miners seem to be taking over the seller role previously held by LTHs. After Bitcoin failed to break the $115,000 mark, miners reportedly sold around $172 million worth of Bitcoin – the largest outflow recorded in almost six weeks.

This suggests that some miners are looking to secure profits amid ongoing price volatility.

While these numbers may seem small compared to the total market capitalization of Bitcoin, the activity of miners is often an indicator of short-term sentiment changes.

This latest wave of selling reflects a slight bearish trend as well as a more cautious approach from miners in managing liquidity amid volatile market conditions.

Read also: 3 Altcoins Accumulated to Millions by Crypto Whale for November 2025

BTC Price Direction Still Uncertain

Bitcoin’s price as of November 3 stands at $107,968, slightly above the key support level of $108,000. Historically, BTC often breaks out of this zone during profit-taking by miners or institutions. Maintaining this support level is crucial to prevent a deeper price correction.

If selling pressure from miners increases, Bitcoin price is at risk of dropping towards $105,585, which would be the lowest level in the past two weeks. This drop could potentially trigger short-term liquidation pressure and increase uncertainty among investors. A deeper correction could also weaken the next technical support at around $103,000.

However, if miners start to hold back their sales and market sentiment stabilizes, Bitcoin has a chance to bounce back to the $110,000 level. If the price manages to break and stay above that level, BTC could continue its rise towards $112,500, which would restore market confidence in the short-term bullish trend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Stalls Below $110,000 as Miners Step In to Sell. Accessed on November 4, 2025