Ethereum Falls to $3,200 as Major ETF Outflows Intensify Selling Pressure

Jakarta, Pintu News – The price of Ethereum has entered a crucial phase following significant ETF outflows and massive liquidations, pushing Ethereum into a deeper correction. The asset’s decline is almost 30% from its annual peak, making traders wary.

However, accumulation by whales and on-chain signals indicate a potential recovery zone starting to form ahead.

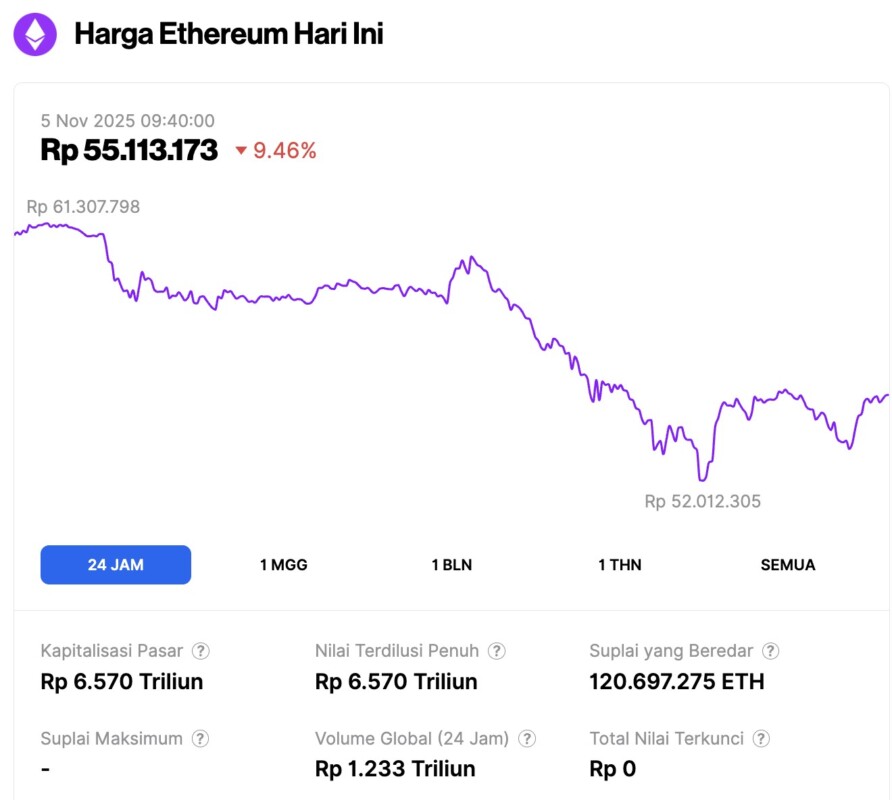

Ethereum Price Drops 9.46% in 24 Hours

On November 5, 2025, Ethereum was trading at approximately $3,282, or around IDR 55,113,173 — marking a 9.46% drop over the past 24 hours. During this time, ETH dipped to a low of IDR 52,012,305 and reached a high of IDR 61,307,798.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 6.57 trillion, while its 24-hour trading volume has surged by 55% to IDR 1.23 trillion.

Read also: Bitcoin Price Bleeds to $101,000 Today: Can BTC Recover to $110,000?

Large Outflows from ETH ETFs Add to Selling Pressure

Over the past four ETF trading days, nine Ethereum ETFs have reported significant capital outflows, further weighing on market sentiment.

According to data from Farside, between October 29 and November 3, Ethereum ETFs collectively recorded continuous fund withdrawals. The largest single-day outflow occurred on November 3, totaling $135.7 million.

In the event, BlackRock sold $81.7 million worth of ETH, which reinforced the selling pressure among institutions.

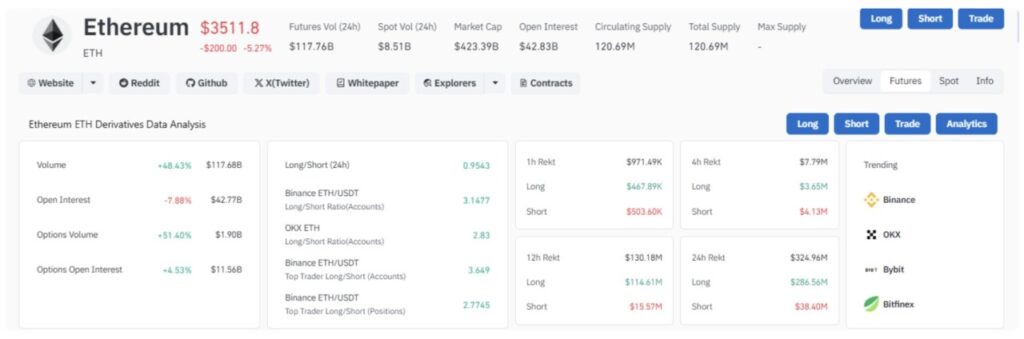

This institutional withdrawal coincided with broader turmoil in the crypto market, which saw liquidations total $1.33 billion in just one day. Ethereum alone accounted for $324.96 million of the total liquidation, signaling fragile market conditions.

As a result, the ETH price is currently trading at around $3,510, down almost 2.6% in intraday trading.

Technically, this decline confirms ETH’s entry into a bear market, with prices now almost 30% lower than its 2025 peak of $4,955. While this suggests market weakness, some long-term investors seem to be taking advantage of this decline to accumulate.

BitMine Accumulation Shows Long-term Optimism

Despite the deteriorating market conditions, large institutional holders continue to show confidence in Ethereum’s long-term fundamentals.

Read also: 2 AI Stocks to Keep an Eye On This November 2025 – Is Nvidia One of Them?

BitMine, one of the major holders of ETH, has reportedly added 82,353 ETH worth around $300 million to its reserves. Now, BitMine’s total Ethereum holdings stand at around 3.16 million ETH, with an estimated value of $11.11 billion.

This accumulation pattern is a stark contrast to the recent outflows from ETFs, indicating that while some investors are choosing to reduce risk, others see the current ETH price as a buying opportunity at a discount.

This kind of activity often reflects a long-term strategy to welcome the next market cycle-especially if ETH’s role in staking, DeFi, and tokenization continues to evolve.

Technically, Ethereum’s closest support area is in the range of $3,300-$3,350. If this level is successfully maintained, it could be the basis for a trend reversal and open up opportunities for ETH to retest its annual high of $4,955 – especially if momentum strengthens in November.

However, if this support fails to hold, the decline could continue all the way to around $2,890, which marks a deeper retracement level.

On-Chain Indicators Show Opportunity Zones

According to on-chain data shared by Santiment, Ethereum’s 30-day MVRV ratio has fallen to -10.5%, falling into what is referred to as the “opportunity zone.” Historically, when this metric falls below -10%, ETH price trends tend to indicate accumulation opportunities that are often followed by short-term recoveries.

In addition, accumulation by whales and capitulation by retail traders remain important factors to trigger further rallies. The pattern in previous cycles shows that when retail traders panic and sell, while whales make massive purchases, it often signals the beginning of a strong rebound.

Thus, despite continued short-term volatility, the combination of technical support, institutional accumulation, and positive on-chain indicators maintain optimism towards a potential recovery in ETH prices in the near future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Ethereum Price Drops 30% as ETF Outflows and Liquidations Shake the Market. Accessed on November 5, 2025