5 Bitcoin Market Facts that Analysts Are Noticing: Not End of Cycle, But Restructuring?

Jakarta, Pintu News – According to the latest analysis, the Bitcoin market is currently experiencing a restructuring phase after the release of excessive leverage. On-chain data shows that BTC’s fundamentals are still solid, although short-term pressures remain.

With exchange reserves low, stablecoin liquidity flowing again, and leverage volumes shrinking, analysts are keeping a close eye on Bitcoin as one of the top cryptos to watch in the near future.

1. Bitcoin (BTC) is not at the end of its cycle, says XWIN Research

According to a recent report from XWIN Research Japan on the CryptoQuant platform, the current state of the Bitcoin market is more accurately referred to as a restructuring phase, not the end of a bull market cycle. The much-discussed drop in BTC’s performance throughout October does not reflect the historical market peak signal.

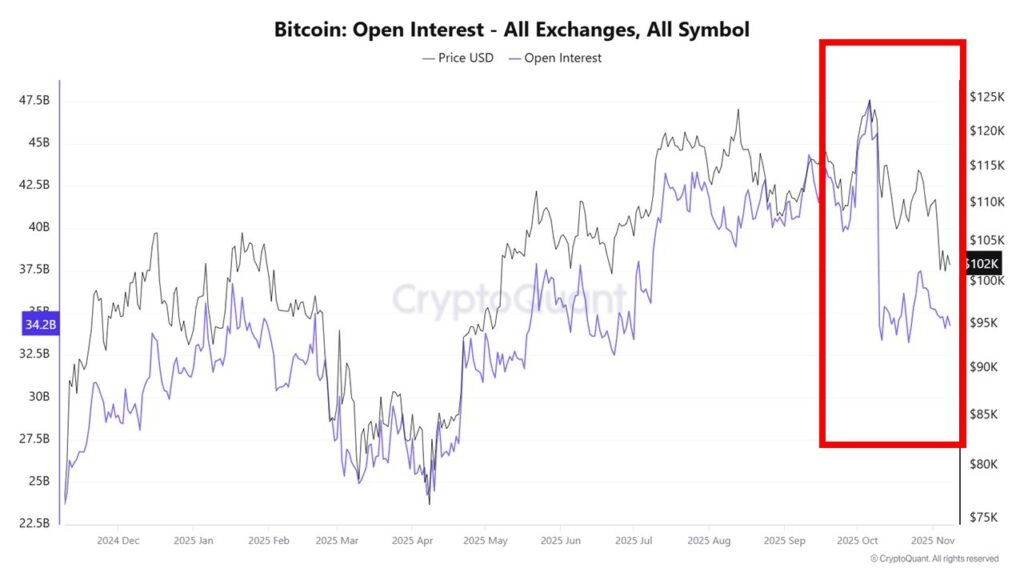

In previous peak phases, leveraged trading activity increased despite the high price. But based on data from XWIN, open interest in the BTC futures market has declined sharply since late October, signaling an exodus of short-term traders from their leveraged positions.

Also Read: Market Crash? Here are 5 Cryptos Predicted to Explode Due to Whale Activity in Futures Market

2. On-Chain Data: Institutional Demand Weakens, but Not Alarming

One of the main reasons for BTC’s weak price momentum is the decline in demand from institutional investors, especially in the United States. This is reflected by the negative Coinbase Premium Index, according to a CryptoQuant report.

Although the indicator received sharp scrutiny from analysts, the data does not indicate that Bitcoin’s market structure is collapsing. On the contrary, according to XWIN Research, BTC’s structural support is still quite strong amid the momentary low demand from large investors.

3. Bitcoin Reserves on Exchanges Are Still Low: Long-term Positive Signals

Another important metric that analysts pay attention to is the amount of Bitcoin reserves remaining on exchanges. Based on blockchain data monitored by XWIN Research, these reserves remain at the lowest level in recent years.

The low reserves on the exchange are an indicator that selling pressure from long-term investors is still minimal. This leads many observers to believe that if demand increases again, especially from institutions, BTC prices could potentially surge again in the near future.

4. Stablecoin Liquidity Flows Back into the Market

XWIN also noted an increase in stablecoin inflows into the crypto ecosystem. These liquidity flows signal that buying power is being readied by investors, who are still waiting for a strategic moment.

Stablecoins like USDT and USDC are often used as a bridge by investors before purchasing top cryptos like Bitcoin (BTC) and Ethereum . This return of liquidity is one of the metrics that many active traders and whales are currently watching.

5. BTC Movement Prediction: Short-Term Consolidation Still Possible

Despite some positive signals, XWIN Research predicts that Bitcoin’s price movement in the short term will most likely remain in a consolidation pattern. This means that the price is moving within a limited range without a clear trend direction.

Bitcoin price as of November 9, 2025 was recorded at around USD 101,930 or around Rp1.698 billion. In the last seven days, the price of BTC has dropped by around 8%, indicating market pressure but not significant enough to be called a structural breakdown.

Also Read: 3 Memecoins that Whale is Starting to Look at in the Futures Market as of November 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Opeyemi Sule/Bitcoinist. Don’t Panic – Bitcoin Market Is Only In A Restructuring Phase: Blockchain Firm. Accessed on November 10, 2025